In an ongoing legal battle, San Francisco-based blockchain company Ripple filed a response to the US Securities and Exchange Commission (SEC), repeating that XRP is not a security nor was it necessary for its distribution and sale to be registered as such – stating that the regulator’s complaint caused some USD 15bn damage to holders and others.

Per the 100-pages document, the SEC’s complaint “advances an unprecedented and ill-conceived legal theory — with neither statutory mandate nor congressional authorization,” that Ripple’s distributions of XRP are investment contracts and thus securities subject to registration.

The response reiterates that,

“[XRP] is not a security and the SEC has no authority to regulate it as one.”

Ripple argues that SEC’s theory ignores a number of functions performed by XRP, which are different from those of securities – “the functionality and liquidity of XRP are incompatible with securities regulation.” As an example, the document states that XRP is a medium of exchange, a virtual currency used in international and domestic transactions.

Furthermore, no registration was required in connection with any distribution or sale of XRP by Ripple, it said.

Ripple denied the great majority of allegations (and all concerning XRP being a security), admitting certain points, such as that Ripple sold XRP in exchange for fiat or other currencies.

The company also objected to the SEC’s use of the term “Offering,” denying that it accurately describes Ripple’s numerous and different types of XRP distributions over the years.

Another set of responses focuses on the alleged damage caused to XRP holders, Ripple partners, and others involved with the company and/or the currency.

Prior to the SEC’s complaint, “no securities regulator in the world has claimed that transactions in XRP must be registered as securities, and for good reason,” said the document. Requiring its registration as a security would “impair its main utility,” they argue. It would, said Ripple,

“subject thousands of exchanges, market-makers, and other actors in the gigantic virtual currency market to lengthy, complex and costly regulatory requirements never intended to govern virtual currencies.”

Ripple further claims that the SEC had meetings with multiple companies that “traded or facilitated activity in XRP or that planned to do so,” but the regulator didn’t tell them that XRP was a security or that transactions in it would be subject to the federal securities laws. “Consequently, those companies proceeded to play significant roles in the development of use cases for XRP, and further contributed to expanded uses of XRP as a virtual currency, with full knowledge of the SEC,” according to Ripple.

There was a lack of fair notice to Ripple and the market, argued the company further, made apparent when a platform decided to list XRP in 2019 after meeting with the SEC, stands further in the text, adding:

“Upon information and belief, during that meeting, even when asked, the SEC did not state that it considered XRP to be a security.”

Therefore, the SEC has already caused more than an estimated USD 15bn in damage “to those it purports to protect,” said the document. It has caused “immense harm” to XRP holders, while numerous exchanges, market makers, and other market participants stopped activities in XRP.

Meanwhile, the regulator is putting XRP in a disadvantage compared to its peers, the document reiterated earlier arguments, saying:

“The SEC’s filing, based on an overreaching legal theory, amounts to picking virtual currency winners and losers as the SEC has exempted bitcoin and ether from similar regulation.”

Additionally, per Ripple, the complaint asks the Court to contradict the findings of the agency’s US and international peers, and to subject XRP as a global virtual currency to conflicting regulatory regimes on a nation-by-nation basis.

Lastly, the complaint threatens to damage US competitiveness and innovation, argues Ripple, “at a time when the United States has national security concerns about China’s efforts to control bitcoin and ether mining pools and seize control of the global payments market.”

Last December, the SEC filed an action against Ripple and two of its executives, Chris Larsen and CEO Brad Garlinghouse, alleging that the company violated US securities laws by selling about USD 1.3bn worth of XRP since 2013, which Ripple denied.

As recently reported, an attorney representing Larsen, the firm’s Co-founder and Executive Chairman, filed a motion to a US federal judge requesting the case against his clients to be dismissed, arguing that the SEC’s claims against Larsen are barred by the five-year statute of limitations.

Meanwhile, money transfer firm MoneyGram is facing a class action lawsuit claiming that the company made false and/or misleading statements about its partnership with Ripple and the legal status of XRP.

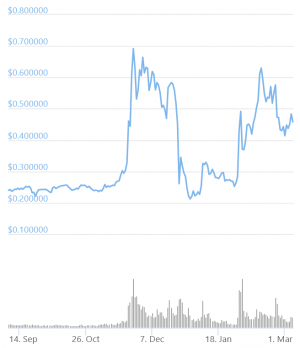

At 10:22 UTC, XRP, ranked 7th by market capitalization, is the only green coin in the top 18 coins by market capitalization in the past 24 hours, appreciating almost 2% to the price of USD 0.459. It’s up 6% in a week in 24% in a month. The price rallied by 95% in a year.

XRP price chart:

____

Learn more:

– Fact-checking Ripple’s Claim that ‘Many G20 Gov’ts’ Call XRP a ‘Currency’

– What SEC Crackdown? Japanese Giant SBI Starts Offering XRP Lending

– XRP Pumpers Hope For More Action; Cardano’s Hoskinson Warns of Pump&Dumps

– XRP Drops Despite Positive Report, A Lawsuit Over USD 50 Loss Emerges

Credit: Source link