Much has been said lately about Bitcoin’s impact on the environment. Mainstream media has been especially keen on declaring BTC’s consensus mechanism (Proof-of-Work) a potential danger for the future of the planet.

A White paper published by Square and ARK Invest, as part of “The Bitcoin Clean Energy Initiative”, makes the opposite case and argues Bitcoin is in fact a “key driver of renewable energy’s future”. The research paper claims Bitcoin mining along with renewable energy to facilitate an “energy transition”.

Thus, energy asset owners could become the “bitcoin miners of tomorrow” operating a resilient electricity grid. BTC miners have certain characteristics which can sustain this new energy model. First, miners are geographically agnostics, with a “flexible and easily interruptible load”, as the White paper claims.

As such, they are “unique energy buyers” appropriate to face the clean energy sector’s main challenges: low production when demand rises and intermittency. The research claims the following:

Bitcoin miners, on the other hand, are an ideal complementary technology for renewables and storage. Combining generation with both storage and miners presents a better overall value proposition than building generation and storage alone.

Bitcoin Leverage The Cleanest And Cheapest Form Of Energy

The Levelized Cost of Energy (LCOE), metric use to measure how expensive is to produce a type of energy, for solar and wind have seen a decline in the past ten years. The White paper claims solar energy cost has fallen by 90% and wind by 71%. Therefore, the cost without external factors (like subsidies) sits at about 3 to 4 cents per KWh and 2 to 5 cents per KWh, respectively.

In contrast, the same metric (LCOE) for fossil energy stands at 5 to 7 cents per KWh for coal and natural gas. The research adds:

(…) solar and wind are now the lowest cost and most scalable. What’s more, we believe they will only continue to get more affordable over time.

Bitcoin mining can be a “complementary” technology that leverages these cleaner and cheapest energy sources. The combination of the above with methods to store energy can lead to, according to the White paper, a migration of clean energy projects into “profitable territory” with benefits for investors.

Also, more flexibility to construct solar and wind projects. Sustainable with BTC mining, they can explore their integration with the main energy grid when “interconnection studies are completed”. Such energy sources can be resilient in “black swan events” providing the energy grid with “readily available excess”.

The miners can absorb this “excess” energy due to their “unlimited appetite” while a Lithium-Ion based storage, for example, can hold its capacity to meet the consumer’s demand during the day. In the long term, the White paper predicts a scenario where there will be a bigger need for electrical supply with the growth of electric vehicle use.

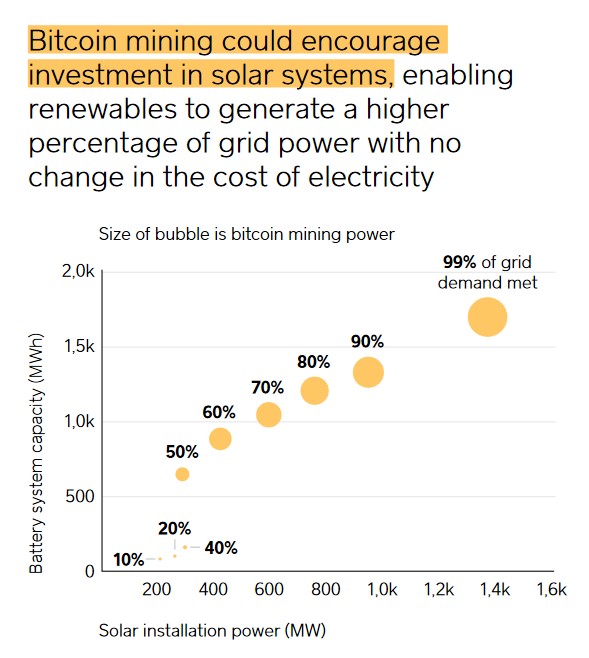

The model presented by Square and ARK Invest could boost the deployment of solar and wind energy sources. At the same time, turning the BTC mining industry into a much “sizable” and greener sector. Without the miners, the research estimates only 40% of grid power before prices must be increased to meet demand. The opposite case is more profitable and sustainable:

With bitcoin mining integrated into a solar system however, energy providers – whether utilities or independent entities – would have the ability to play the arbitrage between electricity prices and bitcoin prices, as well as potentially sell the “surplus” solar and supply almost all grid power demands without lowering profitability.

BTC is trading at $55.394,97 with a 1.8% loss in the daily chart. In the weekly and monthly chart, BTC has a 12.9% and 3.8% loss, respectively. The market cap stands at $1.3 Trillion.

Credit: Source link