Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

I’m BACK! I apologise to readers for my absence of late. Having a newborn is challenging enough and unfortunately we’ve had to make many hospital visits over the past month. But all is well!

Let’s get into it!

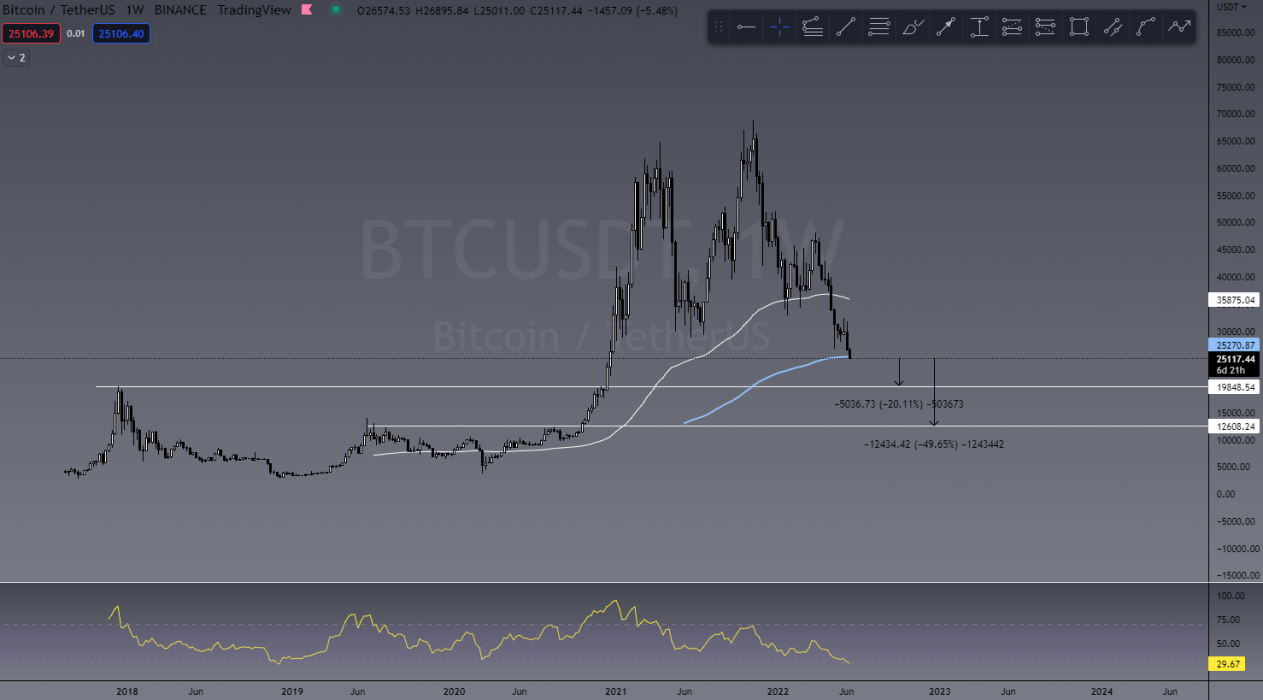

On April 11, I shared with you my thoughts around what I was seeing from BTC, and that was a huge bear flag forming (see image below) indicating further downside in the market. We have since dropped a further 40%. I do believe we are still likely to see an additional 20% drop from the current price level before we see a significant reversal. My first target to start scaling in on SPOT is US$20,000.

