Binance coin (BNB) is now the third-highest cryptocurrency by market capitalization after its price rose by more than 40% in 24 hours. BNB now stands at USD 270 (13:45 UTC), with the native token of the Binance exchange benefitting from the migration of DeFi users towards Binance Smart Chain (BSC).

The flocking of decentralized finance users towards a centralized platform has left Ethereum (ETH) advocates with a sour taste in their mouths, with some figures even speculating that Binance is responsible for the recent spike in Ethereum gas fees that are pushing users away.

However, other commentators have commended Binance for providing a genuine alternative to high fees, while others have urged the Ethereum development to speed up its work in transitioning to a proof-of-stake mechanism.

According to Mable Jiang, Principal at Multicoin Capital, the DeFi industry is now in a phase when ETH is expensive to use, layer 2 solutions on the Ethereum blockchain are not ready yet, and the user interface of some promising layer 1 alternatives is not great.

“BSC was there perfectly picking up this narrative and fitted itself in this vacant phase by tapping into two crowds: 1. [People] who are less evangelical and just want to do cheap on-chain [transactions] ; [People] who never used ETH and had their initial knowledge about [DeFi] via Binance,” she said, adding that this is bullish for ETH longer term.

Jiang opined that it helps educate more people about DeFi and they don’t need to spend a fortune on fees while learning.

“For projects that are harder to stand out competitively on Ethereum, it makes sense for them to tap into this ecosystem because Binance was working hard to build up the BSC community and offering a lot of support. At this alternative battlefield they may have a better chance,” she added.

Meanwhile, Jason Choi, General Partner at The Spartan Group, said that while he “can’t speak to how organic the volumes on BSC protocols are,” this might be the first time when users that are looking for lower fees and have lower sensitivity to decentralization have an alternative now.

“Previous attempts (EOS, Tron) never evolved beyond gambling apps,” he said.

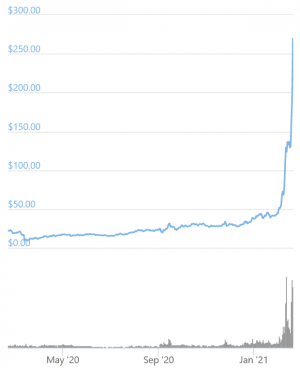

BNB rocket

30 days ago, you could have bought a single BNB token for less than USD 50, while a year ago it would have cost you USD 22. Times have certainly changed, with BNB rising over 1,000% in 12 months and 118% in only seven days.

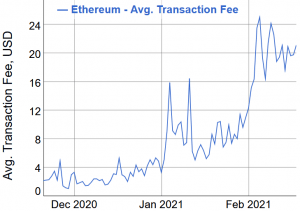

Ethereum gas fees are among the reasons for this change. Because the average Ethereum transaction fee is now USD 20 (having risen by over 500% since January 1), using ETH-based DeFi platforms such as (Uniswap (UNI) and SushiSwap (SUSHI)) has become prohibitively expensive for smaller-budgeted users.

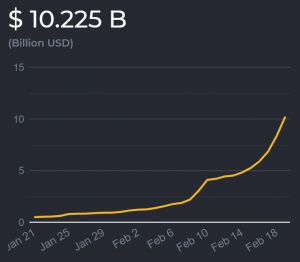

Unsurprisingly, such users have gone to DeFi platforms on the Binance Smart Chain, such as PancakeSwap (CAKE) (a decentralized exchange, DEX) and Venus (a lending platform). As the following chart from Defistation shows, the total value locked into platforms on the BSC has ballooned from under USD 500m on January 20 to USD 10.5bn today.

Because users have flocked en masse to Binance Smart Chain, demand for BNB has inevitably risen, since the token is used as part of Binance Smart Chain’s proof-of-staked-authority consensus mechanism.

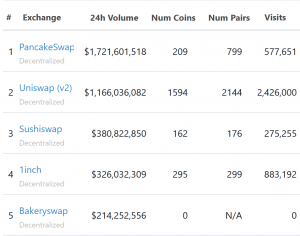

Also, BSC-based PancakeSwap overtook ETH-based Uniswap and is now the biggest DEX by trading volume. However, wrapped BNB and CAKE are the most popular tokens on this platform.

Ethereum sour grapes, conspiracy theories, and solutions

While the rise of BSC is good news for Binance and anyone who wants DeFi with lower fees, parts of the Ethereum community aren’t too happy about the development.

Also, some are even suggesting that Binance might be behind the metastatic growth in ETH gas fees.

So I’ve done some research today to find the cause of high gas fees, and I think I found why fees are insane on… https://t.co/YO6BDqTPHO

Likewise, many are unhappy that decentralized finance users have turned to a centralized platform.

On the other hand, more sober individuals have acknowledged that Binance Smart Chain is helping people use DeFi during a period of expensive ETH fees.

Unpopular opinion : BSC saved our ass in the #Ethereum ecosystem.

There are also people who think that BSC isn’t really a threat to Ethereum, given the latter’s larger network effect.

There’s no need for the Ethereum community to be salty about BSC. Teams I know who moved from Ethereum to BSC by an… https://t.co/PSbkP9iode

While others are offering a possible solution.

Hey @Gemini , @coinbase , @krakenfx and other great exchanges with fiat/retail rails… #

For now, however, Binance Smart Chain is in the ascendancy, and it seems like it could continue growing for some time, while Ethereum developers are working on implementing solutions that might help reduce the fees.

___

Learn more:

– Solana Founder On Critical DeFi Challenges and How To Fix Them

– Crazy Bitcoin and Ethereum Fees Dampen Rally, Help Competitors

– Ethereum’s Upgrade Runs Into an Obstacle as Some Miners Try To Stop It

– Ethereum Fans Brag About All-Time High Fees As L2 Solution Coming

– EIP-1559 Won’t Lower High Ethereum Fees On Its Own – Professor

___

(Updated at 15:31 UTC with a DEX ranking.)

Credit: Source link