Here are the top 10 coins showing percentage increases, including infamous coins like DOGE, which has surged 14,000%+ since 2017.

1- Bitcoin

Bitcoin (BTC) is the founding father of cryptocurrencies – a decentralised P2P online token launched in 2009 by a possibly fictitious person who goes by the name of Satoshi Nakamoto. Bitcoin has gained over 1400% since its previous all-time high in 2017.

Bitcoin’s rise was mostly due to May’s 2020 halving, amplified by the institutional capital that came to the market in October last year. The first quarter of 2021 saw a massive influx of institutional investors, payment companies, hedge funds and asset managers embracing crypto and blockchain, which further accelerated BTC’s price surge.

2- Ethereum

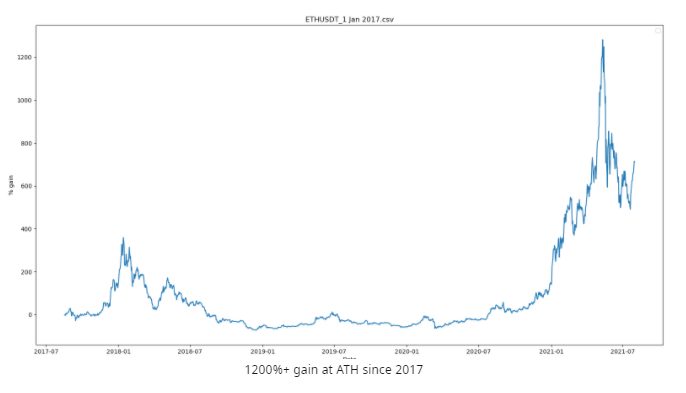

Ethereum is an open-source platform for decentralised applications (dApps) that adds smart contract functionality to developers. Users don’t need to worry about third parties as smart contracts allow peer-to-peer agreements that execute themselves through a code that runs on the Ethereum blockchain.

Ethereum is the platform that most DeFi developers seek to build their dApps without downtimes, fraud or interference from a third party. It has raised 1200%+ since 2017.

Altcoin seasons are always contributors to Ethereum’s price rally. Another boom for Ethereum is largely thanks to institutional capital coming to crypto. It’s worth noting that some of these institutions have also taken interest in opening job positions for Ethereum developers such as JP Morgan or Amazon.

The Ethereum 2.0 upgrade and the London Hard Fork are two primary forces driving up ETH’s price. Just recently, Ethereum notched a 12-day winning streak, a new record for the token.

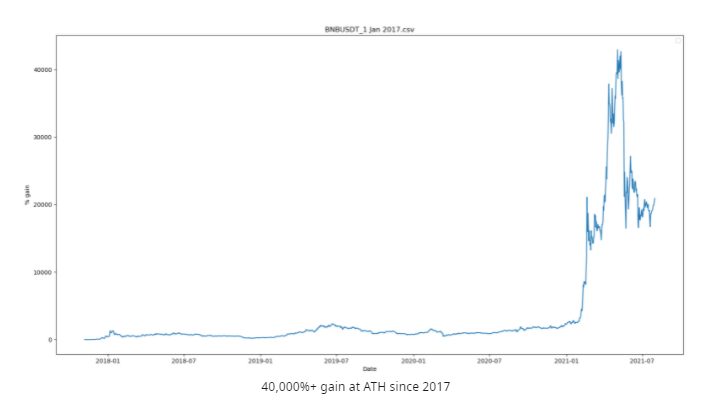

3- Binance Coin (BNB)

Binance Coin (BNB) is the native token of the centralised exchange Binance, used primarily as the utility token to pay for transactions and trading fees on the platform. BNB’s price soared over 60% in the past 30 days, and has gained a total 40,000%+ since its 2017 launch.

The more people come to Binance, the more people will use BNB. During the institutional bull run in the first quarter of 2021, Binance registered a massive influx of newcomers as crypto became mainstream. This further pushed BNB’s price to higher levels.

However, BNB’s price has been affected negatively by the number of rugpulls in the Binance Smart Chain – Binance’s decentralised exchange that adds smart contracts programmability for dApps.

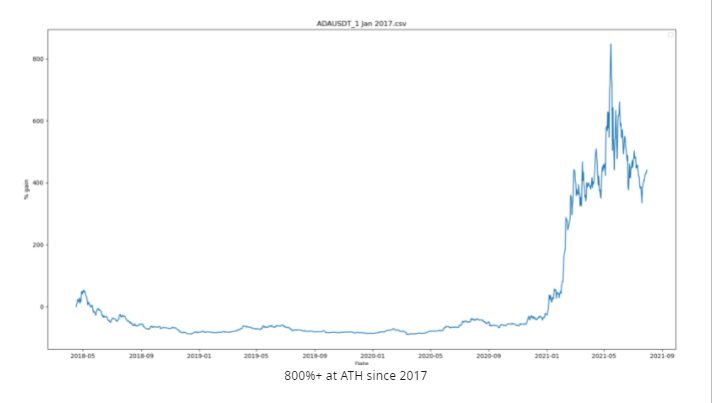

4- Cardano (ADA)

Cardano (ADA) is an open-source Proof of Stake (PoS) blockchain with very ambitious ideas. The project is overseen by the Cardano foundation, founded by Charles Hoskinson in 2015.

