The flash crash in the crypto market on Wednesday was heavily exasperated by liquidations and leverage – debunking some narratives along the way.

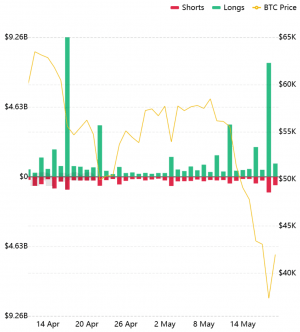

Yesterday, almost USD 9bn worth of trading positions (around 800,000 in total) in the crypto derivatives market were liquidated, per Bybt.com data. Almost USD 4bn of these were trading positions in bitcoin (BTC). Ethereum (ETH) traders lost over USD 2.3bn.

Vijay Ayyar, head of business development at crypto exchange Luno, told Bloomberg that what “causes such deeper pullbacks are a case of system overload, liquidations, and such factors.” He added that “crypto is still a much ‘wilder West’ than any other asset class where you can trade on some exchanges for up to 50-100X leverage,” and “what we’ve seen is a big funding reset across exchanges due to overleveraged traders.”

Total liquidations:

Leveraged trading refers to borrowing funds so that you can take a larger position than you would be able to with your existing funds so that you can potentially generate a higher profit. However, while margin trading enables traders to amplify their returns, it can also lead to increased losses and liquidations, which is why experienced traders tend to advise newcomers to stay away from leveraged trading.

According to partner at DeFi Alliance and Coin Metrics founder, Jacob Franek, leverage in crypto comes in many forms and it’s a critical piece of market structure – therefore, “it’s difficult to boil it down to a single number and gauge overall leverage.”

He stressed that there is more volatility in a bull run, and people should probably decrease their leverage with time, not increase it.

“Sufficient spot selling was achieved to start the mother of all liquidations. We had [USD 38K to USD 30K] within minutes with a cascade of long liquidations as one long dumped out on top of the next below it,” crypto analyst Willy Woo said.

According to him, leverage is now flushed from the system, capitulation completed and exchange flows are now “strongly bullish.”

“The big question I have is whether we get a faster v-shaped recovery or a longer sideways band of re-accumulation. Either way, I think this will take time for the tidal wave of coins that were dumped the few last weeks out to be re-accumulated,” Woo added.

At 13:47 UTC, BTC trades at USD 41,804 and is up by 22% in a day, trimming its weekly losses to 16%. ETH jumped by 18%, to USD 2,914. It’s down by 25% in a week.

Narratives debunked

Meanwhile, a quantitative crypto trader at Alameda Research, Sam Trabucco, took a deeper look into this, while also pointing to some long-held narratives he suggested the event had debunked. Whatever caused the crash, liquidations “did a lot of work to make the downturn more intense,” he said.

According to him, many new buyers have gotten long since before BTC hit USD 40,000, meaning “there were a LOT of long positions which had their first chance to get liquidated.” Moreover, a narrative that certain rallies, particularly ETH ones, were low-leverage and spot-driven, therefore “more organic”, suggesting that during a downturn, there’d be relatively few liquidations, was “super wrong.”

“This narrative has basically been true zero times in the past 3ish years,” Trabucco argued, based on all the volume being in derivatives or spot where the exchange allows leverage. During this flash crash, BTC once again suffered the least, compared with many other cryptoassets.

It was also “baffling” to the trader that some thought ETH was “just all institutions buying on Coinbase or something.”

That people thought ETH in particular was just all institutions buying on Coinbase or something was particularly baffling to me. Look at these GIANT OIs/premia as ETH skyrocketed to its ATH! This was all on leverage, just waiting for a day like today to come along … pic.twitter.com/v4tpVd7teU

— Sam Trabucco (@AlamedaTrabucco) May 20, 2021

There were some disagreements, however, over the use of open interest (OI) as a metric, with some, like trader Alex Krüger finding it “largely irrelevant.”

Co-founder and Chief Operating Officer of CoinGecko, Bobby Ong, said he’s been monitoring the funding rates (a fee paid by long or short traders) to check on leverage, and that it had been “super high” for a long time. “The party went on and on and on searching for a trigger to truly unwind and finally found it with Elon and China FUD [fear, uncertainty, doubt],” he said.

However, Trabucco concluded that moves like this tend to revert “super predictably” when they’re partially liquidation-driven. What Alameda has seen repeatedly is that, when these natural moves get exacerbated by liquidations, no one wanted to sell them as low as they got, meaning that “whenever the market can gather its collateral, the market *should* rebound.”

Also, per Adam Back, CEO of blockchain technology firm Blockstream, when it comes to leverage, it’s better to “don’t” and hold your assets in a cold storage and dollar cost average instead. Those who use leverage for fun of profit, increase risk a lot, Back said, adding to “do it with max 10% of coins (or less). Never place a leverage trade without a limit stop, or implicit stop from small position liquidation.”

also pay attention to which exchanges have a history of crashing under load, choking on orders (become non-responsive), gapping, or price reference defects. poorly managed exchanges are palpable risk. when you most need it they may be non-functional, and liquidate you wrongly.

— Adam Back (@adam3us) May 20, 2021

‘Fundamental questions’

Meanwhile, according to Chainalysis‘ Chief Economist Philip Gradwell, some serious questions need to be answered, as this week’s price falls show that more needs to be done to keep the investment coming in.

Given that crypto has matured into an asset that people have made serious investments in, they want some hard questions answered, many of them faced before, including those about environmental impact, use cases, illicit activity, and regulation. “Elon Musk can clearly drive price volatility, but the sell-off is large enough to demonstrate that other buyers have concerns,” said Gradwell.

Though the current price fall is very significant – with bitcoin price dropping more than 25% over 7 days on four other occasions since the start of 2017 – the price levels for both BTC and ETH are still historically high.

“This is unlikely to be the end of the bull run,” Gradwell argued. “Prices are historically high and much more is at stake than in past price declines.” Given that USD 410bn has been spent to acquire current BTC holdings, there are “serious incentives to resolve problems that people may have with cryptocurrency and to invest in improvements.”

As for the current selloff, while whales appear cautious, the low prices may be tempting them to buy the dip, rather than sell into it, said Gradwell. Meanwhile, much of the selling is from people with assets already on exchanges, he said, likely retail investors and liquidations.

____

More reactions:

Yesterday #Bitcoin saw virtually every buyer in 2021 get taken out to the wood shed. This was a multi month topping… https://t.co/xBZP04gOvh

__

I think at least 2 general rules can be applied:

1. The longer into the bull, the higher the overall leverage.

2. Corrections compound — the larger the move, the greater the potential to unwind more leverage thus exacerbating the move.

— Jacob FranΞk (@panekkkk) May 19, 2021

__

__

__

__

___

____

Learn more:

– Crypto Flash Crash: Recovery, Unavailable Exchanges & Tesla’s ‘Diamond Hands’

– Another Usual Bitcoin Crash? BTC Almost Tests USD 30K

– Weeks Of Sideways Trading Ahead as Bitcoin Newbies Panic Selling to Hodlers

– Fundstrat’s Tom Lee Boosts Bitcoin Target 25% Despite Musk’s Criticism

– Bitcoin May Double This Year Despite Energy Concerns – Pantera CEO

– Traders Rotate From Bitcoin To Alts, While JPMorgan Sees Ether As Overvalued

– If History Rhymes, ETH Might Hit USD 19K; Downside Risk Stronger Than BTC’s

Credit: Source link