At the moment, Tether (USDT) is the largest stablecoin by supply. However, it has been losing out in supply growth to USD Coin (USDC), according to the “State of the Network” report by CoinMetrics.

Tether vs USDC Supply Growth

Following the data on CoinMetrics, the total supply of USDC has risen over $22 billion, or about 57 percent since May and over 450 percent since the beginning of the year. In less than two weeks, USDC grew from a $15 billion USD asset on May 12 to over $20 billion USD. It’s worth mentioning that USDC is one of the fastest-growing stablecoins in the crypto market.

Two plausible factors driving more demand for USDC are market trust and the decentralized finance (DeFi) space. There is a possibility that USDC may soon catch up with USDT, provided the supply trend continues to increase.

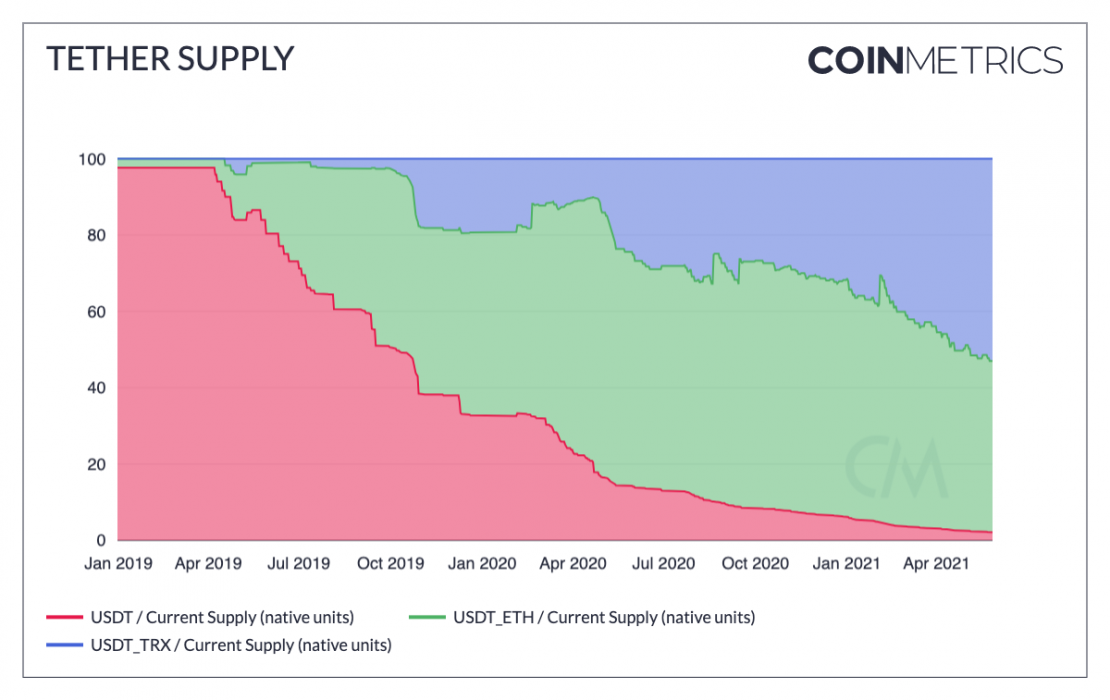

USDT has only increased by over 190 percent in supply to a +$61 billion USD asset since the beginning of the year. Tron Network is currently the dominant blockchain for USDT, accounting for more than 50 percent of the entire USDT supply. There is now a lower supply of $30.9 billion USD (49 percent) on Ethereum, probably due to the expensive transaction fee on the blockchain, which led to the increase in demand on Tron.

Notwithstanding the USDT supply and transaction count, the ERC-20 version of USDT sees more transfer value compared to the TRC-20 tokens, which indicates that both versions of USDT have different use cases, as per CoinMetrics.

BUSD Supply Increase Over 800% Since January

The Binance-backed BUSD is one other stablecoin in the spotlight. BUSD has risen by over 820 percent since the start of the year. There has been a strong demand for stablecoin amid the Binance DeFi space and the incredibly cheap transaction fee on the network.

Join in the conversation on this article’s Twitter thread.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link