After recent record losses, Bitcoin HODLers enjoyed gains over the weekend for the first time in weeks as the digital asset surged over 5 percent overnight. This was largely attributed to the influx of Bitcoin whales holding 100 to 10,000 Bitcoin accumulating over 60,000 coins in a single day, worth US$2.7 billion.

Bullish Signs as Bitcoin Whales Steadily Accumulate

On-chain analyst and trader Willy Woo had a humorous take on the aggressive whale accumulation, tweeting:

According to on-chain analysts Santiment, these addresses now hold 9.12 million coins combined, up over 100,000 from only six weeks ago.

The total number of coins held by whale entities – addresses controlled by a single network participant holding 1,000 to 10,000 Bitcoin – rose by over 80,000 to 4.216 million Bitcoin on 2 July, hitting the highest level since May. For context, this remains some way below the record high of 4.542 million reached in February.

The number of whale entities has now jumped to a three-week high of 1,922, which read together with signs that Bitcoin may have bottomed out, offers bullish support.

Whale Accumulation Coincided with Largest Downward Bitcoin Mining Difficulty Adjustment in History

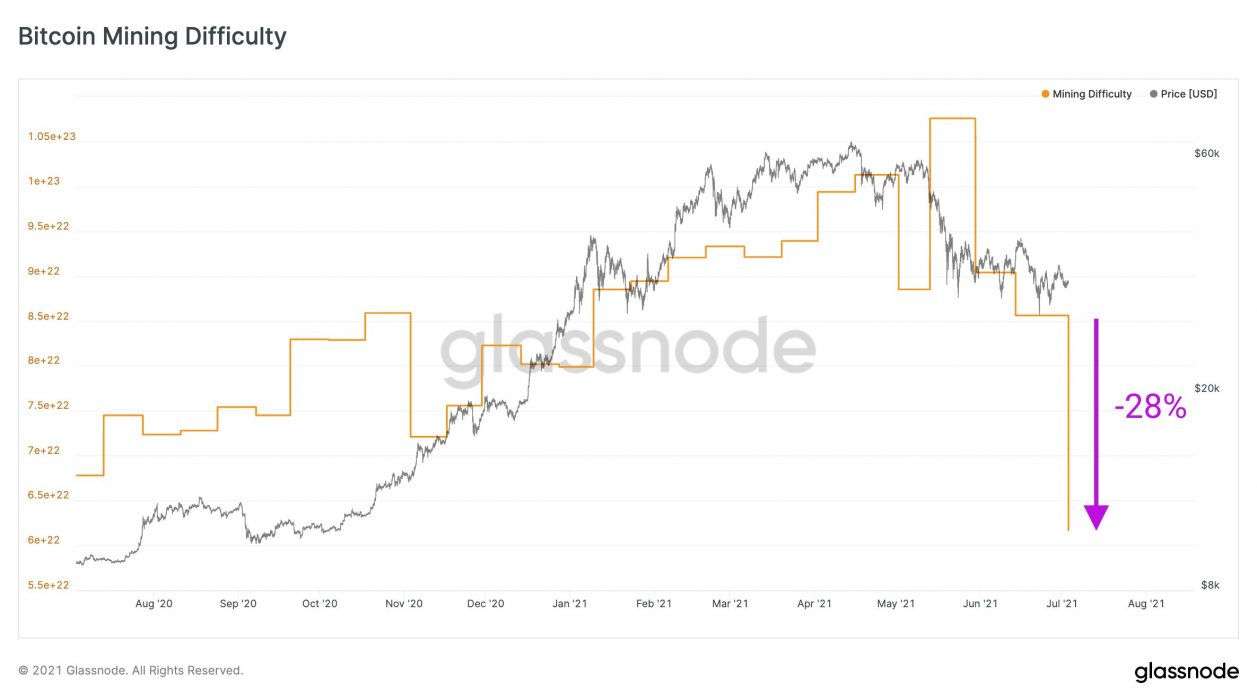

Interestingly, this recent whale accumulation coincided perfectly with the largest negative difficulty adjustment (-28 percent) in the history of the Bitcoin network.

In short, the difficulty adjustment refers to the difficulty of mining Bitcoin and is linked to the hashpower. As hashpower is removed, the difficulty decreases and where hashpower increases, difficulty is increased. The record 28 percent reduction in the difficulty adjustment was a direct consequence of China banning Bitcoin mining.

Most, however, view the mining ban in a positive light. As hashrate migrates out of China, the network becomes more decentralised and given the network’s response to the recent negative difficulty adjustment, it appears as resilient as ever.

At the moment, whales appear bullish. Historically, this tends to provide evidence of a broader shift in sentiment. It remains to be seen whether this trend will continue in the coming months.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link