Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

As I mentioned in last week’s article, we are in protecting-our-capital mode! This is because the past week has only been a good week for those trading in the futures markets and shorting – and I don’t think it’s over yet.

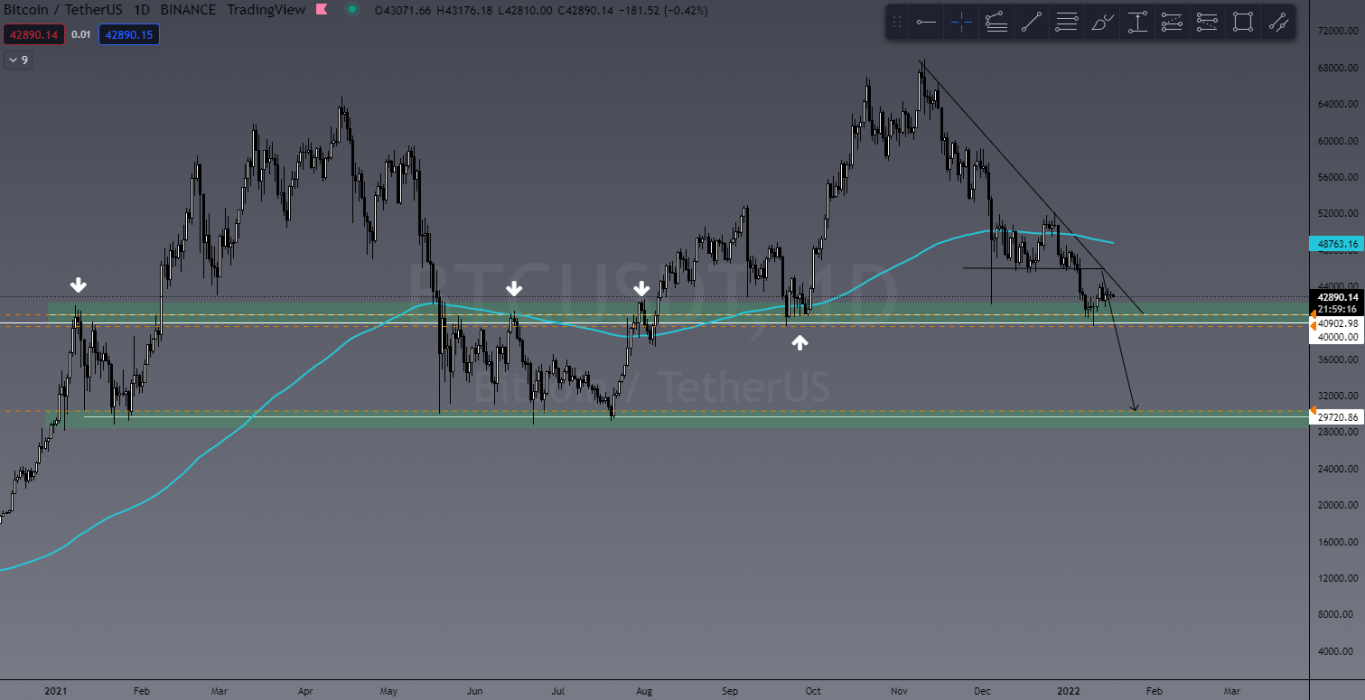

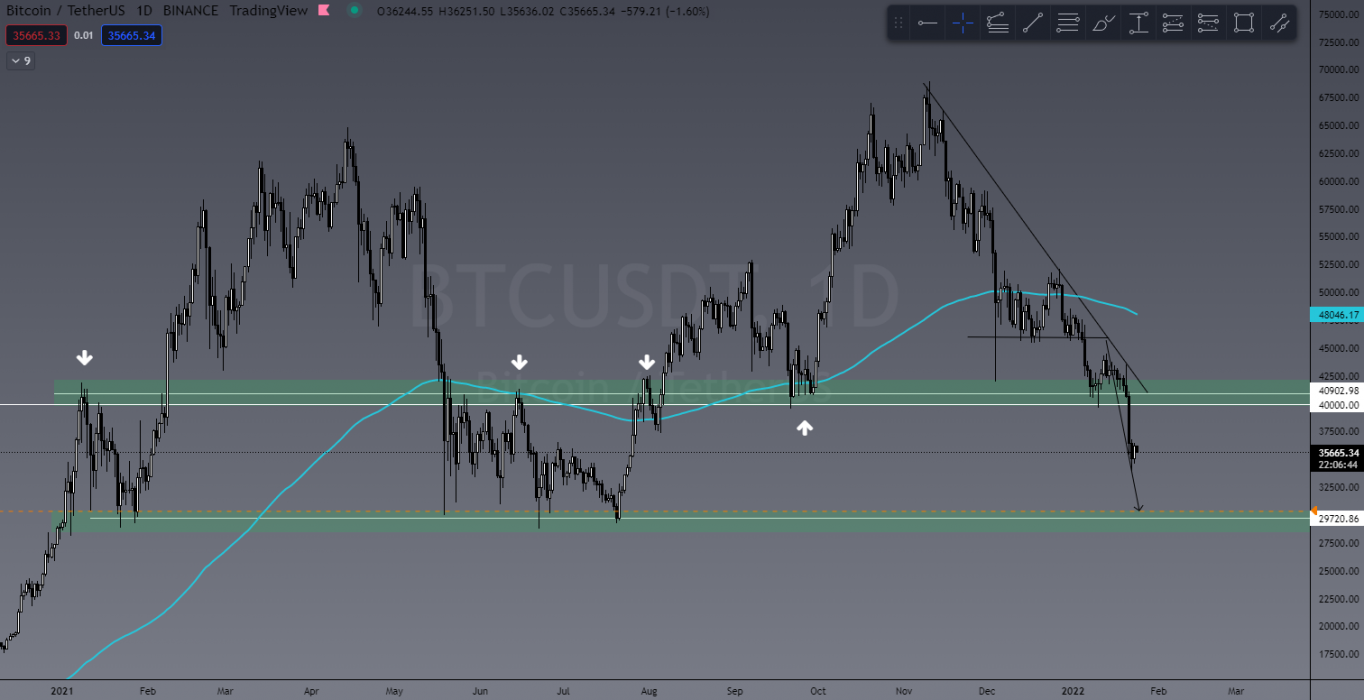

If we take a look at the Bitcoin CME Futures chart (BTC1!), you’ll see two very distinct gaps in price action displayed by the green boxes. Now, generally speaking, these gaps get “filled” (meaning price revisits those levels) 80 percent of the time. The further PA gets away from these gaps, the less likely they will be filled. That being said, we are very much in range of these gaps getting filled, which means the BTC price could very likely revisit US$32,000 and US$23,000. It’s my opinion that IF this does happen, BTC will test the previous top of the last bull cycle at US$20,000.

Comparing this week’s BTC chart to last week’s, you can see the target identified of US$30,000 has not yet been hit and is still very much in play. This will correlate well to the BTC1! gap closing.

We could see a very short-lived relief rally, but once again these are very short-term rallies. My money is still hedged on a further downside.

