The US government is increasing its efforts to combat cryptocurrency criminal funding, especially in response to terrorist attacks in Israel.

The world’s largest economy has expressed concerns that some crypto firms are not doing enough to prevent illegal funds flowing to bad actors.

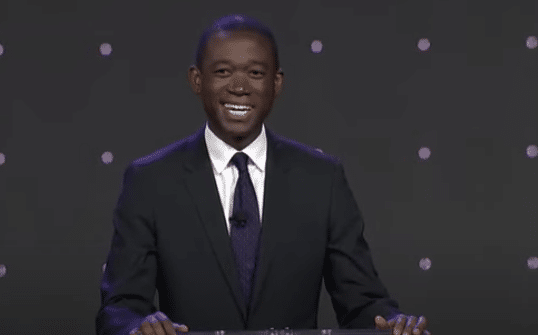

Speaking at the ongoing Royal United Services Institute in London, US Deputy Treasury Secretary Wally Adeyemo stated that the US’s war on terrorism has evolved due to new tactics employed by groups like Hamas and the Kremlin to bypass financial sanctions.

Remarks by Treasury DepSec Adeyemo at RUSI in London on targeting #Hamas & Russian illicit finance, work of TFTC, & focus on working with Europeans so Hamas has nowhere to hide https://t.co/h35GNdywvj

— Matthew Levitt (@Levitt_Matt) October 27, 2023

To stop the flow of illegal funds, the US Treasury Department is collaborating with financial institutions and virtual currency platforms to establish effective measures that prevent terrorists from accessing funds.

Despite these efforts, challenges remain. The Deputy Treasury Secretary pointed out that a few digital asset firms are seeking to enable decentralized access to funds without adequately considering the consequences, especially when it involves illicit resources.

To these deterrents, the Deputy Secretary stated that the US and her allies are ready to take necessary actions to clamp down on such operations.

Stating the US government’s expected line of action as the crackdown on terrorist financing picks up pace, Adeyemo told the body of gathered statesmen that financial sanctions on bad actors will expectedly increase.

To achieve this, the US will target emerging shell companies, intermediaries, and facilitators who serve as channels for the illicit flow of funds and donations.

Secondly, the Biden administration will partner more with its allies to increase information sharing and collaboration in order to weaken and disrupt the funding network of terrorist organizations.

Lastly, it will engage with relevant stakeholders and financial institutions to ensure steps are taken to stem the flow of funds for illegal purposes.

1,000+ Individuals Sanctioned for Terrorist Financing

Since the outbreak of Israeli and Hamas hostilities weeks earlier, the US government has sought for avenues to cripple the funding pipeline of the terrorist organization.

So far, the Treasury Department has launched a series of sanctions against 10 key Hamas group members, operatives, and financial backers in Gaza and elsewhere.

One such facilitator is a Gaza-based virtual currency exchange and its operator, who served as a pathway for the aggressors to move funds illicitly amongst their groups.

The Department has also added over 1,000 entities and individuals who serve as proxies for the Iranian regimes for enabling the continued terrorist attacks on Israel to its sanctions list.

Furthermore, the Financial Crimes Enforcement Network (FinCEN) has also released a notice for proposed rulemaking (NPRM), which will allow the US to designate convertible virtual currency (CVC) mixing services as a vehicle for money laundering.

FinCEN says that crypto mixing is of primary money laundering concern, yet it also admits that there are legitimate reasons to mix.

Given this admission, why doesn’t it set a threshold, say $5k, below which mixing is exempt, rather than declaring all mixing to be of concern? pic.twitter.com/p2AbaMuhJ8

— John Paul Koning (@jp_koning) October 20, 2023

CVC mixing services or platforms allow users to send funds discreetly due to their ability to bundle transactions randomly together to escape detection from the public eye.

The NPRM is targeted at improving transparency in fund movements in the crypto space and cutting down on terrorist funding.

Credit: Source link