Alexi Lane of Ethereum tokens explorer Ethplorer.

____

As bitcoin (BTC) keeps reaching its new all-time highs, all eyes are on the world’s leading cryptocurrency as it dominated news cycles and attracted newcomers to the digital asset industry. The price action of the heavily followed asset is driving attention and investment into Ethereum (ETH)-based protocols such as Uniswap (UNI) and Aave (AAVE) with the total value locked (TVL) in decentalized finance (DeFi) rising by over USD 20bn since January 2021.

At the turn of 2018-2019, the height of the most recent bear market, few knew about decentralized finance as an industry, yet just a year on, neologisms such as yield farming and liquidity mining have seen an influx in attention and investment with popular yield farming platform Harvest Finance having over USD 600m in TVL.

Wrapped Bitcoin, or WBTC for short, is the first ERC-20 token with the same 1:1 ratio to bitcoin, and it was launched in 2019.

The concept of WBTC emerged in a bid to improve bitcoin’s functionality and usability by delivering the power of bitcoin with the flexibility of an ERC-20 token, allowing those with bitcoin to take part in major DeFi protocols, many of which are based on Ethereum.

As Bitcoin and the Ethereum blockchains are not compatible, WBTC bridges the gap.

WBTC is completely transparent, 100% verifiable, and community-led, and with more people entering the space it is becoming even more crucial for these measures to be present in cryptocurrencies.

WBTC is the pioneer of tokenized bitcoins with a market capitalization of USD 7.9bn, ranking 14th on CoinGecko (as of March 18, 12:45 UTC).

Bitcoin’s limitations have been addressed through WBTC, while approaches to issuing and securing wrapped assets differ significantly from traditional bitcoin.

Let’s explore how WBTC helps provide more sophisticated financial services to traditional BTC holders and merges the worlds of Bitcoin and DeFi.

Current state of affairs: The ways in which Bitcoin and DeFi have met in the middle

There is much debate in the industry as to whether or not Bitcoin, at the most basic level, is actually the original decentralized financial system.

This is because, people who use Bitcoin are already acting as their own banks (as long as they control their own private keys) and can permissionlessly exchange value with whomever they want, anywhere and under no central entity.

What arguably stops Bitcoin from reaching parity with decentralized networks is its current use cases. These are mainly as a means of payment, HODLing, storage as digital gold, and trading on centralized exchanges.

This is where wrapping comes in. Wrapping tokens on Ethereum describes the process for transforming an existing crypto asset into an ERC-20 token. ERC-20 tokens remain the most widely-used standard for token design, and ensures that the rules of smart contracts remain compatible with applications like decentralized exchanges or lending protocols.

There are countless things you can do with WTBC that you can’t with bitcoin.

These include adding more liquidity to your portfolio of crypto assets, using it as collateral for borrowing or lending, and yield farming.

You can interact with key DeFi projects via lending your WBTC on the decentralized lending system, Aave, and liquidity provisioning your WBTC on decentralized crypto exchanges like Uniswap.

According to Ethplorer, a total of 129,336 tokenized bitcoins are circulating on the market. This is equivalent to approximately 4.11% of ethereum’s market cap and 0.91% of the total market value of the first cryptocurrency.

How could the relationship between Bitcoin and DeFi evolve in 2021?

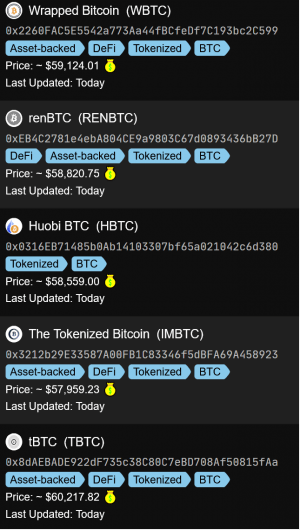

Against the background of the boom in the DeFi sector, other wrapped projects have appeared – tBTC, renBTC, and HBTC – signalling how competition in the segment has intensified. This ranking by Ethplorer outlines the current status of leading wrapped tokens.

Projects like WBTC and renBTC have long been entrenched in the listings of the largest exchanges and have become familiar to many users old and new.

To make the most of wrapped tokens and access the DeFi industry via bitcoin’s liquidity, it’s important to grasp the behaviors of wrapped tokens on the Ethereum blockchain using resources such as blockchain explorer platforms, Ethplorer and Etherscan, to breakdown things such as price action, transfers, and volume.

In 2021, if WBTC is to achieve true decentralization, it needs to combat a key drawback – centralized custodianship.

What does this mean for the average crypto user?

Bitcoin’s shortcomings on its own were one of the main reasons for the emergence and growth of the popularity of WBTC.

Use-cases of wrapped tokens that appeal to crypto users range from the ability to access inexpensive loans where there is no Know Your Customer (KYC) and other bureaucratic red tapes, the possibility of placing funds at an attractive interest rate, spot and margin trading of tokens and derivatives on non-custodial exchanges, and asset insurance.

This opens up a much broader world of possibilities for crypto users who want to really engage with the variety of financial instruments available through DeFi.

This in turn signals the merging of both these worlds if Bitcoin maximalists begin to view decentralized financial markets as a good playing ground.

Conclusion

The combination of the power of Ethereum and the benefits of Bitcoin creates a powerful value proposition.

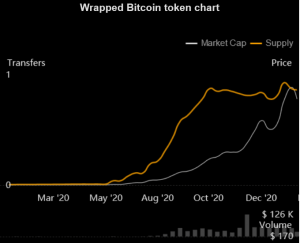

Funnily for many skeptics, a year and a half after its creation, the capitalization of the first WBTC grew from almost zero to over USD 7bn, and since 2020, the market supply of WBTC has grown more than 200 times.

Amid the ongoing boom in the DeFi sector, we can expect further growth in the capitalization of tokenized bitcoins, for which there are many use cases.

The apparent success of WBTC and other similar assets may also drive the rise in popularity of tokenized versions of altcoins to achieve the same success in intersecting different worlds in the blockchain industry.

____

Learn more:

– DeFi On Bitcoin To Grow In The Shadow Of Ethereum

– Prompted by Booming DeFi, a Bridge Between Bitoin and Ethereum is Growing

– Red Lever Pulled on Bitcoin-Ethereum Bridge Two Days Post-Launch

– What Can Crypto Crisis Managers Learn From BlockFi’s Silence & tBTC’s Openness?

– Unchained DeFi Unicorns – The Next Wave of Billion Dollar Companies

Credit: Source link