Last Week’s Performance

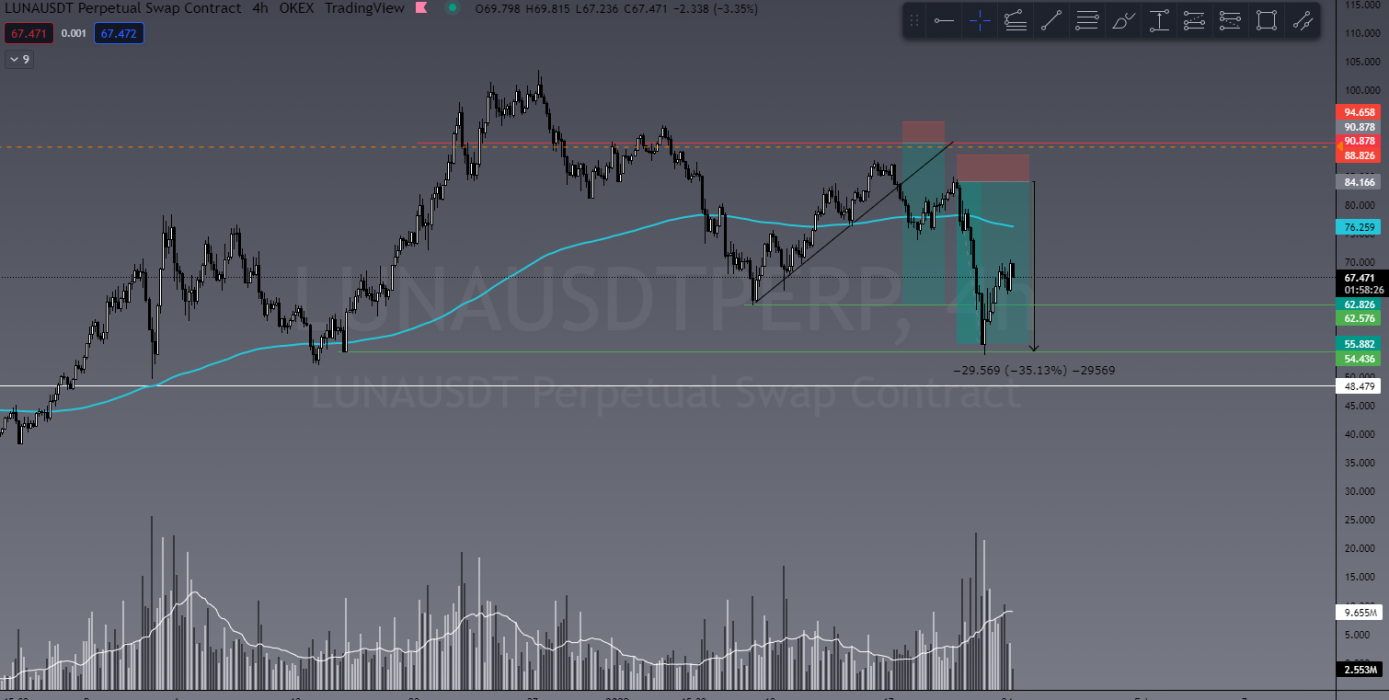

LUNA/USDT

We had a great primary target for a LUNA short which unfortunately was missed, so we hit the secondary target at a retest. This was still a profitable 330% trade on only 10x leverage.

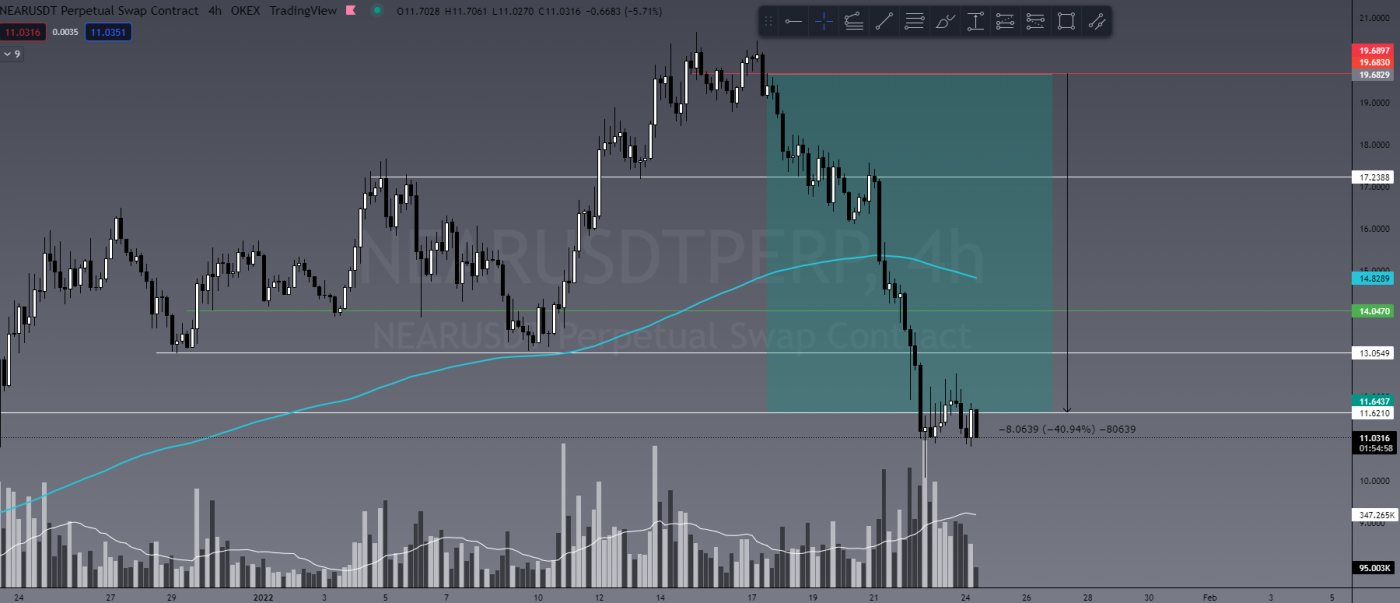

NEAR/USDT

One of the biggest trades from last week was on NEAR, short closing in a whopping 400% on only 10x leverage. We correctly identified the bearish engulfing candle after some indecision and entered. This one well and truly exceeded our expectations, thanks to BTC!

