Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

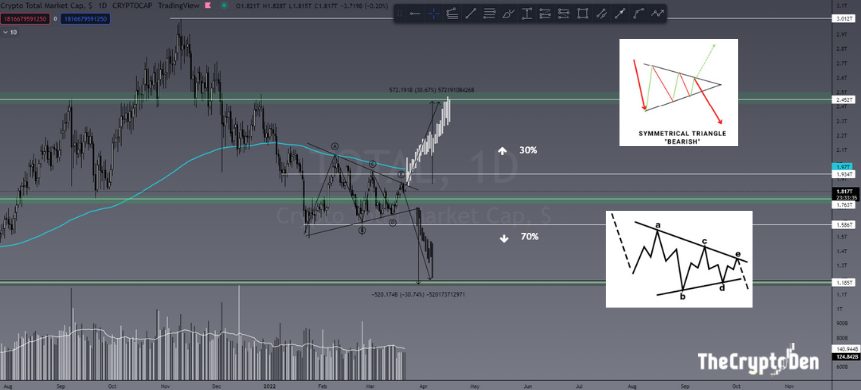

The market is constricting into a decision point. Up or down? Well, we’ll know soon. The TOTAL, like BTC, is still in this symmetrical triangle pattern. Like I said last week, this is generally a continuation pattern with a 70% chance of persisting with the current trend, leaving a 30% chance of reversal. In the chart below, you can see that in both directions we have a high probability of moving 30%, leaving us currently sitting at an equilibrium (EQ).

Elliott Wave Theory would suggest we are in this bearish symmetrical triangle, also with an ABCDE consolidation. While ever it remains below the daily 200EMA, this will be my bias, which I’ve stated many times.

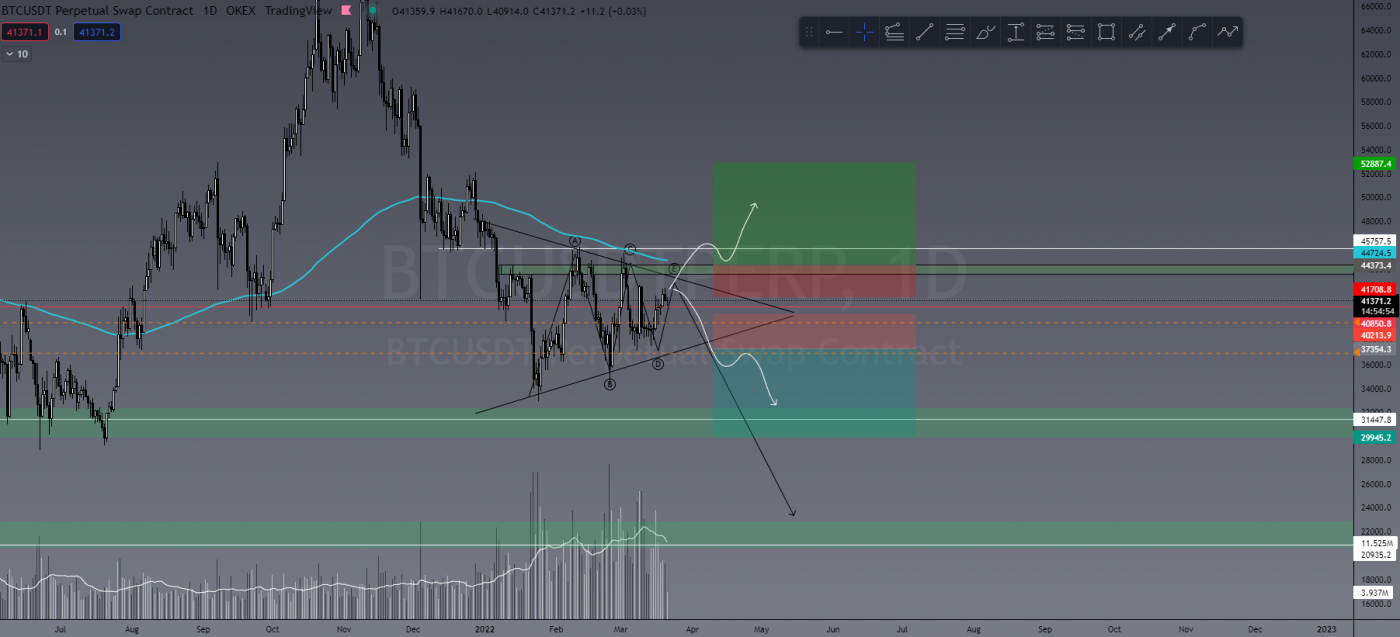

BTC is painting the same pattern and scenario. Despite popular belief, I’m not a “permabear” – I just trade what’s in front of me and even though we have seen some small pumps in price action, I’m still not seeing anything overly bullish. Does this mean BTC is all doom and gloom? No. It just means that for me, it’s bearish until it’s not, and that point of invalidation is a breakout above local market structure (US$45,760) and the daily 200EMA, and to hold above for a few days to a week.

Last Week’s Performance

Again, like the week before last, I didn’t enter any new positions. The reason for this is I don’t like to trade a ranging market. I like to trade with A trend. And while ever it’s ranging, it’s NOT trending.

I still have 11 short positions open but have not opened anything new in two weeks. I’m waiting for the market to decide which trend it’s going to follow. Continue down? Or reverse and head up? Either way, I’m waiting.

Here is a visual representation of what I mean by my no trade zone:

This Week’s Trades

WAVES/USDT

This is a tough one due to the fundamentals surrounding WAVES at the moment with all that’s happening in Ukraine, but from a technical standpoint I’m seeing a daily bearish divergence at daily resistance with declining volume. So we could certainly see a retracement here soon. I’ll be entering a small position.

BTC/USD

For BTC, I’m hoping we get a decision this week. One way or another, I have a plan and so should you! If we break to the upside, I’ll wait for the pullback to confirm new support and enter LONG. If we break to the downside, I’ll do the reverse and wait for the retest on enter SHORT. As a trader trading on leverage, it doesn’t matter to me.

Introducing TCD’s New Social Platform

The Crypto Den now has a FREE purpose-built social platform to share investment ideas, trade chat, connect to like-minded people, share info and more, without the censorship of Facebook. The platform is designed for those more focused on the investment/profitable side of the crypto world.

Are You a Trader?

Invite to Join our TradeRoom

If you’d like to become a better trader, you’re invited to join our TradeRoom where we share daily charts and market analysis. In our community we strongly encourage and teach correct risk management strategies to keep our members safe in this new volatile crypto market.

Join our “Apprentice” plan now for your 7-day trial.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link