Bitcoin is one of the most interesting and powerful pieces of mathematical code out there, launched as an open source project by the mysterious Satoshi Nakamoto.

In yet another one of the many ways math and mystery come together in relation to the cryptocurrency, its origins, and the underlying technology, the current peak in recent price action also just so happens to taken place perfectly at the golden ratio. But why?

Math, Mystery, And So Much More: Crunching The Cryptocurrency Numbers

Math is one of those love it or hate it subjects in school, but no one can discount just how powerful it is when used effectively. It is by definition “the study of quantity, structure, space, and change.”

When it comes to Bitcoin, math is everywhere around it. The hard-capped “quantity” of BTC will always remain at 21 million, while the “structure” of its code maintains that maximum cap.

Related Reading | Third Time’s The Harm: Trader Warns Of Bitcoin Reversal Pattern

“Space” in this case, isn’t in reference to moonshots, but in the geometric shapes and patterns that appear on Bitcoin price charts, which “change” with each buy or sell order.

Math is integral to quantifying data in fundamental analysis, and measurements go into plotting the lines and averages of technical indicators.

However, there’s no easy way to explain why the cryptocurrency’s recent bull rally, has topped out at a key mathematical area.

Why did Bitcoin stop at the golden ratio? | Source: BTCUSD on TradingView.com

Bitcoin Bull Rally Takes Pause At Golden Ratio, But Why?

Strangely, the current high in Bitcoin price is $61,800. At first glance, nothing appears to out of the ordinary about the number. But there very well could be some serious significance that could explain why momentum is beginning to turn around.

The number, now more than three times its 2017 record, just so happens to be 61.8% to the price point most investors are HODLing for, which is $100,000 per coin.

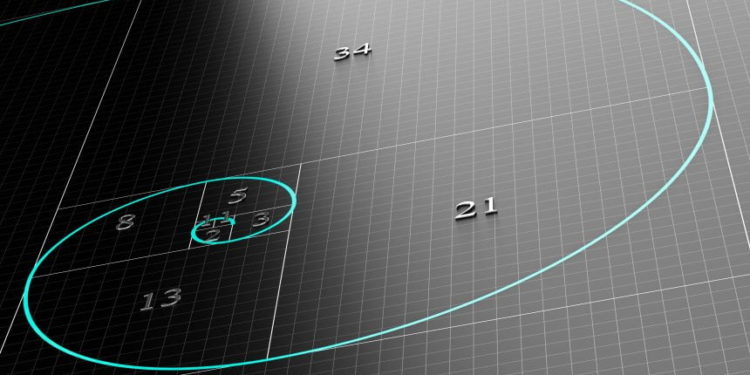

The golden ratio itself is 1.618, with the inverse as 0.618. The number is used in technical analysis as one of the Fibonacci retracement levels with the most significance.

Fib retracement and extensions are measured from lows to highs or vice versa, while in the case of the current rally, price action stopped instead at 61.8% of the way to the speculate target of $100,000.

Related Reading | Heads Up: Bearish Bitcoin Technical Pattern Shouldn’t Be Shrugged Off

It is a theory that cannot be proven, nor is it fully understood why the golden ratio is found so commonly throughout nature and within the price charts of assets like cryptocurencies.

Renowned twentieth-century artists such as Salvador Dalí have included the golden ratio within their works, “believing this to be aesthetically pleasing,” according to Wikipedia.

It also appears in various places within nature, such as within the pattern of leaves, or the spiral of the Nautilus shell. But could it also be the ideal zone for the speculators to begin taking profit before the bull market keeps going?

Featured image from Deposit Photos, Charts from TradingView.com

Credit: Source link