Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Verge (XVG)

Verge XVG is a privacy-focused cryptocurrency and blockchain that seeks to offer a fast, efficient, decentralised payments network that improves on the original Bitcoin blockchain. It includes additional privacy features including integrating the anonymity network Tor into its wallet, called Verge Pay, and providing the option of sending transactions to stealth addresses. The project describes itself as community-driven, relying on volunteers and priding itself on being open-source.

XVG Price Analysis

At the time of writing, XVG is ranked the 302nd cryptocurrency globally and the current price is US$0.005272. Let’s take a look at the chart below for price analysis:

XVG has retraced nearly 80% from its Q1 highs and appears poised to continue its downtrend. If Monday’s trading fails to reach $0.006071, resistance might begin just above the current price at $0.005635.

Just above this level rests higher-timeframe resistance from $0.006399 to $0.007132. Inside this broad zone, $0.007509 is an inefficiently traded area, and $0.007817, the monthly open, might offer the most sensitivity.

A more significant rally would likely find resistance between $0.008050 and $0.008355, where the monthly chart shows inefficient trading. However, the current bear market decreases the probability of a rally reaching this far.

The quarterly chart shows a broad zone of possible support near $0.005107. Inside this zone, $0.004856 – near the 90% extension of the last retracement upward – offers a higher probability for a bounce or bottom. This level is near the midpoint of Q4 2021’s massive rally.

However, the swing low at $0.004352 and an inefficiently traded area below, inside late 2019’s consolidation, offers an attractive target for bears. Bulls should be cautious with entries until the trend flips bullish.

2. Ankr (ANKR)

ANKR originated as a solution that utilises shared resources in order to provide easy and affordable blockchain node hosting solutions, and has since built a marketplace for container-based cloud services through the usage of shared resources. It is a platform that enables the sharing economy, where any customer can access resources at a more affordable rate, while also providing enterprises with the ability to monetise their spare computing power. It is unique in the way that it is the first to use trusted hardware, and this ensures a high level of security.

ANKR Price Analysis

At the time of writing, ANKR is ranked the 14th cryptocurrency globally and the current price is US$0.04024. Let’s take a look at the chart below for price analysis:

ANKR continues to set monthly lows in its downward trend. Support might be found in the daily gap above the monthly open near $0.03695, though a deeper retracement is likely to target the relatively equal lows into support near $0.03225.

The daily gap near $0.03066 could also provide support. However, another gap inside the down candles, around $0.02732, provides the highest chances of solid support while offering a high risk-reward entry.

There is currently no resistance overhead since the price is in discovery. Extensions hint at the areas around $0.04995 and $0.05463 as reasonable take-profit zones.

3. Curve DAO Token (CRV)

Curve CRV is a decentralised exchange for stablecoins that uses an automated market maker (AMM) to manage liquidity. Curve has gained considerable attention by following its remit as an AMM specifically for stablecoin trading. The launch of the DAO and CRV token brought in further profitability, given CRV’s use for governance, as it is awarded to users based on liquidity commitment and length of ownership. The explosion in DeFi trading has ensured Curve’s longevity, with AMMs turning over huge amounts of liquidity and associated user profits.

CRV Price Analysis

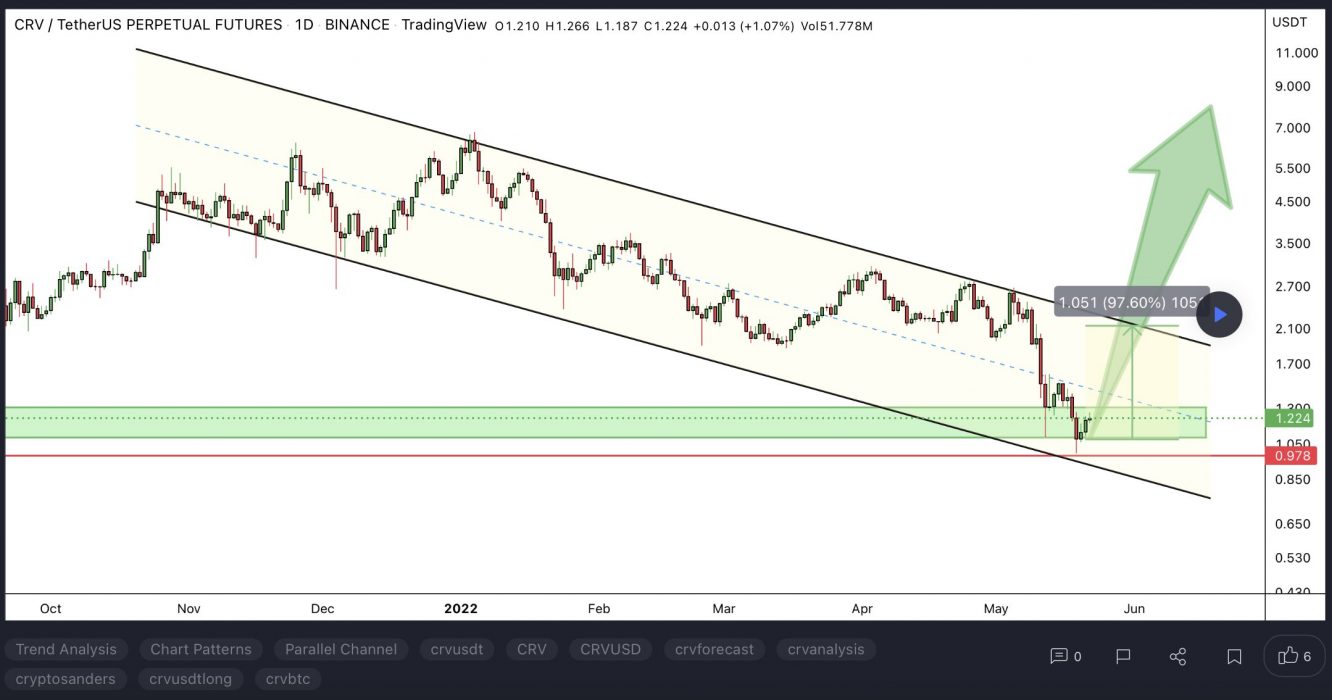

At the time of writing, CRV is ranked the 80th cryptocurrency globally and the current price is US$1.24. Let’s take a look at the chart below for price analysis:

Last week, traders enjoyed 20% gains at CRV‘s peak before the price confirmed stiff resistance beginning at $1.30.

The 1-Day chart shows that support may be forming between $1.15 and $1.05, near the weekly open. Aggressive bulls could enter in this area, although safer entries may be found much further below near $1.00 and $0.9781 after a sweep of the current consolidation’s swing lows.

The last swing high near $1.38 provides a likely first target if the price does bounce from this region. Beyond this swing high, the 1.0 extension near $1.47 and the 2.0 extension near $1.60 and $1.72 may provide the next major targets.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link