Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Major cryptocurrencies plunged to multi-month lows today as investors sold off digital assets amid broader market concerns. XRP fell to $1.65, Bitcoin dropped to $74,100, and Ethereum crashed to $1,390 in what analysts are calling a significant market correction.

Related Reading

XRP Loses 20% In Single Day

According to market data, XRP experienced its worst trading day since November 2024, falling 20% from $2.11 to $1.65. This sudden drop comes as part of a wider sell-off affecting the entire cryptocurrency sector.

The biggest cryptocurrency by market cap, Bitcoin, also experienced steep losses, reaching $74,000 – a five-month low. It seems even more dire for the holders of Ethereum, who have seen their investment decrease in value by 60% over the last 90 days, bringing prices to pre-early 2023 levels.

Market Veterans Point To Previous Recoveries

While fear spreads among newer investors, some cryptocurrency observers are calling for calm by mentioning earlier market downturns that eventually translated into record-breaking gains.

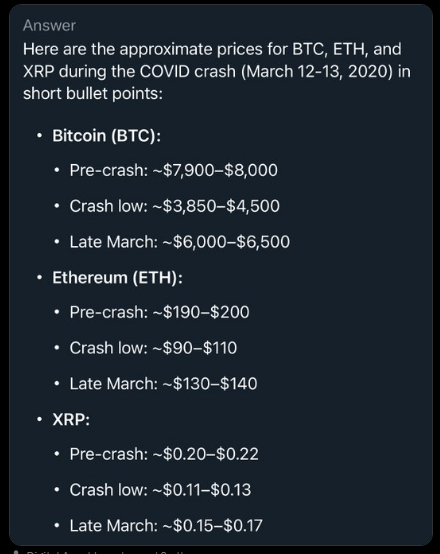

REMEMBER THE COVID CRASH IN 2020… $BTC was $3,850 $ETH was $100$XRP was at $0.11…

And all these projects went on to create millionaire’s over the next few years!

In times of crisis, you can follow the masses or go against the heard. 🇺🇸 pic.twitter.com/RzGsOEtkkB

— Good Morning Crypto (@AbsGMCrypto) April 7, 2025

Good Morning Crypto host Abdullah Nassif put followers in perspective by reminding them of the 2019 COVID-19 market crash. According to his statements, Bitcoin fell as low as $3,850 back then, with Ethereum selling as low as $100 and XRP falling to a low of $0.10.

The bounce back from those lows was significant. Bitcoin subsequently hit $69,000 in 2021 and $110,000 at its latest high – gains of 1,700% and 2,750% respectively on the 2019 low. That would mean an investor who put $40,000 into Bitcoin in the 2019 crash could have had their assets increase to more than $1 million by January 2025.

Optimism Despite The Sell-Off

Certain market players feel the current downtrend is a short-term affair and could bring with it the kind of buying opportunities seen during past market downturns. According to some analysts, although investment during times of market stress is a courageous step, past experience suggests such investments often pay dividends.

Market observers hypothesize that if XRP were to mirror its historic 30-fold increase from present levels, investors who own about 22,500 XRP tokens (currently valued at about $40,000) may be able to see their positions hit $1 million. If we do a quick math, that would mean that XRP would have to have a price of $50 per token to hit the vaunted million-dollar mark.

Related Reading

Similar Pattern Observed With XRP

XRP has followed a comparable trajectory since its March 2020 low of $0.11, despite facing legal challenges from the Securities and Exchange Commission. The token reached $1.96 in 2021 and $3.40 in the current market cycle.

These figures represent approximately 30 times growth from the 2020 bottom. Anyone who invested $40,000 in XRP during that period might have seen their investment grow to over $1.23 million by early 2025, according to the analysis.

Featured image from Gemini Imagen, chart from TradingView

Credit: Source link