Cardano has performed well during the first half of this year as the foundation announced the launch of “Alonzo”, an upgrade that would allow the platform to host smart contract compatibility for developers.

ADA has gained over 800% at ATH since 2017. Last week it gained 6% on a single day after trading in an uptrend last month. However, it has struggled to keep above levels of $1.40/1.50.

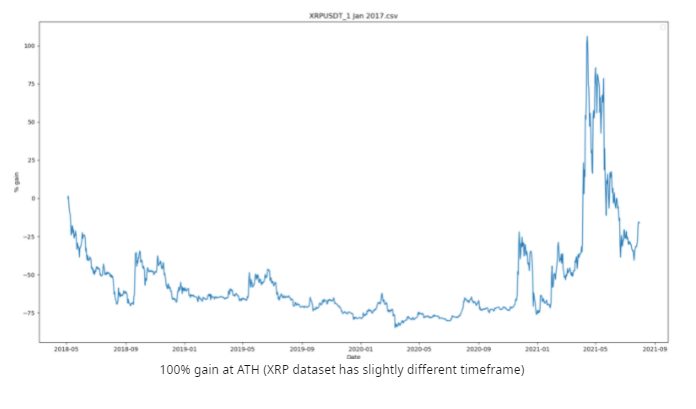

5- Ripple (XRP)

Ripple is an open-source money transfer network released in 2012 along with its native currency, XRP.

While XRP had performed steadily in the market during most of 2020, it fell sharply when the SEC announced on December 21, 2020 it was filing a lawsuit against Ripple, which traded in a downtrend during Q1 2021.

However, XRP managed to gain some ground after the company rallied in its fight against the SEC. A price boost for XRP came shortly after the judge denied SEC access to Ripple’s legal advice.

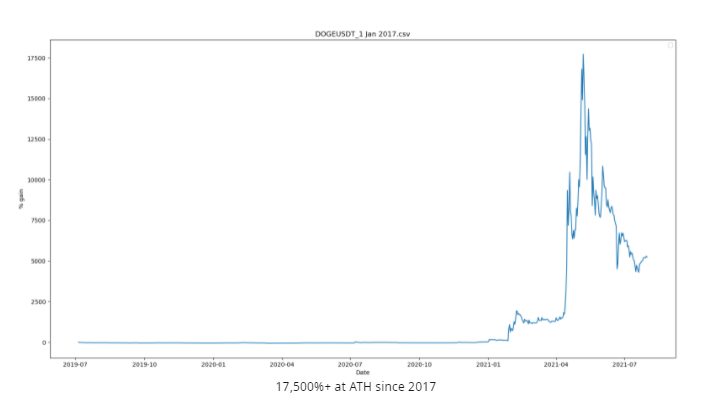

6- DOGE

DOGE, a cryptocurrency created by IBM software engineer Billy Markus that started as a joke, has skyrocketed 17,500% since 2017.

The coin debuted in the market in 2013. It only met popular demand when Elon Musk decided to talk about the memecoin, which massively boosted its popularity in the first months of 2021. Another boost for the token came after Coinbase decided to list DOGE on its trading platform.

Some people in and outside of the crypto community have claimed that Musk’s actions amounted to market manipulation as the price of DOGE is sensitive to whatever Musk says, good or bad. However, it appears that Musk’s recent efforts to pump DOGE are failing.

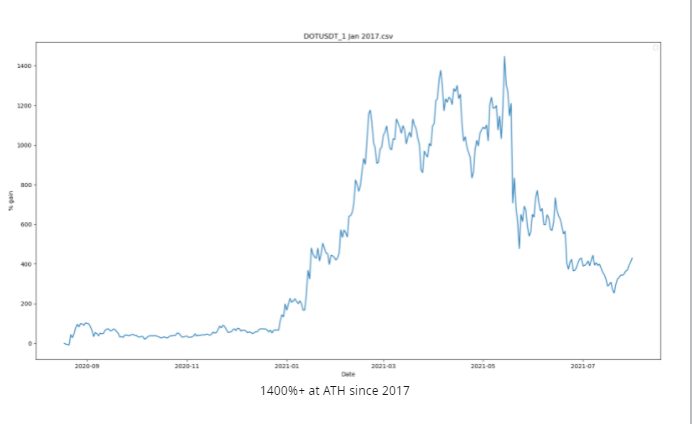

7- Polkadot (DOT)

Polkadot is a shared multi-chain platform that allows blockchain interoperability. DOT is Polkadot’s native currency, used for transactions and trading fees.