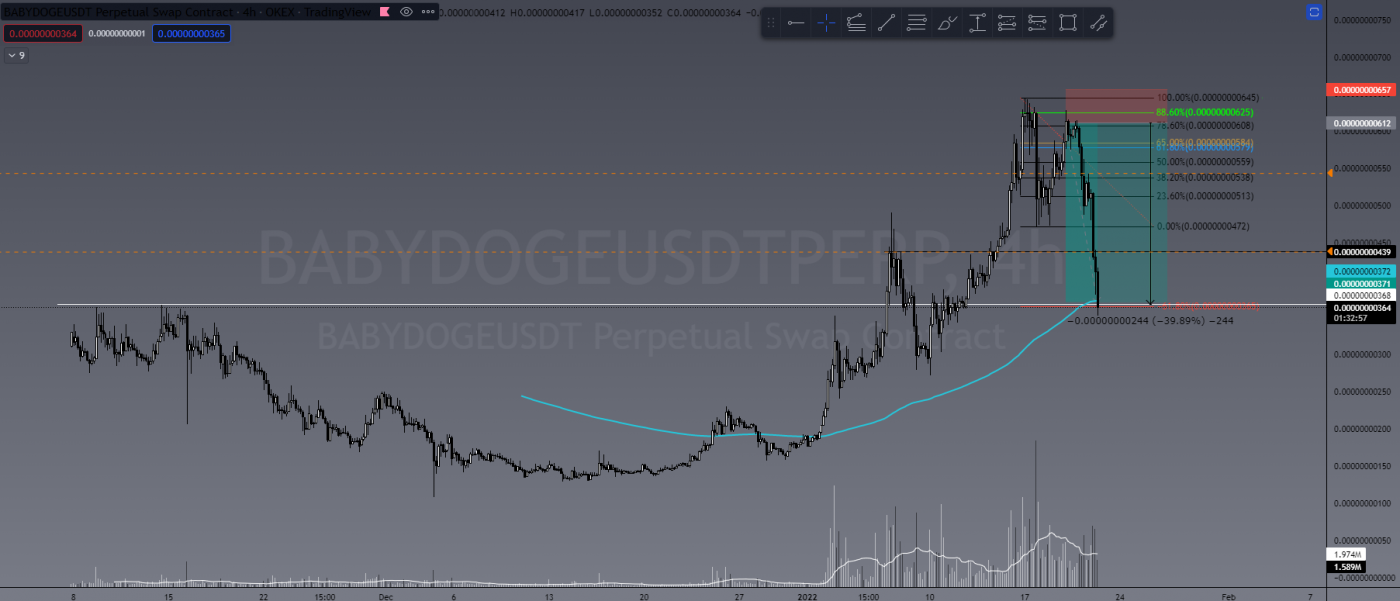

BABYDOGE/USDT

Easily my favourite trade of the week was on BABYDOGE. On a fundamental level, I have absolutely no idea what this coin even is or does and it sound ridiculous, but nevertheless the opportunity was there and we took it!

This short trade was identified in a TradeRoom live market scan and profits were taken at just under 500%. I still have some capital in this trade and have added to my position in the current relief rally. We’ll see how it plays out soon enough!

This Week’s Trades

BABYDOGE/USDT

As mentioned above, I’ve added to my BABYDOGE short position here, which could be an opportunity for a new trade entry. If this plays out, it could prove to be another 500% on only 10x leverage.

ATOM/USDT

What we look for in a bearish market is the biggest relief rallies to present the better short entries. I think ATOM has painted a good push back to test previous support as resistance, and therefore presents great shorting opportunity here.

When BTC has large dumps like this, the volatility is increased for both up and down swings, making it far less predictable than in a stable market. Because of this, we generally think it is wise to reduce capital input during times of uncertainty.

Learn to Trade

Unfortunately, due to COVID, we have had to postpone the start date for our upcoming trading course. The next live trading course for newcomers will be on Feb 28; see full details below.

The Crypto Den is holding its first of only two trading courses for 2022 on February 28! That’s right, we will only be running two programs in 2022! What makes us different? Our lessons are LIVE and come with a community where you submit your homework and receive feedback to ensure you understand what we teach!

Duration: 6 week course

Date/Time: Live trading course twice a week – Mon & Wed at 7pm AEST

Frequency: We now run our LIVE course only twice per year

Location: Zoom Webinar

From: February 28 to April 13

The Crypto Den’s Trading Fundamentals trading course is a LIVE interactive course designed to teach you how to trade the crypto markets from absolute beginner level!

Our six-week program teaches you how to set up your trade accounts using reputable exchanges and brokers, how to read the charts using technical analysis, and to protect your capital using effective risk management strategies.

We have taught thousands of students of the past five years how to trade these volatile and highly profitable markets. See our REAL reviews from REAL students.

Using ZOOM twice a week, all of our lessons are LIVE and recorded so you can access them over and over again in our structured course through our website and smartphone app. Lessons come with homework and online quizzes, as well as an amazing online and private community of students.

So what are you waiting for? Join now to start learning!

Already Know How to Trade?

Invite to Join our TradeRoom

If you’d like to become a better trader, you’re invited to join our TradeRoom where we share daily charts and market analysis. In our community we strongly encourage and teach correct risk management strategies to keep our members safe in this new volatile crypto market.

Join our “Apprentice” plan now for your 7-day trial.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link