There are seven important challenges that are currently standing in the way of bitcoin (BTC) adoption, according to the Miami BTC conference participants speaking to Cryptonews.com – and yet, BTC is likely to see greater consumer and business adoption, which would also help its price.

Bitcoin 2021, a major conference focused on the world’s number one crypto project, was held in Miami, USA, from June 4–5 – gathering thousands of people in an in-person crypto event, one of the first of the kind since the onset of the COVID-19 pandemic.

The insiders talking with Cryptonews.com identified a number of significant – and as noticeable, interconnected – issues that slow down BTC’s mainstream adoption.

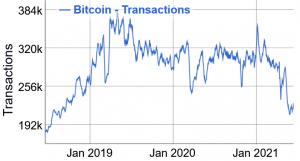

1. Scalability

This one is certainly not a surprise. David Shafrir, Co-Founder and President of GDA Capital, the capital markets arm of the GDA Group of Companies, named it as one of the biggest problems facing Bitcoin, given that the network, at the moment, is not capable of handling a large number of transactions. It is managing around 7 transactions per second (TPS), which is significantly less than Visa’s ceiling of 24,000 TPS, he said, adding that:

“This doesn’t bode well for use on a global scale, as increased usage would throttle transaction speed and hike fees to exorbitant levels.”

However, there are several solutions in the works, including the Lightning Network, which is a Layer 2 scaling solution designed to carry the weight of transaction data.

Matthew Gundrum, the marketing director for cryptocurrency payroll service Bitwage, also stressed that, if Bitcoin hopes to receive more adoption, it needs to function as a payments system as well.

“In its current state, it is extremely impractical for transitions,” Gundrum said, adding that innovations like the Lightning Network may change this, as companies such as Strike already demonstrate this.

__

Learn more:

– Bitcoin Eyes USD 40K Amid Musk Statement, Taproot Confirmation

– The Bitcoin Lightning Network Grows Even If You’ve Forgotten About It

2. Business accepting it for payment

Business acceptance of bitcoin as a form of payment is a challenge, according to BitPay’s William Zielke. 93% of consumers with crypto indicate they want to be able to spend it, but many top retailers have yet to offer BTC as a payment alternative, he said.

Per a recent report by BitPay and interactive news platform PYMNTS, out of 8,008 US consumers (current and former cryptocurrency users and nonusers) surveyed in February, 57% of former or present crypto owners made at least one purchase using it last year, and 59% of consumers who never owned crypto are interested in using it to make purchases in the future. Meanwhile, a recent international survey by Mastercard showed that 40% of the respondents are considering using crypto as a payment method.

In either case, the whole crypto industry is now watching El Salvador, where BTC is set to become legal tender in September this year and merchants will be obliged to accept BTC at the request of a customer. However, as reported, two opposition lawmakers aim to amend key clauses in the Bitcoin law.

__

Learn more:

– Bitcoin Mass Adoption Would Benefit and Harm Current Economy

– Stablecoins Might Be Better Than Bitcoin For Payments, But Maybe Not For Long

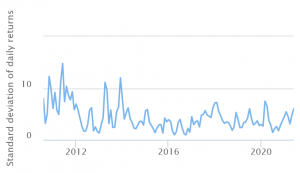

3. Volatility

Another issue is volatility, reminded Shafrir, and this one certainly doesn’t come as a surprise to anybody. And while many BTC proponents claim that volatility is a feature, not a bug, it is “a significant hurdle” to mainstream adoption, the president stressed.

“While crypto veterans understand that bitcoin is where it is today as a direct result of its inherent volatility, the average investor is unlikely to stomach a 30% intraday downdraw,” he said.

Notably, volatility remains one of the main arguments against bitcoin’s status as a store of value, Shafrir noted, adding that “once bitcoin hits critical mass and liquidity increases on a global scale, it’ll be much harder for individuals, or even organizations, to move the price of BTC — meaning volatility will subside.”