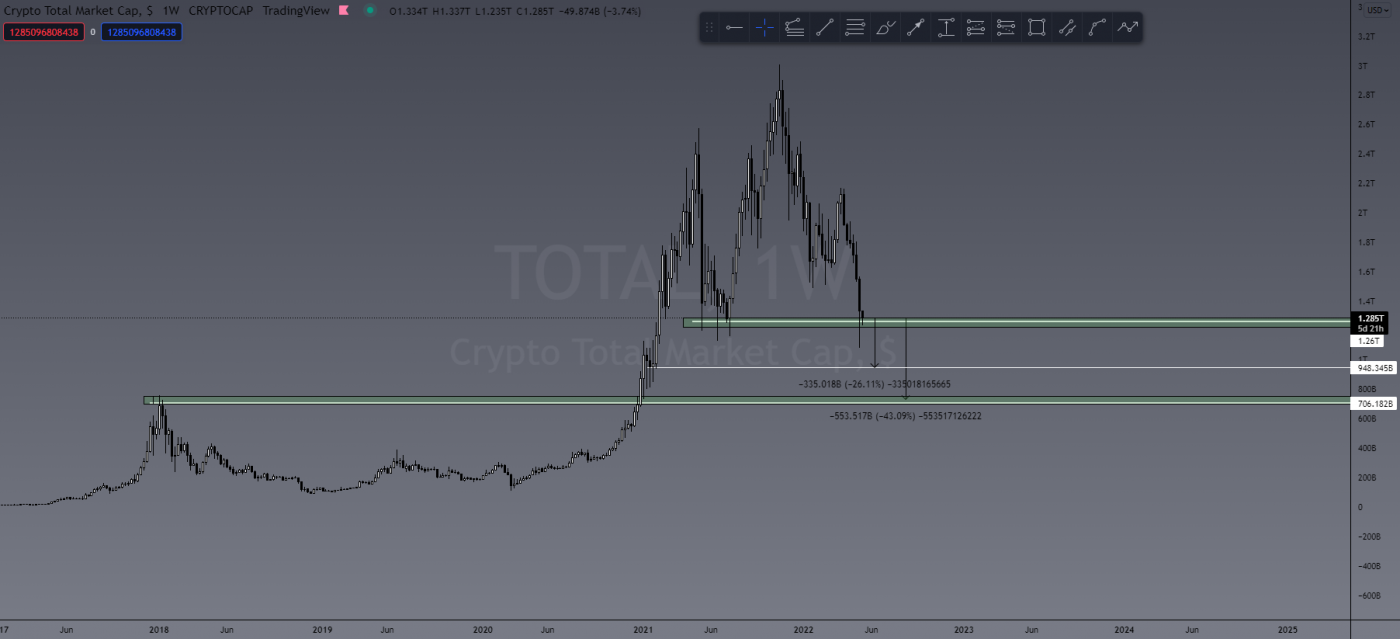

The TOTAL market cap is now down 65% from ATH, and I think in the coming days/weeks we will drop below the US$1 trillion valuation. On May 17 I shared the below chart showing another potential loss of over US$300 billion to US$500 billion, and you will see that the TOTAL has now shown a weekly close below its 200 EMA, which tells me the likelihood of this happening is getting higher.

Recent Performance

There have been two trades in particular that I’ve shared here numerous times that had great shorting potential: DOGE and ADA. These charts started back in December, if you’d like to take a look.

DOGE/USDT

DOGE is almost at my key Take Profit (TP) level of US$0.04, which will yield me a total of 730% profit from this entry using a 10x position.

