Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Tezos (XTZ)

Tezos XTZ is a blockchain network that’s based on smart contracts in a way that’s not too dissimilar to Ethereum. However, there’s a big difference: Tezos aims to offer infrastructure that is more advanced – meaning it can evolve and improve over time without any danger of a hard fork. This is something both Bitcoin and Ethereum have suffered since they were created. People who hold XTZ can vote on proposals for protocol upgrades that have been put forward by Tezos developers.

XTZ Price Analysis

At the time of writing, XTZ is ranked the 46th cryptocurrency globally and the current price is US$3.82. Let’s take a look at the chart below for price analysis:

XTZ‘s 65% drop since late December saw a second leg after last month’s market-wide drop ran the previous consolidation’s stops.

The level near $4.10 is providing some resistance. However, continuation through the monthly high at $4.32 is not out of the question. Aggressive bulls might bid in the current region near $4.58.

If the price runs the recent swing low, bulls might bid in the gap near $3.70. A deeper retracement could reach near the early-February level and a gap near $3.57. The region near $3.49 and $3.40 may also provide some support during a deeper retracement.

2. Stratis (STRAX)

Stratis STRAX is a blockchain-as-a-service platform that offers several products and services for enterprises, including launching private sidechains, running full nodes, developing and deploying smart contracts, an initial coin offering platform, and a proof-of-identity application. The company also provides cryptocurrency wallets and blockchain consulting services. Stratis operates its own blockchain-powered by a native token, STRAX.

STRAX Price Analysis

At the time of writing, STRAX is ranked the 290th cryptocurrency globally and the current price is US$1.27. Let’s take a look at the chart below for price analysis:

Since its rally in H1 2021, STRAX has been in a massive range between approximately $2.50 and $1.20. Long upper wicks during the second half of 2021 show distribution, while the daily chart shows a bearish trend since January.

The price is currently around the 79.6% retracement, near $1.30. This level has seen interest from bulls since July. It might provide support again for a short-term bounce.

The closest resistance may be at $1.42, near the 9, 18, and 40 EMAs. If the price breaks this level, bulls might target the old swing high near $1.59, another old swing high and inefficiently traded area near $1.72, and the consolidation around $1.80.

However, repeated tests of a level, plus the higher-timeframe downtrend, may cause an eventual breakdown of the current support near $1.20. If this occurs, old swing lows near $1.12 – particularly an inefficient region starting near $0.9877 – may be the bearish target and the subsequent support.

3. Coti (COTI)

COTI markets itself as the first enterprise-grade fintech platform that empowers organisations to build their own payment solutions as well as digitise any currency to save time as well as money. COTI is one of the world’s first blockchain protocols that is optimised for decentralised payments and designed for use by merchants, governments, payment DApps, and stablecoin issuers. The ecosystem has a DAG-based blockchain, proof-of-trust consensus algorithm, multiDAG, GTS (Global Trust System), a universal payment solution, and a payment gateway.

COTI Price Analysis

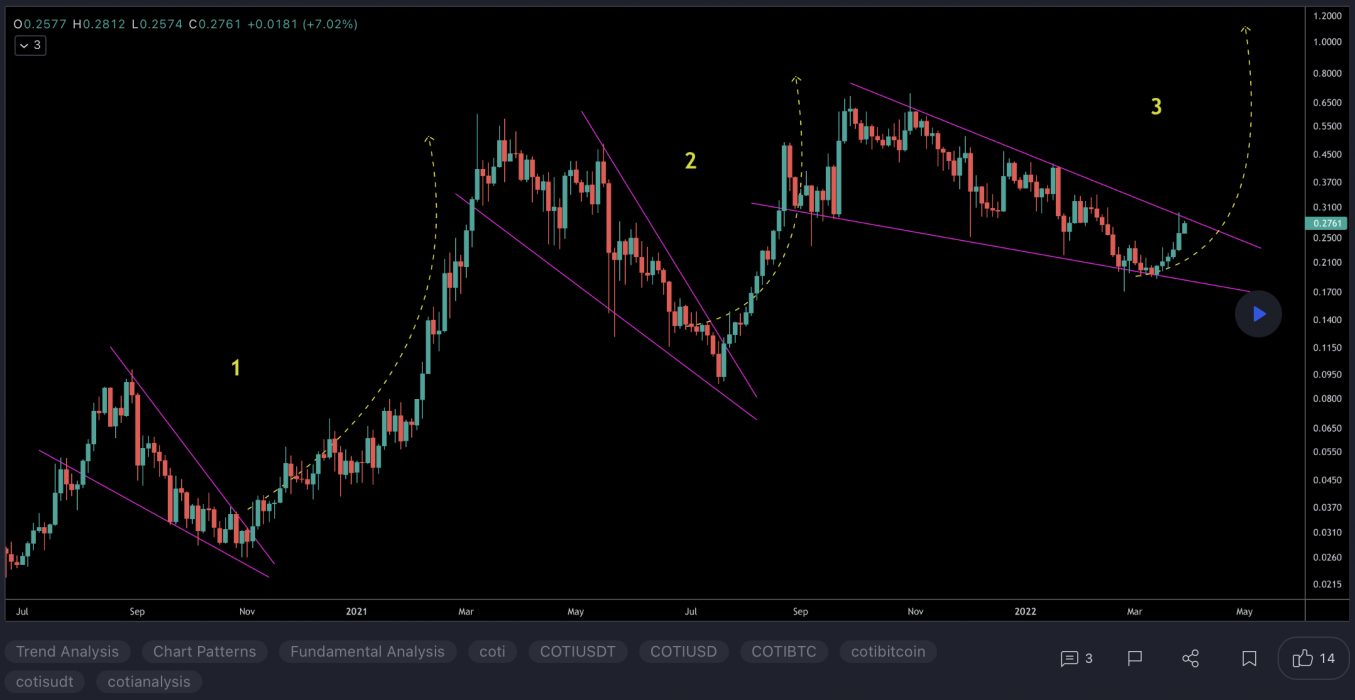

At the time of writing, COTI is ranked the 180th cryptocurrency globally and the current price is US$0.2896. Let’s take a look at the chart below for price analysis:

COTI‘s rally during H2 2021 broke down in early November and has since been in a bearish trend on the daily chart. The price recently swept lows below a contested area at $0.1952, which prompted a rally during the last week into resistance at the 40 EMA near $0.2988.

It remains to be seen whether this contested area from $0.2603 to $0.2252 can support a retest.

Unless the overall market turns bullish, a bearish continuation to possible support near $0.2165 – just under the 79.6% retracement level – seems likely. This area has sparked multiple consolidations.

A break of this level might continue to possible support near $0.1599, where the H2 2021 rally began accumulating before its run.

If the market continues its rally, breaking through resistance near the 2021 yearly open, the macro range highs near $0.3913 might provide the next resistance.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link