Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

The Crypto markets took a pretty decent hit after a US$500 Billion sell off in the last week. If you’re one of those people I’m seeing across all socials freaking out about this DONT STRESS!

You can see in the TOTAL chart below that the entire crypto cap took a US$600 Billion hit back in September and recovered quite well. At this point I’m expecting the same to happen.

Looking at Bitcoin we are seeing a bit of Elliot Wave Theory in play here. For those who don’t know what that is, its essentially investor psychology and sentiment presented as recurring patterns in the market – A 5 wave pattern – 3 waves up (impulse waves) and 2 waves down (corrective waves).

BTC is currently in the middle of wave 4 having a small bounce on the 50% Fibonacci level. We are expecting to to see further down side to a level of confluence between the current uptrend, 61.8% Fibonacci level and daily support level at US$51,500. All of which supports the Elliot Wave Theory.

Keep in mind wave 4 is a corrective wave. So this doesnt mean doom and gloom. This would indicate BTC is simply having a healthy correction before the next leg up. I stand by our initial target of US$78,000 as target one and US$ 87,000 as target 2.

Last Week’s Performance

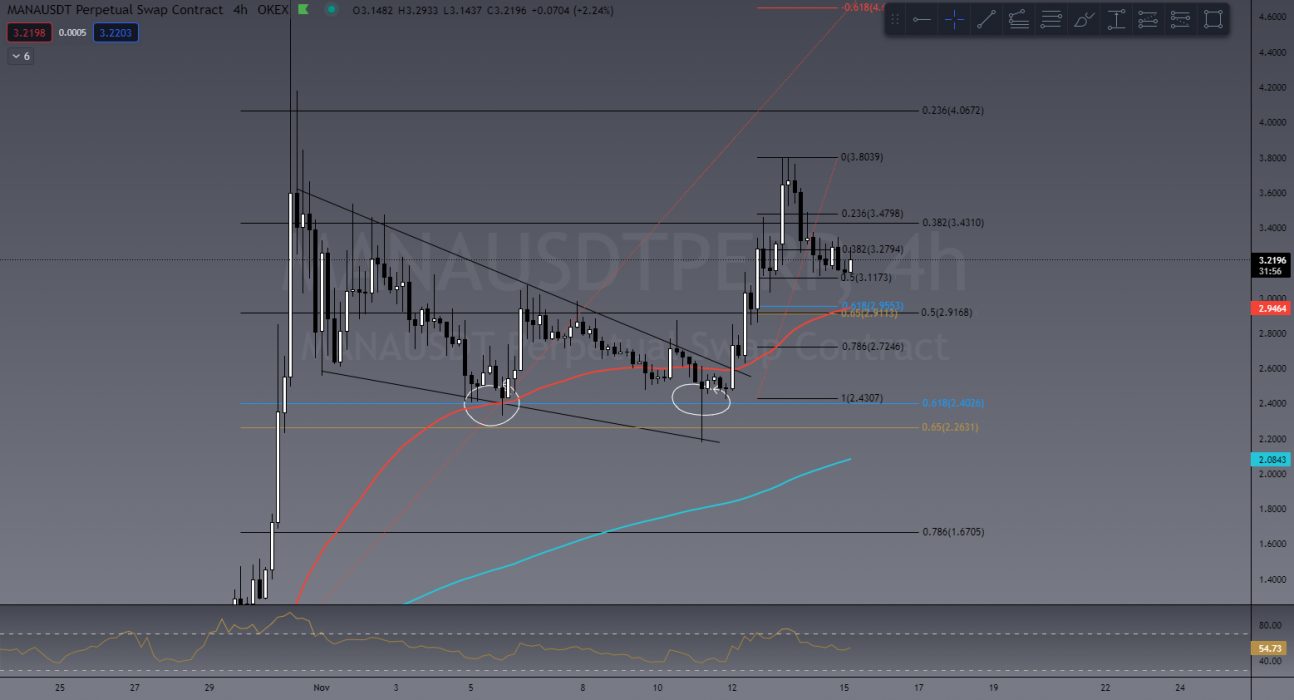

MANA/USDT

MANA has again made the list this week for top performers. In the TradeRoom these MetaVerse tokens have been going crazy despite BTC itself seeing bearish action. In last weeks article I mentioned MANA will likely see a pullback into that 61.8% Fib level which it did before a continuation up. Performed perfectly with a price increase of 50%

ENJ/USDT

Another MetaVerse coin that performed well last week was Enjin. A nice clean pullback to a solid support level and the 50 Fib and away she went with a nice 43% rise.

This Week’s Trades

AXS/USDT

Sticking with the MetaVerse theme this week we cant go past AXS. Hoping to see a pullback to a good buy zone at US$115 mark where I’ll be looking for entries. If AXS continues to perform well with the BTC drops who knows how high this beast can go.

SAND/USDT

Again with the MV coins I know but hey, profit is profit. SAND is current looking to be forming a bit of a bull pennant, however, I’m personally hoping to see a bigger pull back into a healthier buy zone at around US$3.48 area. Why? Well its a good test on what will be a new level of support, test on current uptrend and the 50% Fib retrace.

LRC/USDT

LRC is showing a really good pullback into a buy zone. In a chart posted in the TradeRoom by one of our team leaders – Pete – this morning you can see the buy zone clearly displayed in the 61.8% Fib level, which again is a common retracement level and Pete has also drawn a bullflag which is a strong bullish continuation pattern. Target of US$2.10

Invite to Join our TradeRoom

If you’d like to become a better trader, you’re invited to join our TradeRoom where we share daily charts and market analysis. In our community we strongly encourage and teach correct risk management strategies to keep our members safe in this new volatile crypto market.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link