DOT started trading in 2020, which is why it looks different to the other charts, which started earlier.

DOT has managed to record a 1400%+ rise starting in the first months of 2021, turning it into one of the currencies with the best return on investments (ROI).

It peaked at US$373.19 after Facebook announced it was making an ecosystem for creators on the Polkadot Blockchain.

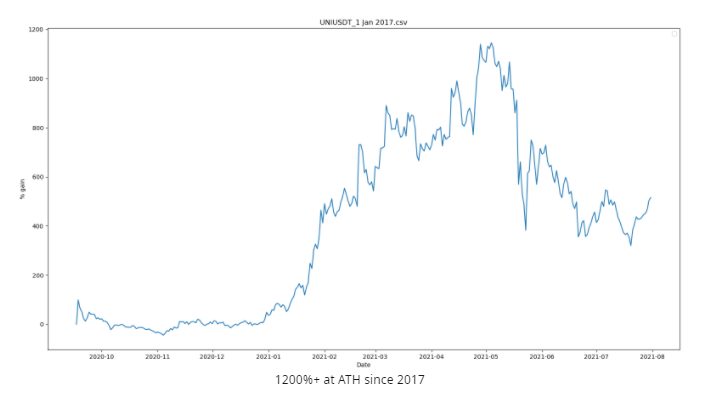

8- Uniswap (UNI)

Uniswap (UNI) is a decentralised exchange (DEX) that facilitates automated swaps between tokens on the Ethereum network. It was built by the company going by the same name on November 2, 2018.

Uniswap has had an overall solid market performance during the first half of 2021. The token seems to be gaining traction after trading negatively during May, but it seems the company is the subject of rumours about working with centralised institutions. A recent video emerged showing Uniswap’s growth lead, suggesting possible tie-ups with PayPal, E*Trade and Stripe.

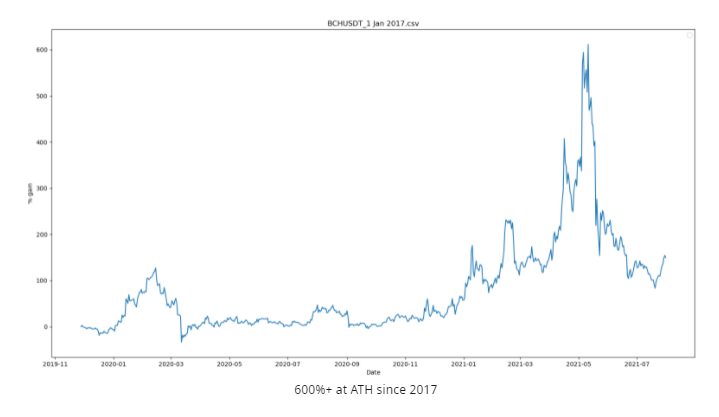

9- Bitcoin Cash (BCH)

Bitcoin Cash (BCH) is a cryptocurrency product of a fork of Bitcoin, created in 2017. It has surged above 600% of its 2017 ATH, in a similar move to other high-market cap currencies.

BCH resulted from a disagreement between two groups over scaling issues. It offers lower transaction fees and greater throughput. While BCH was recovering from losses in previous sessions, it’s now trading in a downtrend as fear takes over the market.

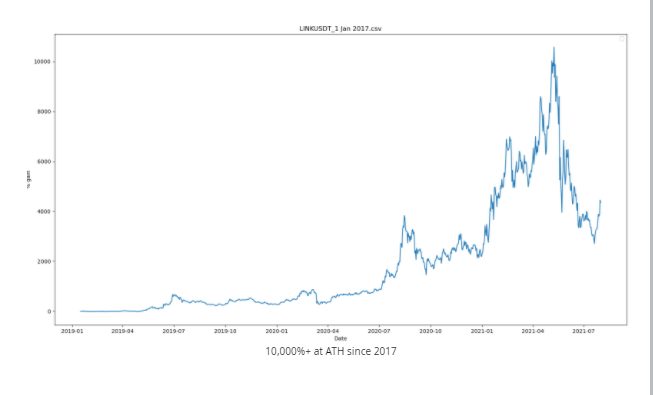

10- Chainlink (LINK)

Chainlink is the leading decentralised oracle service built on Ethereum. Its native token, LINK, has surged over 10,000% at ATH since 2017.

LINK has become an efficient data provider from off-chain sources to on-chain smart contracts through oracles. It has been trading largely in an uptrend as many companies have embraced the oracle solution to rely on trustworthy real-time information.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link