Bitcoin (BTC) mining difficulty is about to drop sharply, almost reaching levels seen in January, while at the same time, the coin’s price is much higher since the year began – spelling good news for miners.

Bitcoin mining difficulty, or the measure of how hard it is to compete for mining rewards, is expected to drop more than 11% in a day, as mining pool BTC.com estimates at 7:17 UTC.

This drop would be significant for three reasons:

- It would bring the difficulty down to 20.88 T, which is the lowest it has been since January this year, when the difficulty was on the rise.

- In the last year, or since the beginning of April 2020 to be precise, there have been only nine drops. This one would be the second-highest among them, following November’s 16% fall – itself the second-largest drop in the history of the network.

- At the same time the difficulty would see a massive drop, bitcoin’s price is recording much higher levels since the year began. On January 1, BTC was trading at USD 30,700. Since then, the price had hit a series of all-time highs and, at the time of writing, it’s standing at USD 54,444 – a 77% rise in four months.

The mining difficulty of Bitcoin is adjusted around every two weeks (that is, every 2016 blocks) to maintain the normal 10-minute block time. The 7-day simple moving average block time on April 29 was 10.8 minutes.

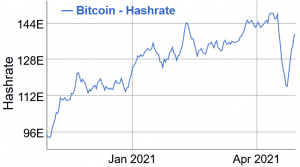

Per BitInfoCharts.com, hashrate, or the computational power of the network, is back on the rise. The 7-day simple moving average hashrate plunged 21% between April 16 and April 23. It’s been rising since, going up 16% and standing at 139.35 Eh/s on April 29.

___

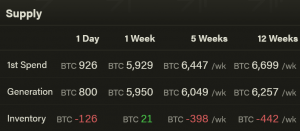

Meanwhile, in the past 5 weeks, miners have been spending more coins than they’ve been holding, according to ByteTree. Miners usually build their inventory during market weakness and sell into strength.

____

Learn more:

– Proof-Of-Bitcoin Needed As Critics & Competitors Unite To Play Climate Card

– A Closer Look at the Environmental Impact of Bitcoin Mining

– New Bitcoin Mining Giant Emerging in US With USD 651M Deal

– Bitcoin Miner With Own Power Plant Aims For Nasdaq Listing

– Bitcoin Mining Becomes A Side Venture For Chinese Non-Crypto Firms

– This Is How Satoshi Nakamoto Defended Bitcoin Mining & Converted A Skeptic

– Bitcoin Mining in 2021: Growth, Consolidation, Renewables, and Regulation

– Proof-of-Disagreement: Bitcoin’s Work vs. Ethereum’s Planned Staking

___

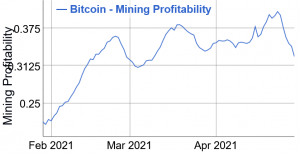

(Updated at 09:36 UTC: with a BTC mining profitability chart.)

Credit: Source link