Let’s take a closer look at this week’s altcoins showing breakout signals. We’ll dive into the trading charts and provide some analysis to help you.

1. Elrond (EGLD)

Elrond is a blockchain protocol that seeks to offer extremely fast transaction speeds by using sharding. The project describes itself as a technology ecosystem for the new internet, which includes fintech, decentralised finance and the Internet of Things. Its smart contracts execution platform is reportedly capable of 15,000 transactions per second, six-second latency and a $0.001 transaction cost.

EGLD Price Analysis

At the time of writing, EGLD is ranked the 63rd cryptocurrency globally and the current price is A$94. Let’s take a look at the chart below for price analysis:

EGLD‘s stunning – nearly 4,000% – climb since Q4 2020 has since retraced 73%, finding some support near A$87.05.

Retracements toward the monthly open, possibly running stops near $141.15 and $147.60, are likely to be capped between $145.25 and $153.64. A break through this level may find another area of resistance near the gap and old swing lows near $161.62 – possibly spiking up to $177.82.

The price appears to be struggling to maintain support between $113.23 and $98.69, making the swing lows near $100.85, $87.05, and $76.99 likely shorter-term targets.

A run on these lows could find another area of support near $73.95. If this area fails to hold, a drop to the lower end of the monthly gap around $39.54 may be on the cards, with $34.02 offering some hope of support.

2. Mina Protocol (MINA)

Mina Protocol is a minimal “succinct blockchain” built to curtail computational requirements in order to run DApps more efficiently. Mina has been described as the world’s lightest blockchain, since its size is designed to remain constant despite growth in usage. Furthermore, it remains balanced in terms of security and decentralisation. Mina is working on achieving an efficient distributed payment system that enables users to natively verify the platform right from the genesis block. Its technical whitepaper calls this a “succinct blockchain”.

Mina Price Analysis

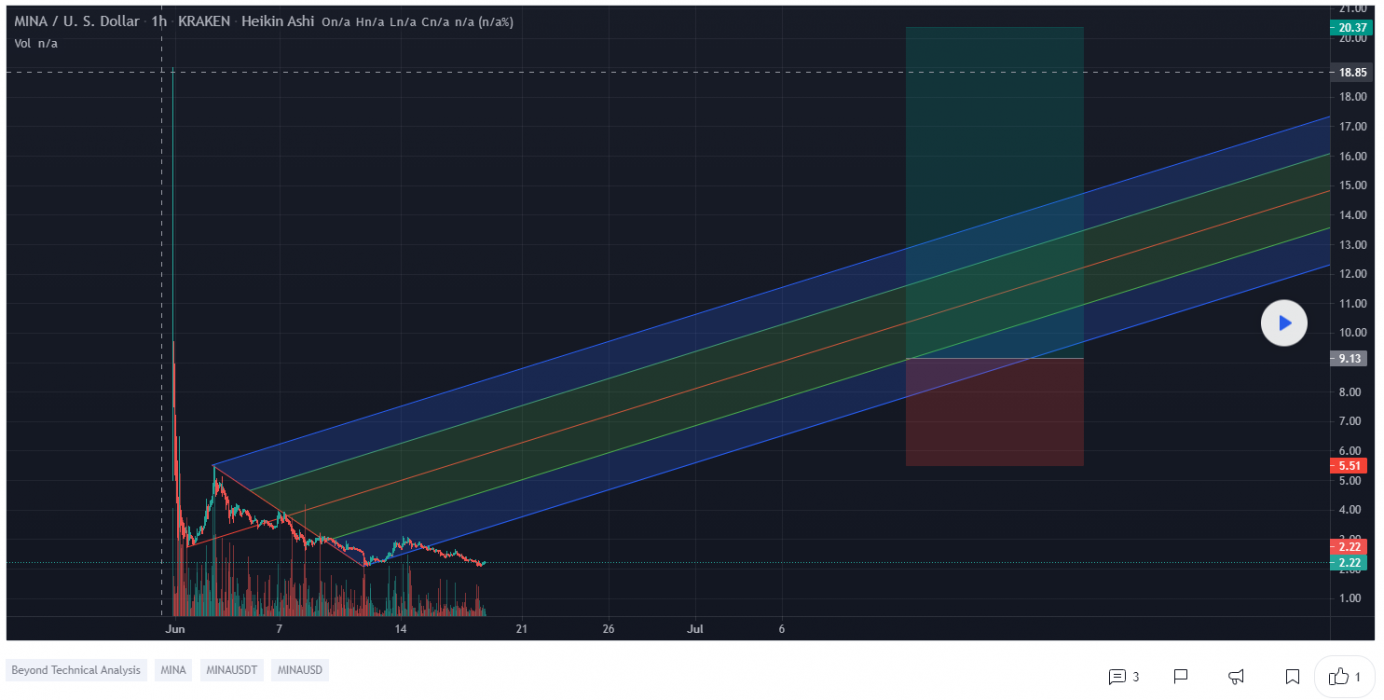

At the time of writing, MINA is ranked the 233rd cryptocurrency globally and the current price is A$2.08. Let’s take a look at the chart below for price analysis:

MINA has continued its steady downtrend. Meanwhile, the chart offers bulls no strong support for long entries.

The recent low at A$2.39 is likely to be swept – a region that offers a glimmer of hope for support based on some methods of measuring moves. However, bulls are likely to wait for more signs of support and a market structure shift before entering long positions.

Resistance rests just overhead between $2.77 and $3.26. The gap at $3.04 offers a high probability target for any potential downtrend retracements.

A more substantial bullish shift in the markets could help the price run the stops near $4.11 into resistance, beginning near $4.19. Any move upward is likely to find a cap near $5.51, although the current chart offers no hints that a movement this large should occur anytime soon.

3. Orion Protocol (ORN)

Orion aims to solve the difficulties in performing profitable transactions associated with the lack of liquidity on the majority of crypto exchanges. This is the case for both centralised and decentralised exchanges. Orion’s solution to this is to aggregate exchanges’ order books into one simple-to-use-and-understand terminal.

The Orion Protocol’s goal is to help users get the best returns out of their investments while also lowering the risks associated with using multiple exchanges.

ORN Price Analysis

At the time of writing, ORN is ranked the 236th cryptocurrency globally and the current price is A$8.54. Let’s take a look at the chart below for price analysis:

After an 83% retracement from its March highs, ORN found a temporary low near A$6.53. A recent move above $12.61 could be the first sign of a bullish shift – but could also signal a stop run before the next drop lower.

If the market adopts a more bullish tone, the price could run through the most recent swing high. If this bounce occurs, it would likely find some resistance near $13.85, possibly reaching up to $16.51.

However, a move below the closest support near $6.558 makes stop runs on the swing lows near $7.63 and $6.53 likely. A confluence of several levels near $5.71 could provide a temporary bounce. Still, a sustained bearish market will likely target $5.18 and even $2.39.

Where to Buy or Trade Altcoins?

These three Altcoins have the high liquidity on Binance Exchange, so that could help with trading on USDT or BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.

Join in the conversation on this article’s Twitter thread.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link