- Trump has promised major changes for the crypto industry, including dismissing SEC Chair Gary Gensler and creating a Bitcoin reserve, though these face legal and political hurdles.

- Crypto analysts and industry leaders view Trump’s win as pivotal for the sector, anticipating deregulation and increased institutional adoption.

- Despite the uncertainty of Trump’s promises being fulfilled, the crypto market reacts positively, setting new price records.

Donald Trump will be the next president of the United States and he won the election with a lot of promises. One particular sector he courted extensively is crypto of course. Being skeptical and anti-crypto in the past, Trump has done a 180 in 2024, now embracing crypto.

He also has made many promises, like firing Gary Gensler, the chair of the US Securities and Exchange Commission (SEC) and introducing a Bitcoin reserve.

I will fire Gary Gensler on day one. The day I take the oath of office, Joe Biden and Kamala Harris’ anti-crypto crusade will be over.

Donald Trump

Donald TrumpAs always in politics, both these promises might be harder to keep than first meets the eye.

To fire Gensler outright, Trump would need serious legal grounds, which don’t appear to exist. As much as anyone – including yours truly – would love to see him go, we must acknowledge the complexity of ending all the legal shenanigans the SEC has cooked up.

Related: Solana ETF Next? SOL Rallies 14%, Surpasses BNB to Become Fourth Largest Crypto

There are hurdles for a Bitcoin reserve too, and although not impossible, like most things in politics, it could be a lengthy process.

So, then you might ask, what’s this “Golden Age” for crypto that’s been thrown around a lot?

Trump Election ‘Most Important Day’ for Sector, Says Novogratz

Well, for starters, Trump, love him or hate him, is seen as the more crypto-friendly president by a long shot.

While we don’t yet know how many of his election promises he’ll keep (which politico does, anyway?), there’s hope that he will at least be more positive toward crypto overall.

Kamala Harris hasn’t really said much about crypto, all but vague statements about making the US “dominant in blockchain” – whatever that means.

And to be fair, while Bitcoin didn’t need any clarity, it has already benefited from the Trump win and made fresh new all-time highs. And analysts, like JP Morgan, think we are just getting started.

We continue to see room for the Trump trade to reverberate over the coming eight weeks or so in a similar fashion to 2016.

JP Morgan

JP MorganMike Novogratz, CEO of Galaxy Digital Holdings, even called the Trump win the “most important day for crypto”.

He expects that under Trump’s watch disliked rules, like SAB 121, “get repealed very quickly”.

Analysts See Bullish Case for Crypto Amid Regulatory Easing

Novogratz also expects a whole host of institutional and Trad-Fi players and investors to put crypto on their balance sheets, driving adoption onward and prices upward.

Others, like Bitwise Chief Investment Officer Matt Hougan, say they’ve never been as bullish, eyeing a Bitcoin price of US$100k (AU$150k) by the end of 2024 and US$200k (AU$300k) in 2025.

But beyond price, Hougan believes the increasing institutional demand, constrained supply, the out-of-control deficit – which may actually get worse under Trump – and increasing use cases are all bullish for crypto.

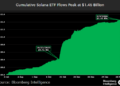

Related: Spot Bitcoin ETFs Experience Record-Breaking Inflows, IBIT Hits $1 Billion Volume in 20 Minutes

Boris Bohrer-Bilowitzki, CEO of Concordium, told CNA in an emailed statement that he is expecting regulatory pressure to ease and the United States to attract more crypto talent.

I predict that he will take a lighter approach to regulating crypto and digital asset technologies, possibly deregulating in favor of aiding the growth of startups in these areas. Doing so would also make the US an attractive place for foreign innovators to set up crypto and digital asset startups and will allow the US to outflank competitors like China in the long term.

Boris Bohrer-Bilowitzki, Concordium CEO

Boris Bohrer-Bilowitzki, Concordium CEOCredit: Source link