Up to US$3.4 billion in realised losses in Bitcoin were recorded last week, according to on-chain data by Glassnode. This is the highest capitulation ever recorded in the history of Bitcoin.

Realised Losses Spike as Investor Uncertainty Rages

Losses in Bitcoin are realised when bitcoin bought at a higher price is spent or sold at a lower price. Last week’s panic selling indicates a high level of uncertainty in the market, especially among short-term holders.

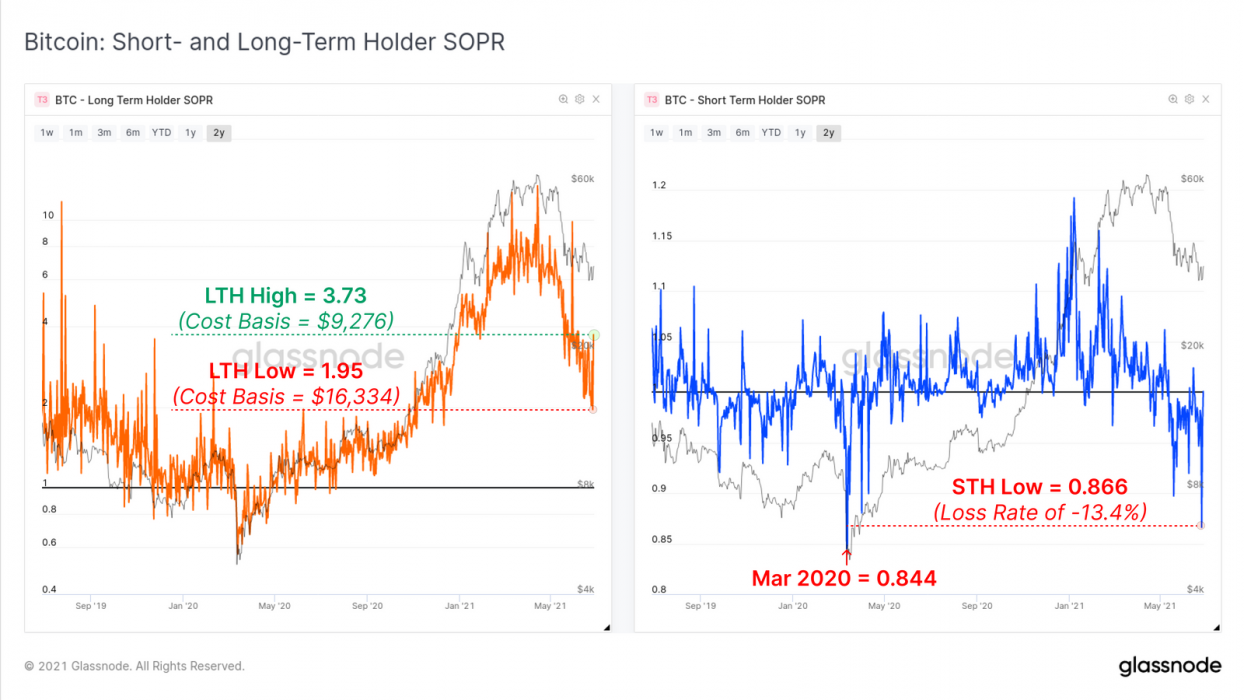

About 23.5% of Bitcoin in circulation is held by short-term holders and according to Glassnode, the majority is underwater (unrealised loss). This shows why the selling pressure is higher among short-term holders than long-term holders, most of whom are still in profit.

Despite that, some long-term holders sold during the week, their spending offset about US$383 million from the total realised loss of $3.833 billion in Bitcoin to US$3.45 billion. This is because most of them sold for a profit. Only 2.44% of Bitcoin’s circulating supply held by long-term holders is underwater.

Bullish Factors For Bitcoin

Bitcoin was trading at US$34,905 on 1 July and was down only about 4.18% over the previous 24 hours. Judging by Bitcoin’s market performance, this past month and the whole of Q2 were not exactly favourable for Bitcoin in terms of value. However, there have been a lot of indicators to suggest Bitcoin has not yet reached the top of the bull cycle.

On 29 June, the Puell Multiple signalled only the fifth buying opportunity in Bitcoin’s history. Crypto News Australia has also reported on the growing stablecoin reserves across all exchanges and the increasing rate of Bitcoin accumulation by long-term holders.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link