In a major milestone for the global crypto community, the number of cryptocurrency user addresses has reached 50 million, according to data from CoinMetrics.

Steady Increase in Addresses

In the past half-decade, everything from governments to influencers have caused fluctuations in price. But however the market values these digital assets, the amount of crypto addresses continues to grow as more people start using cryptocurrencies and transacting on the various chains.

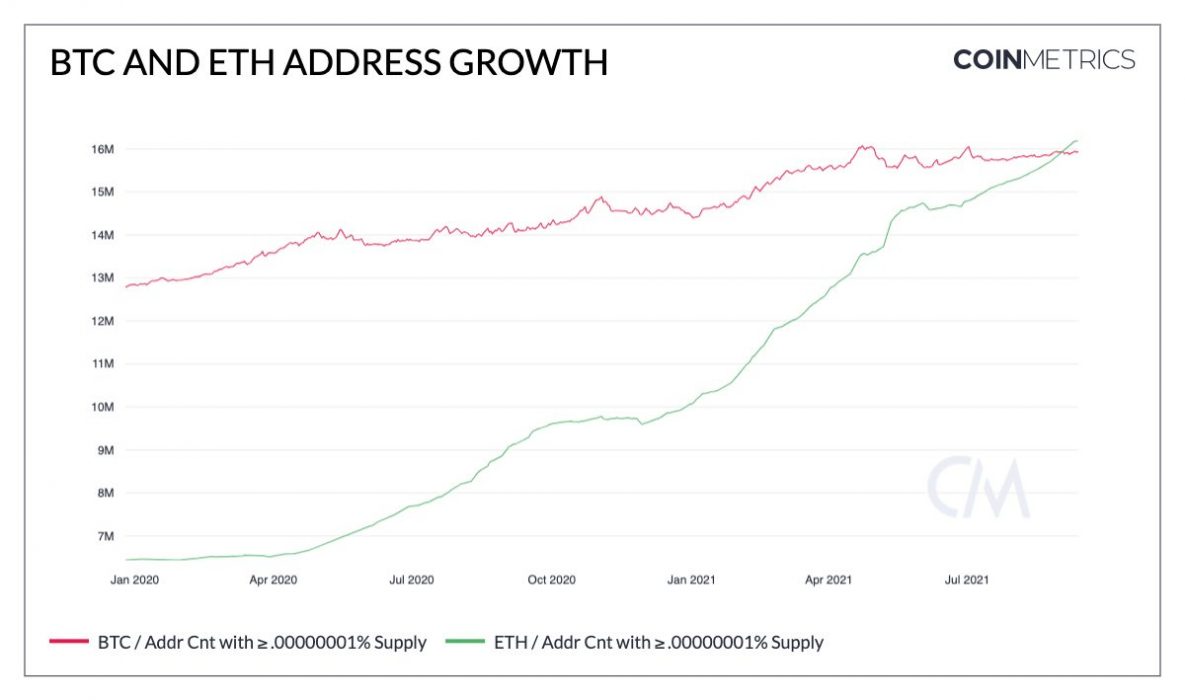

The chart above shows the number of addresses holding at least one ten-billionth (> .00000001 percent) of total supply of various crypto assets. This tiny metric is used to determine new addresses that hold even a smidgen of crypto. Although a single user can have several wallets, the point here is that there is a steady increase in the number of crypto addresses/users.

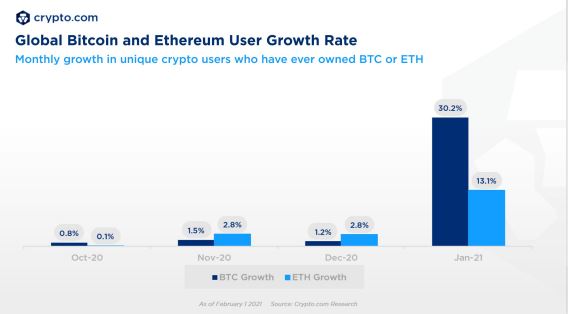

According to a market size measurement study based on on-chain metrics, Crypto.com has shown that:

- The number of global crypto users reached 106 million in January 2021.

- A strong increase in bitcoin adoption was one of the main drivers for January’s 15.7 percent increase in global crypto adoption.

- Some 2021 events have also driven crypto adoption, such as the massive growth of the DeFi sector, the NFT craze, El Salvador adopting bitcoin as legal tender, and major companies like PayPal opening up crypto services.

There has also been a significant increase in the number of bitcoin whale addresses over the past year. These are wallets that hold over 1,000 BTC. From January to December 2020, this class of bitcoin address grew by 6.7 percent, according to data from Glassnode. However, in a single month from December 2020 to January 2021, the number of addresses increased by 7.2 percent, indicating major interest from deep-pocketed investors.

Active bitcoin addresses have also been on the rise in the past month with an increase in exchange outflows, indicating investors are taking their BTC out of exchanges and putting it back into their wallets.

ETH Overtakes BTC

Data on CoinMetrics also shows that in July 2021, the number of Ethereum addresses overtook those associated with the Bitcoin network.

This is quite the turn of events but is most likely due to the adoption of NFTs, DeFi, and the use of all sorts of Dapps on Ethereum as opposed to BTC, which acts as a store of value and only recently gained the ability to run smart contracts with the Taproot upgrade. The number of addresses on the Ethereum blockchain should overtake bitcoin simply for its utility, unless the whole planet uses bitcoin at some stage.

With more blockchain projects adding real-world value, it’s obvious individuals are starting to make use of the services offered. And as the industry moves further beyond its infancy, businesses and individuals alike will need to create addresses to participate in the ecosystem.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link