Bitcoin volatility chart:

__

Learn more:

– Bitcoin Was This Cheap Only 20% of Its History – Pantera CEO

– Volatility Is Crypto’s Best Friend

4. Legal status

William Zielke noted the recent move by El Salvador, which shook the crypto and the noncrypto worlds alike – accepting BTC as legal tender – stating that BitPay was encouraged to learn that the first country in the world named bitcoin a currency.

He added that, “until bitcoin is determined to be a currency (vs a store of value), adoption will continue to be slow.”

__

Learn more:

– El Salvador Brings New Global Puzzle – What Is Bitcoin & How To Tax It?

– World Bank Accused Of Ignorance & Hypocrisy As It Refuses to Help El Salvador

5. Education

Per Zielke, many consumers are not even aware that they can spend their bitcoin, and they don’t know how to do it. In order to get the word out on both of these, what’s needed is education.

Similarly, Gundrum noted a simple fact: “Bitcoin is complicated” – it comes with many factors one needs to learn about and understand. “All companies in the space must be prioritizing education and clearing up misconceptions so that people can enter this space with confidence,” he said.

__

Learn more:

– Knowledge of Crypto on the Rise, Encouraging Investment – Survey

– Honesty and Education Will Help Bitcoin Build Trust – Survey

6. Regulation vs self-regulation

Regulation is one of those aspects within crypto that not everybody can agree on – while some see it as beneficial, others deem it detrimental. Yet, many find that a decentralized system can’t fit regulatory frameworks made for centralized ones – and that decentralization by design requires self-regulation.

Shafrir opined that regulations across all major economies remain “the biggest hurdle” to the growth of cryptocurrencies. Bitcoin is currently forced to comply with regulations and systems that were not designed with such innovation in mind – and these regulations “favor incumbents over disruptors because governments are not confident about how to protect consumers and markets when the finance system is decentralized.”

On the other hand, with a traditional centralized institution, someone has control over transactions and balances, he said, concluding that:

“Governments around the world need to embrace new technology and allow crypto industry leaders to develop a self-regulatory model that encourages innovation, while protecting consumers.”

__

Learn more:

– SEC Commissioner Worried Tight Regulation Could Thwart Crypto Innovation

– Crypto Industry’s Lobbying Power Grows As Former Officials Change Sides

“The Bitcoin community feels very insular and, sometimes, toxic,” said Matthew Gundrum.

This can be particularly seen on social networks such as Twitter and Clubhouse. And though some people argue that “that crazy, passionate people are needed,” it’s also necessarily to ensure that people are not scared away from the space.

“Albeit, some say that everyone will come to bitcoin eventually so it doesn’t matter how the community acts at this current time,” Gundrum concluded.

__

Learn more:

– Communities Are Vital For Crypto Projects But Might Become Less Important

– ‘Nocoiner’ Dispute Ends Up Questioning Value of ‘Coiners’

Still waiting for the moon

Despite the obstacles, the surveyed conference attendees stressed that there is significant consumer and business interest in crypto, and specifically in bitcoin, seeing the crypto’s price exploding in the future.

This conference was a hint of what’s to come, said Gundrum, noting the “staggering” number and diversity of attendees.

“This is going to be a long and hard journey, but Bitcoin is one of the most important inventions of all time and people are finally starting to wake up to that.” So the answer to the question what awaits the world’s oldest crypto is that “Bitcoin is going to the moon.”

BitPay’s biggest takeaway from the conference was that consumer and business interest is “exploding,” said Zielke. For 2021 and 2022, the company sees merchant and consumer adoption going more mainstream as increasingly more businesses and consumers turn to bitcoin and other cryptos as a means of commerce and for transacting.

____

Learn more:

– People Tell Cryptoverse to Fix These Things to Reach Bitcoin Mass Adoption

– 6 Crypto Experts on What Would Encourage People to Use Bitcoin

– Bitcoin Is More ‘Public’ Money than Central Bank-Issued Fiat Currencies

– Prepare For ‘Uncertain Future of Money’ – US Intelligence Center

– Bitcoin Faces Hedge Test Amid Rising Inflation Concerns

– Institutions & Retail Compete For Bitcoin – Whose Hands Are Stronger?

Credit: Source link