- Robinhood, one of the world’s premier low-commission brokers, has offered crypto products for over five years.

- The team is continuing its expansion into the Web3 world following a US $200M purchase of BitStamp earlier this year.

- It is believed this acquisition may lead to Robinhood offering US and European customers crypto derivatives, specifically, BTC and ETH futures.

Robinhood is one of the most significant financial institutions in the world. Arguably responsible for ushering in the era of micro-investments – allowing everyday earners to steadily accumulate a portfolio with minimal brokerage fees – crypto has always been a match made in heaven for the platform.

After crossing the 2 million customer mark in 2018, Robinhood began offering “commission-free” trading of Bitcoin and Ethereum. As part of the team’s expansion, Robinhood wants to take its crypto products to the next level by introducing crypto derivatives.

Related: Circle Gains EU Stablecoin License, Is First to Be MiCA Compliant

Futures a Dangerous But Lucrative Asset Class

Futures (a form of derivative) essentially allow investors to bet on the future price fluctuations of an asset without ever holding it. Because derivatives can be leveraged, meaning losses (and profits) are amplified compared to the amount invested, experienced, high-volume investors often use this form of trading.

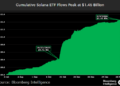

In fact, according to CCData, derivatives trading volume (US $3.7T) was more than double that of spot trading volumes (US $1.5T) in May.

So it’s easy to see why Robinhood offering low-commission futures products to investors in the US and Europe could be a huge deal.

Related: Ancient Ethereum Whale Moves 7,000 ETH to Exchange Kraken

No Official Announcement, Only Smoke and Mirrors

At this point, Robinhood’s plans are far from set in stone. In fact, nobody has officially gone public with the news of futures products – at the moment, it’s all whispers and rumours. One spokesperson even poured cold fire on the potential offerings:

We have no imminent plans to launch these offerings.

Robinhood

RobinhoodThings can fall through at the last minute, so it’s understandable why Robinhood are being cagey. But, following the team’s US $200M (AU $300M) buyout of Bitstamp in June, Robinhood is entrenching itself as a crypto powerhouse in the American and European markets.

Credit: Source link