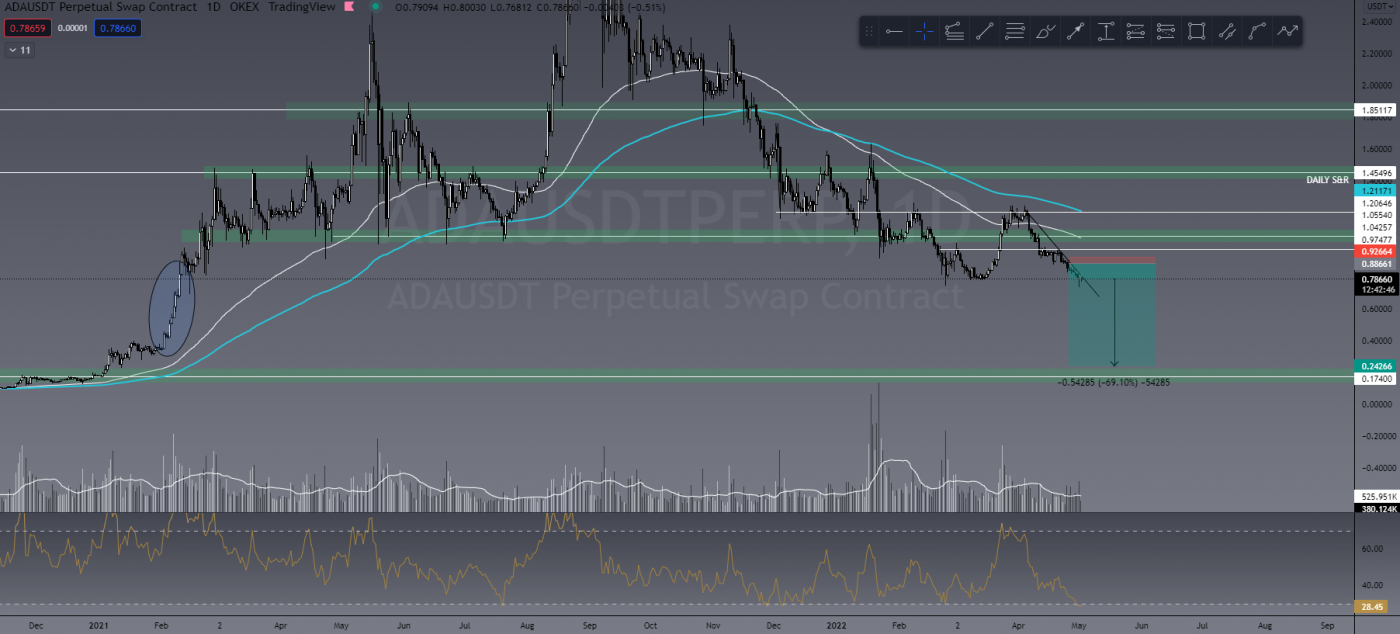

ADA/USDT

An ADA target of US$0.18 is still on the table and at this point I will likely close my Short at around 800% profit using 10x leverage, and look to not only enter LONG positions but also scale into ADA on the SPOT market.

This Week’s Trades

I will absolutely NOT be entering new trades this week. We are mid-dump in a bearish market and it’s safer to stay out and just wait.

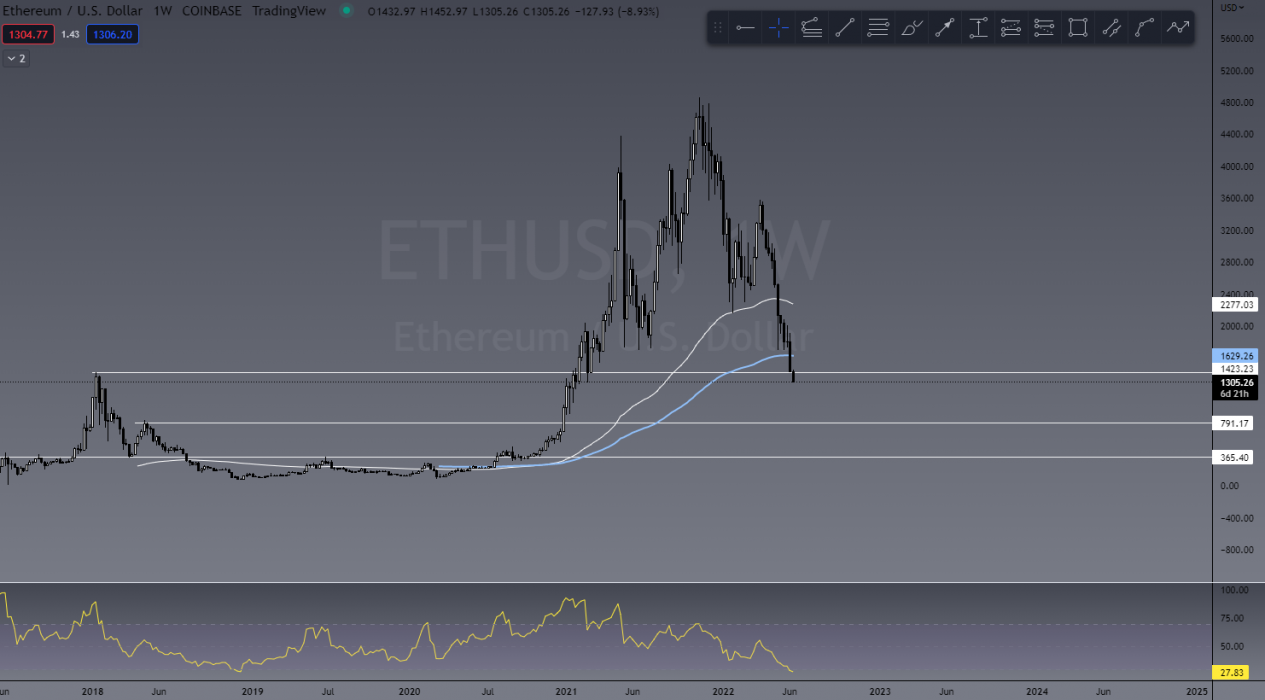

What I’ll be looking for are key levels on the daily and weekly charts for both BTC and ETH where I will enter SPOT positions and open longs. This is where patience is key.

