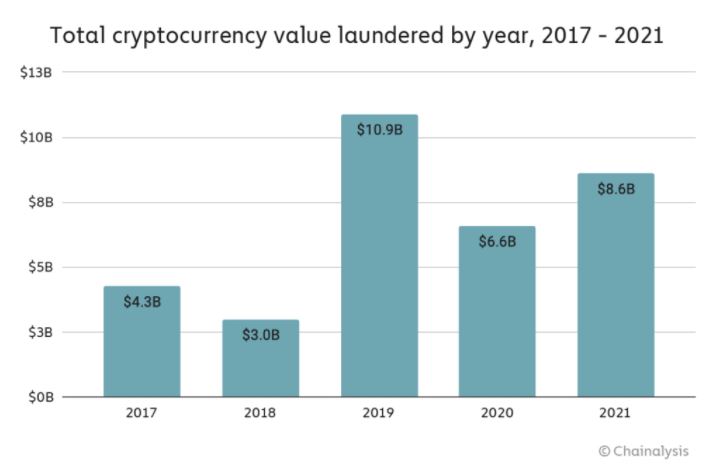

New research by blockchain data firm Chainalysis shows there has been an estimated US$33 billion laundered through crypto in the past five years, mainly through centralised exchanges, but as of 2021 there has been a major increase in money laundered through DeFi.

Chainalysis has released a preview of its 2022 Crypto Crime Report detailing how illicit funds have been moved over the blockchain and its various services. The total value of cryptocurrencies laundered by services in 2021 was estimated at US$8.6 billion.

That figure was up 30 percent on the previous year, which was expected, given the boom in both legal and illegal activities in the crypto space. However, the figure is down 23 percent from 2019, which was the most significant year for laundered crypto.

These numbers only account for funds obtained from “cryptocurrency-native” crime, meaning activities such as darknet market or ransomware attacks in which profits are virtually always denominated in cryptocurrency. In spite of the billions of laundered dollars, money laundering accounted for only 0.05 percent of all cryptocurrency transaction volume in 2021.

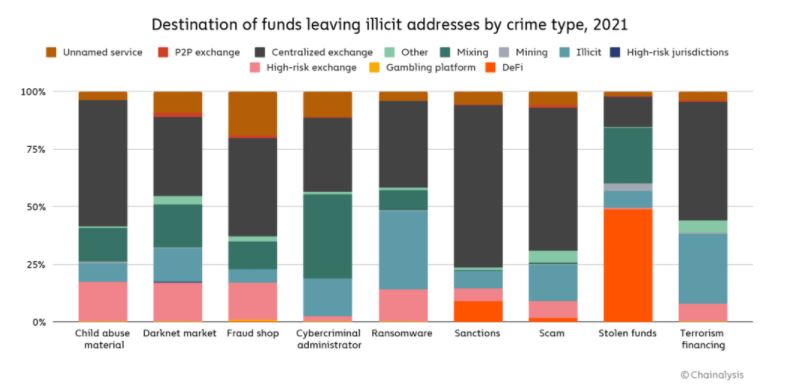

One thing that stands out is the difference in laundering strategies between the two highest-grossing forms of cryptocurrency-based crime in 2021: theft and scamming. Researchers think this might be because more cryptocurrency was stolen from DeFi protocols than any other type of platform last year, as well as the technical skills required to launder money. For example, a DeFi hacker would have better technical skills and use different means to launder money than a scammer using a centralised exchange.

Easier to Track Laundering on the Blockchain

It’s considerably more difficult to track illicit funds when they are first converted to crypto from fiat. But due to the inherent transparency of blockchains, analysts can more easily trace how criminals move cryptocurrency between wallets and services in their efforts to convert funds into cash.

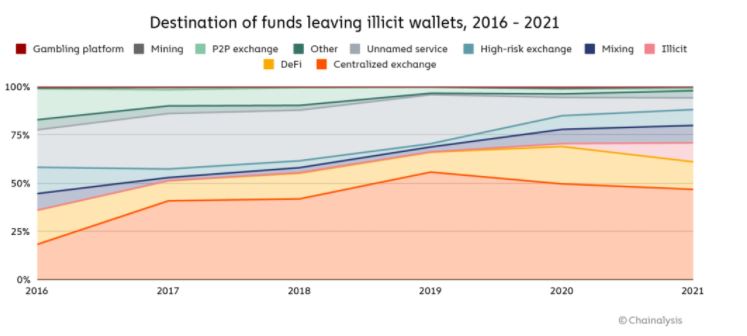

Since 2018, centralised exchanges have been the main conduit for money laundering, with 58 percent of laundered crypto funnelled into just five trading platforms.

Increase in Laundering Through DeFi

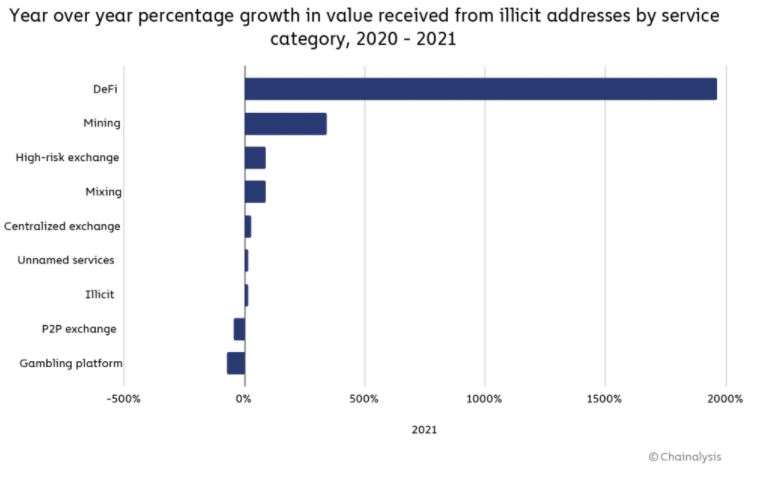

Last year, for the first time since 2018, centralised exchanges did not receive the majority of funds sent by illicit addresses. Instead, DeFi protocols are making up much of the difference. The report states that DeFi protocols received 17 percent of all funds sent from illicit wallets in 2021, up from 2 percent the previous year.

This phenomenon translates to a 1,964 percent year-on-year increase in total value received by DeFi protocols from illicit addresses, reaching a total of US$900 million in 2021.

North Korea at the Forefront of Money Laundering

Kim Grauer, Chainalysis’ director of research, says that “there are certain types of criminals in particular that lean into technological advancements more quickly”, adding that “North Korea is always the first to use a new kind of tech solution for laundering money. We follow them each year, and this year they’ve used a lot of mixers. Last year, they were using DeFi.”

This year “is already off to a big start for NFT crime”, Grauer says, pointing to the rise in wash trading on NFT platforms. “This is definitely going to continue.”

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link