SOL, the native token of the Solana blockchain, rallied in the crypto market today after the chain reached a new all-time high in terms of the total value locked (TVL) in DeFi applications. Meanwhile, the token also looks strong from a technical analysis standpoint, according to analysts.

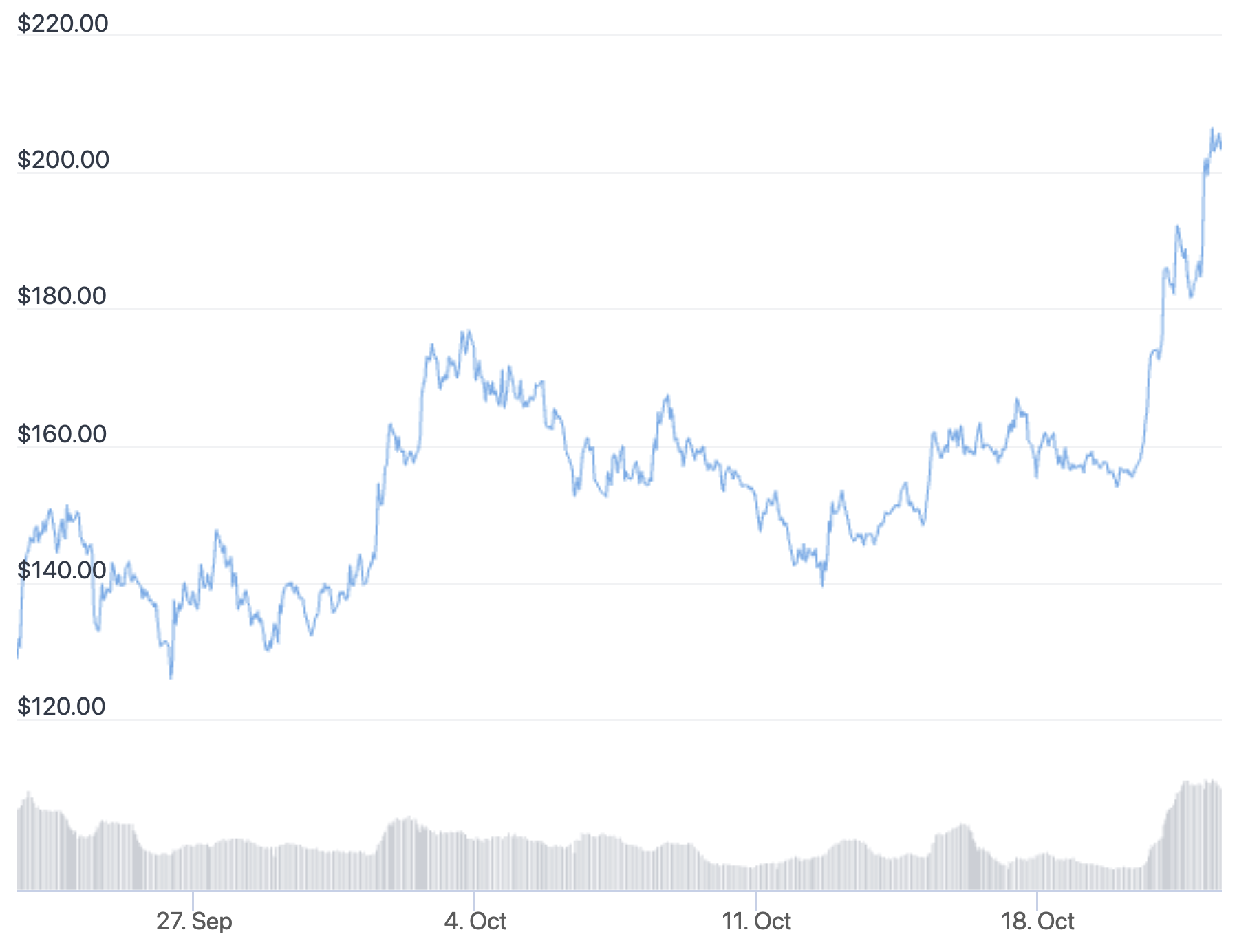

At 11:30 UTC on Friday, SOL traded at USD 203.95, up 6% over the past 24 hours. The rally today follows strong gains on Thursday and Wednesday, pushing the token up by more than 36% for the past 7 days to levels close to its all-time high from September 9 of about USD 215.

The rally over the past week has coincided with increased usage of DeFi protocols on Solana, with the TVL on the platform reaching as high as USD 12.58bn at the time of writing on Friday – well above the prior all-time high from September 12 of USD 12.2bn.

The current TVL represents a 57% rise from a month ago, when Solana’s TVL dipped below USD 8bn, per Defi Llama data.

Meanwhile, technical analysis also suggests that the SOL token may have further room to run, according to some analysts.

Commenting to Forbes on the current bull-run for the token, Joe DiPasquale, CEO of crypto hedge fund BitBull Capital, said that the token’s jump from USD 160 just two days ago “has created a bullish flag pole in the chart.”

“Technical analysts will now wait to see if the pole leads to a Bull Flag, meaning a steadying of the price, which would signal further bullish moves and new support,” DiPasquale was quoted as saying.

On a similar note, Armando Aguilar, vice president of digital assets strategy at Fundstrat Global Advisors, said that SOL has already broken through some important resistance levels, which indicated that traders are “not concerned about downward pressure” at the moment.

Aguilar also added that SOL has seen increased trading volumes on Coinbase, which could indicate rising popularity among spot crypto buyers.

Over the last 24 hours, Coinbase saw USD 592.5m in its SOL/USD trading pair, making up 10% of the total trading volume for SOL across the market. The largest market for SOL was Binance, with more than 23% of the volume over the past 24 hours, according to CoinGecko.

At the same time, news also broke yesterday that an on-chain asset management protocol built on the Solana blockchain known as Synchrony has raised USD 4.2m in funding from investors, including Sanctor Capital, Wintermute Trading, and GBV Capital.

The funding will mainly go towards further development of the protocol’s configurable indices for decentralized finance, while some of it will also be directed towards marketing efforts.

The aim with the indices is to create “algorithmically optimized” and “automatically rebalancing pools or portfolios,” per their announcement.

___

Learn more:

– Ethereum, Solana, Polygon & Co Form A New Hot Market Of Blockchains

– Multi-Chain Future Brings Multiple Competitors to Bitcoin & Ethereum – Analysts

– Solana Full Service Expected Soon, SOL Recovering

Credit: Source link