If BTC and ETH both close a weekly candle at or below current levels, things will certainly go from bad to worse. Targets are outlined on the charts below.

Be patient, invest wisely and don’t stress. Crypto is still in its infancy of what it can accomplish!

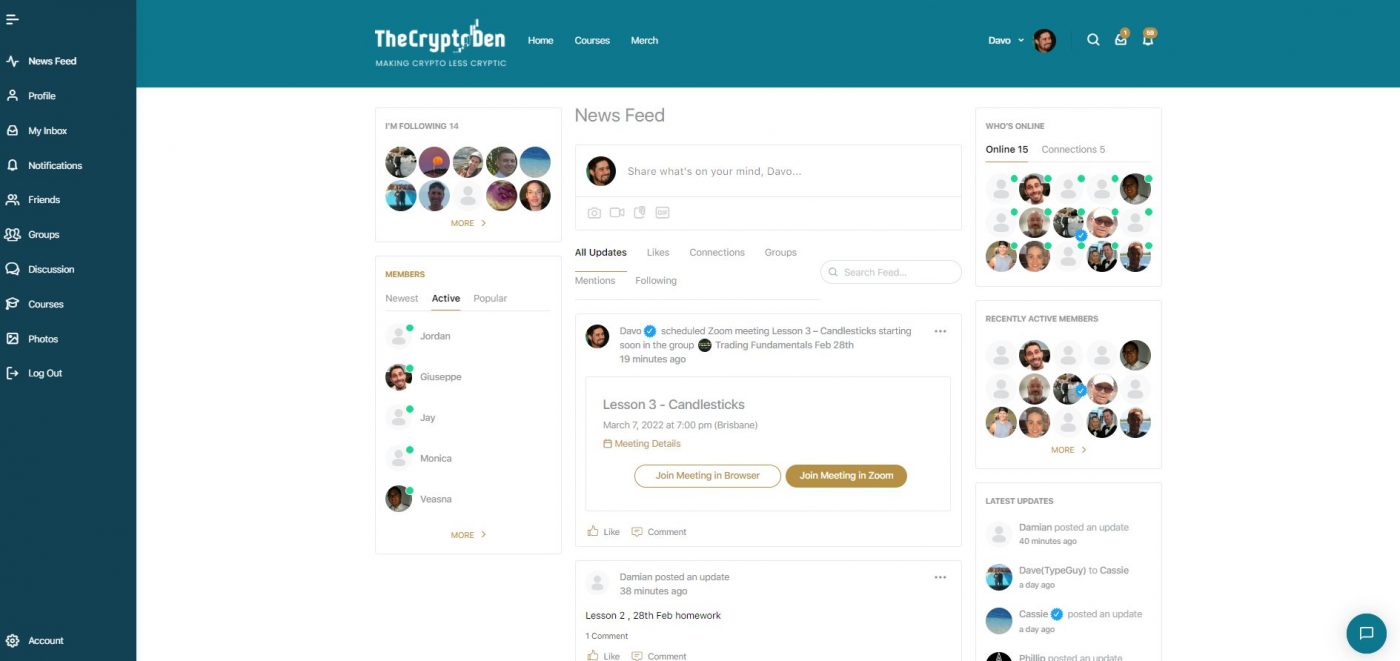

Introducing TCD’s New Social Platform

The Crypto Den now has a FREE purpose-built social platform to share investment ideas, trade chat, connect with like-minded people, share info and more, without the censorship of Facebook. The platform is designed for those more focused on the investment/profitable side of the crypto world.

Are You a Trader?

Invite to Join our TradeRoom

If you’d like to become a better trader, you’re invited to join our TradeRoom where we share daily charts and market analysis. In our community we strongly encourage and teach correct risk management strategies to keep our members safe in this new volatile crypto market.

Join our “Apprentice” plan now for your 7-day trial.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom, you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link