Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

XRP is trading at critical levels after dropping below the $2 mark on Sunday, following a wave of panic selling across the crypto market. The move came as global financial markets reacted sharply to aggressive new U.S. tariffs, escalating trade tensions and sending risk assets tumbling. XRP, like many altcoins, has been hit hard by the volatility, with sentiment turning increasingly bearish.

Related Reading

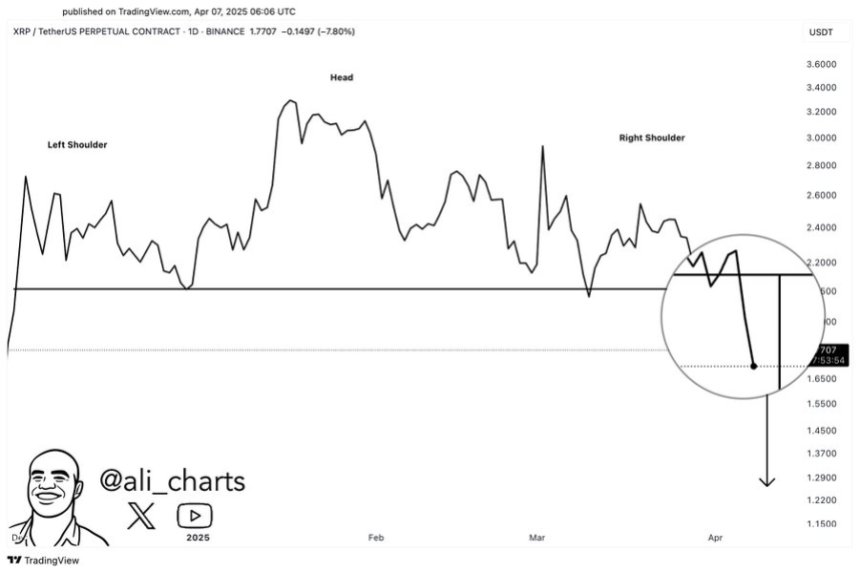

Adding to the concern, top analyst Ali Martinez shared technical insights that point to further downside. According to Martinez, XRP is currently breaking out of a head-and-shoulders pattern — a classic bearish setup that often signals the beginning of a larger correction once the neckline is broken.

If the pattern plays out, XRP could be heading toward the $1.30 level, a key zone of historical demand and potential support. With market conditions already fragile and uncertainty growing, this pattern reinforces the bearish outlook for XRP in the short term.

Unless bulls can reclaim $2 and invalidate the breakdown, XRP may continue to bleed alongside the broader market. All eyes are now on how price behaves in the coming sessions, as traders assess the strength of this technical signal.

XRP Faces Bearish Outlook As Head-and-Shoulders Pattern Confirms Breakdown

XRP has now lost over 50% of its value since reaching its recent all-time high, and the market is showing no clear signs of stability. As fear spreads across both traditional and crypto markets, XRP remains under heavy pressure, with volatility intensifying in recent sessions. The broader landscape clouds with macroeconomic tension, particularly US tariffs that have triggered global trade concerns and sent risk assets into a tailspin.

The sentiment surrounding XRP is deeply divided. While some investors still believe that a broader market recovery could help XRP reclaim range highs, others remain skeptical. For now, price action supports the latter. Bulls have failed to defend the $2 mark — a critical psychological and technical level — and XRP has continued to trend lower.

Martinez added to the bearish narrative, sharing a technical breakdown on X that shows XRP is currently breaking out of a head-and-shoulders pattern. This formation is widely regarded as a bearish reversal signal, and Martinez suggests that the confirmed breakdown could send XRP tumbling toward the $1.30 level. That target aligns with historical demand and previous support zones, making it a likely destination if current momentum continues.

Unless bulls reclaim $2 quickly and invalidate the pattern, XRP may struggle to recover in the near term. With the broader market still unstable and high-risk assets under pressure, the bearish outlook for XRP appears to be gaining traction. The coming days will be critical as traders watch whether XRP stabilizes — or slips further into its current downtrend.

Related Reading

Bulls Struggle At $1.86 And Fight To Avoid Deeper Correction

XRP is trading at $1.86 after several days of struggling to reclaim higher levels, with selling pressure dominating price action. Bulls lost momentum once the price broke below the key $2 support, which had previously served as a psychological and technical floor. Since then, XRP has continued to slide, failing to generate enough buying volume to spark a meaningful recovery.

The current level around $1.86 is now acting as a short-term support zone, but it remains vulnerable. If XRP doesn’t hold above this area, sellers will likely push it toward the $1.50 region. This level marks a significant demand zone from previous market cycles and could act as the next stop in the event of continued bearish pressure.

Related Reading

On the flip side, if bulls can manage a swift rebound and push the price back above $2, it may trigger a short-term relief rally. Reclaiming that level would invalidate some of the recent bearish momentum and potentially set the stage for XRP to target higher resistance around $2.20 and beyond.

For now, XRP remains caught in a delicate spot — and what happens next will depend largely on whether buyers step in to defend the current support zone.

Featured image from Dall-E, chart from TradingView

Credit: Source link