Three weeks ago, the Luna Foundation Guard announced it would be buying US$1 billion in bitcoin to help restore “peg parity” between its decentralised stablecoin TerraUSD (UST) and the US dollar.

Terra’s founder has now decided to go one step further and declared his intention to acquire up to US$10 billion in bitcoin:

Refresher on UST and BTC

For those unclear as to how bitcoin fits within the context of a decentralised stablecoin such as UST, it’s worth going back to an earlier statement by the LFG Foundation:

As an algorithmic stablecoin, UST’s peg is maintained by a series of open market operations, arbitrage incentives, and countercyclical levers within the Terra protocol to offset market forces pushing the UST peg above or below one USD. LUNA, Terra’s reserve, staking and governance asset, retains an elastic supply to help neutralise directional market pressures impacting the peg.

LFG Foundation announcement

In short, bitcoin is used to restore the UST’s peg parity to the US dollar at times when there are protracted market sell-offs.

Terra Founder Reveals Plan Details

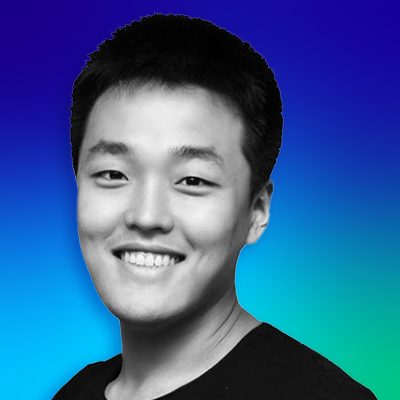

In a Twitter Spaces conversation with renowned crypto troll, Udi Wertheimer, Terra co-founder Do Kwon revealed plans to back UST with bitcoin:

Haven’t been following up with the exact numbers ’cause transactions we generally do this over OTC, but the current clip that we have to buy big coin is about $3 billion [referring to bitcoin] and we will add to that.

Do Kwon, Terra co-founder

He added that “out of that 3 billion, most of it we haven’t bought yet”. Do Kwon went on to describe the move as a “new monetary era of the Bitcoin standard”:

Naturally, there was a lot of excitement across crypto Twitter:

However, some of the more experienced market participants, including Bitcoiner Adam Back, had more questions. He asked, “Where is the $10 bil coming from?”, to which Do Kwon responded:

It’s not 10B today – as UST money supply grows, a portion of the seigniorage will go to build BTC reserves bridged to the Terra chain. We have 3B funds ready to seed this reserve, but technical infrastructure (bridges etc) is still not ready yet.

Do Kwon, co-founder of Terra

Details remain somewhat muddied and it’s not clear whether even Do Kwon has all his proverbial ducks in a row, having conceded at the end of the Twitter Spaces conversation: “I said more than I shoulda”.

Initial Acquisition More Like $3 Billion

While plans are to acquire US$10 billion in total, as noted by Do Kwon the initial acquisition will be US$3 billion. Eagle-eyed on-chain analysts have already seen evidence of buying with US$125 million already bought, and another tranche of US$125 million imminent:

If Terra’s plans go through as intended, it would become one of the largest bitcoin holders, more so than every corporate outside of MicroStrategy with its 125,051 BTC stash.

Whatever one’s thoughts are on algorithmic stablecoins such as UST, or Terra itself, it’s undeniable that using bitcoin as a tool to maintain peg parity is a unique approach that remains untested. At the very least, it introduces some excitement at a time when the market appears to be in a sideways consolidation phase.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link