Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Zcash (ZEC)

Zcash ZEC is a decentralised cryptocurrency focused on privacy and anonymity. It uses the zk-SNARK zero-knowledge proof technology that allows nodes on the network to verify transactions without revealing any sensitive information about those transactions. Zcash transactions, on the other hand, still have to be relayed via a public blockchain, but unlike pseudonymous cryptocurrencies, ZEC transactions by default do not reveal the sending and receiving addresses or the amount being sent.

ZEC Price Analysis

At the time of writing, ZEC is ranked the 50th cryptocurrency globally and the current price is US$53.23. Let’s take a look at the chart below for price analysis:

ZEC‘s recent bearish flip of the 9, 18, and 40 EMAs may cause bulls to be less aggressive in bidding. However, possible support near $50.47 and $41.96 – between the 41.8% and 58.6% retracements – could see at least a short-term bounce.

Last year’s long-term consolidation suggests that the areas near $84.23 may be more likely to cause a longer-term trend reversal.

Bears are likely to add to their shorts at probable resistance beginning near $95.50, which has confluence with the 18 EMA. A fast break of this resistance could trigger more selling near $106.12, the start of the bearish move.

If an aggressive bullish move does appear, trapped buyers in the probable resistance beginning near $115.32 might provide a ceiling for this impulse.

2. Request (REQ)

The Request REQ utility token ensures the performance and stability of the Request Network. The Request Network itself is an Ethereum-based decentralised payment system where anyone can request a payment and receive money through secure means. It removes the requirement for third parties in order to provide a cheaper, more secure payment solution that works with all global currencies.

REQ Price Analysis

At the time of writing, REQ is ranked the 160th cryptocurrency globally and the current price is US$0.1174. Let’s take a look at the chart below for price analysis:

REQ has continued its rally through the daily gap between $0.08133 and $0.1057, turning this region into an area of possible support.

However, a stop run under the relatively equal lows at $0.07583 could form a wick below this level, potentially reaching an untapped daily gap beginning near $0.07051.

Resistance beginning at $0.1372 has seen significant profit-taking, shown by the long upper wicks on the daily candles. A break of this resistance may reach the next significant swing high at $0.1507, continue into probable resistance just above, and possibly set a new monthly high at $0.1833.

3. Cosmos (ATOM)

Cosmos ATOM bills itself as a project that solves some of the “hardest problems” facing the blockchain industry. It aims to offer an antidote to “slow, expensive, unscalable and environmentally harmful” proof-of-work protocols, like those used by Bitcoin, by offering an ecosystem of connected blockchains. ATOM tokens are earned through a hybrid proof-of-stake algorithm and they help to keep the Cosmos Hub, the project’s flagship blockchain, secure. This cryptocurrency also has a role in the network’s governance.

ATOM Price Analysis

At the time of writing, ATOM is ranked the 27th cryptocurrency globally and the current price is US$7.10. Let’s take a look at the chart below for price analysis:

ATOM has been consolidating in a range around Q1 2022’s high.

Q2 2022 saw the start of a smaller range inside this larger range. Near the current price, $7.00 or $6.80 could support at least a small move upward. This area is near the local range low, inefficiently traded, and the site of a stop run.

Just above the current price, the 9, 18, and 40 EMAs might provide resistance near $7.86. This level saw consolidation before last week’s downward move.

A move back toward the local range highs could reach possible resistance near $8.65, where bears rejected recent rally. This level is just above the May monthly open.

A more extended move by bulls might reach the larger range’s rejection area near $9.81. However, a move this far is less likely unless the overall market rallies.

Below the higher timeframe’s range, $6.75 to $6.10 could provide more substantial support to start a longer-term bullish trend. This level is near the 78.6% retracement of the July 2021 to September 2021 rally, shows inefficient trading on higher-timeframe charts, especially between $6.05 and $5.90, and provides a reasonable stop run target.

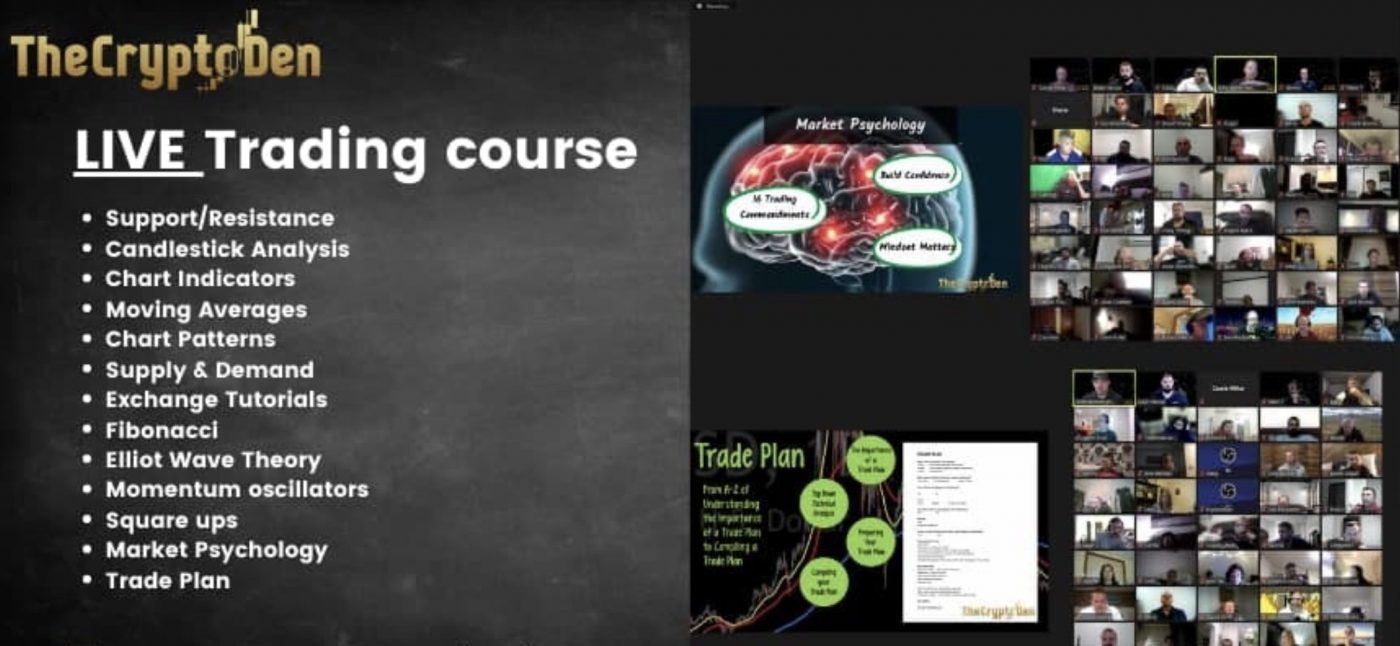

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link