Let’s take a closer look at this week’s altcoins showing breakout signals. We’ll dive into the trading charts and provide some analysis to help you.

1. Ethereum (ETH)

Ethereum is a decentralized open-source blockchain system that features its own cryptocurrency, Ether. ETH works as a platform for numerous other cryptocurrencies, as well as for the execution of decentralized smart contracts.

Ethereum’s own purported goal is to become a global platform for decentralized applications, allowing users from all over the world to write and run software that is resistant to censorship, downtime, and fraud.

Ethereum Price Analysis

At the time of writing, ETH is ranked 2nd cryptocurrency globally and the current price is A$3571. Let’s take a look at the chart below for price analysis.

ETH‘s stunning rally to $5647 plummeted over 60 percent during May to sweep consolidation lows at $2576. This sweep of the lows could set the stage for a new bullish cycle to begin.

The price is currently balancing around the June monthly open. A quick stop runs into support beginning near $2527 could set the stage for a move into the daily gap beginning near $3255 – potentially reaching resistance near $4624.

A sweep of the highs near $3752, followed by a sharp sell-off, could hint that bears are preparing to run the swing low near $2810 AUD. This drop could find support around $2479 in the candle wick that created the May low. If the market remains bearish, the price will likely sweep May’s low into possible support near $2192.

2. Elastos (ELA)

Elastos aims to be a blockchain-powered version of the internet. The project originates all the way back to the year 2000; however, the current version that is based on blockchain technology and has been in active development by Elastos was founded in June 2017.

The team behind the project genuinely believes that Ethereum, as well as DApp platforms, faces limitations in scaling. While they are great for smart contracts, they are slow, not flexible at all, and inconvenient for full applications, according to Elastos. Elastos is a platform for decentralized apps (DApps for short) that claims to solve many of these limitations.

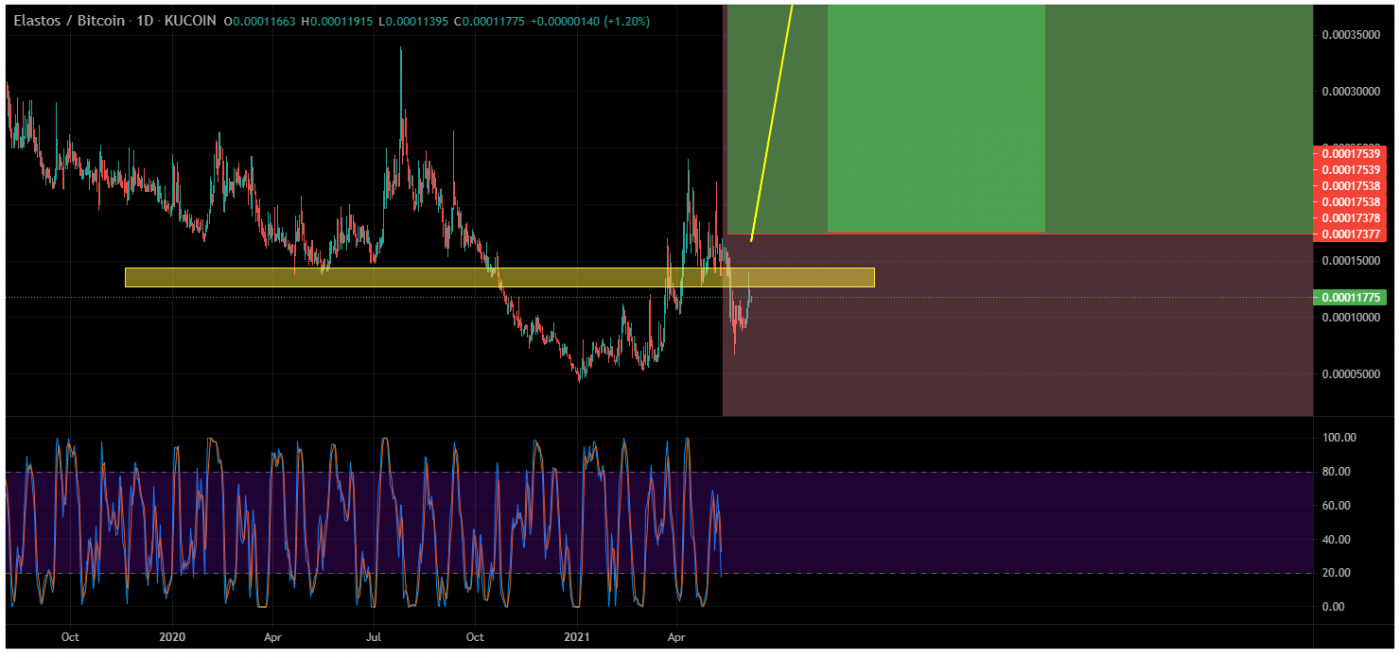

ELA Price Analysis

At the time of writing, ELA is ranked the 366th cryptocurrency globally and the current price is A$5.44. Let’s take a look at the chart below for price analysis.

ELA formed relatively equal lows near A$3 after dropping over 81 percent during May. These lows could provide the target for another leg down, possibly finding support in the monthly gap of around $2.63.

If this sweep of the $3.90 swing lows occurs, more aggressive bulls might begin bidding the weekly level near the swing low around $3.37. Should the market take a more bullish turn, the level just below near $5.08 could provide some short-term support.

The steep drop left large areas of inefficient price action, making the daily gap up to $7.60 likely to be touched or filled. A sustained move through this resistance could visit a significant area on the monthly and weekly chart near $9.55.

3. Origin Protocol (OGN)

Origin Protocol is a network that allows market participants to share goods and services through peer-to-peer (P2P) networks. The platform aims to create an extensive online marketplace leveraging the Ethereum (ETH) blockchain and Interplanetary File System (IPFS) in order to eliminate the need for middlemen.

The protocol allows for the creation of a decentralized setting where both buyers and sellers can connect, check for available listings, write reviews, and perform many other actions. With this, fractional usage of assets can be traded more easily.

OGN Price Analysis

At the time of writing, OGN is ranked the 139th cryptocurrency globally and the current price is A$1.19. Let’s take a look at the chart below for price analysis.

April started a gradual 87 percent decline in OGN‘s price. The move into February’s swing high saw a sharp jump in price, showing that some support exists near $0.59.

A sweep of the most recent swing lows into possible support beginning near $1.04 could lead to a rally over the June monthly open. This rally would likely sweep the swing high into the resistance near $1.55.

This potential bullish move could continue through the relatively equal swing highs near $1.89 – but is likely to find some resistance in the weekly level around $2.

Continued bearishness in the crypto markets might push the price to fill the weekly gap down to $0.54. This drop would sweep the stops under May’s low and potentially mark a new accumulation zone for the next bullish cycle.

Where to Buy or Trade Altcoins?

These 3 Altcoins have the highest liquidity on Binance Exchange, so that could help for trading on USDT or BTC pairs. Instead, if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is a popular choice in Australia.

Join in the conversation on this article’s Twitter thread.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link