The weekend selling in the crypto market occurred despite a number of recent optimistic forecasts predicting everything from a bottoming out to an expected break in the correlation between crypto and traditional assets this spring.

Today, bitcoin (BTC) tested USD 37,500, while ethereum (ETH) bounced only from USD 2,600. At 17:49 UTC, BTC traded at USD 38,712 and was up less than 1% in a day, trimming its weekly losses to 8%, and increasing its monthly gains to 6%. ETH stood at USD 2,713, after increasing 2% in a day. The price was down 6% in a week and up almost 6% in a month.

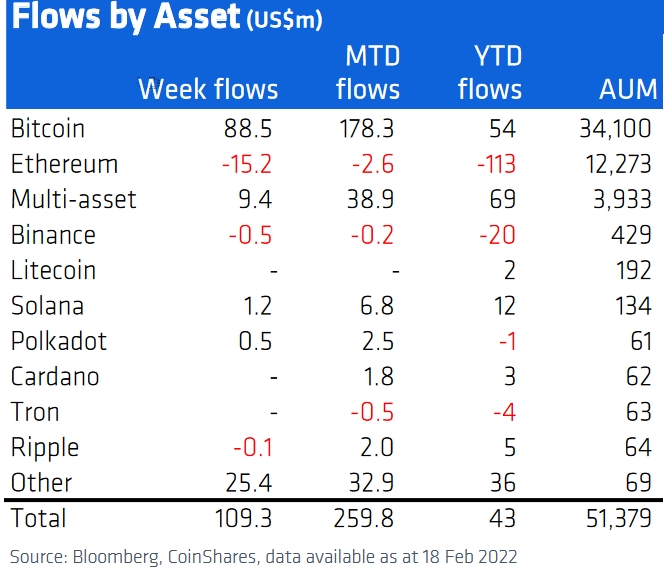

Last week, digital asset investment products saw inflows totaling USD 109m, or 45% more than a week earlier, despite recent price weakness and perceived negative impact from the looming conflict in Eastern Europe, per CoinShares data. The Americas were responsible for 92% of these inflows. Meanwhile, inflows in the BTC investment products jumped from USD 25m to almost USD 89m in a week. ETH saw outflows worth USD 15m, compared with USD 21m inflows a week earlier.

Meanwhile, on Sunday, Du Jun, Co-founder of the crypto exchange Huobi, told CNBC that the next BTC bull market may not come until late 2024.

Referring to bitcoin’s four-year halving cycle, Du Jun said that the entire crypto market tends to follow these cycles, with peaks in prices following after each new bitcoin halving.

“If this cycle continues, we are now at the early stage of a bear market,” the Huobi co-founder said, before admitting that crypto prices are still notoriously difficult to predict because there are so many other factors that can affect the market as well.

The somewhat pessimistic comment about the current state of the market stands in contrast to several optimistic takes from recent weeks. Among them was the crypto hedge fund Pantera Capital, which earlier this month told investors in a call that they expect the recently high correlation between crypto and traditional markets to break this spring.

If prices between the two asset classes decouple as expected, crypto markets “will bounce back relatively quickly,” Pantera’s co-chief investment officer Joey Krug said on the call.

Less sure about a potential break in correlation was Man Institute, a research institute co-founded by the University of Oxford and the hedge fund giant Man Group.

According to an article from the institute in early February, bitcoin is simply behaving as “a rate-sensitive risk asset,” with strong correlations to the Nasdaq stock index and the ARKK Innovation Equity ETF.

“This mirrors bitcoin’s own journey along the Gartner hype cycle: from being an underground tech phenomenon, the flagship cryptocurrency is now a mainstream way for both institutional and retail investors to speculate,” the researchers wrote.

They added that the more bitcoin becomes correlated with stocks, the more it appears to be just another manifestation of what it said has become “a crucial facet of investing,” namely that there is “too much capital chasing too little genuine economic growth.”

Among those who have been more bullish on bitcoin, however, was Bloomberg Intelligence analyst Mike McGlone, who wrote in a report from early February that “Bitcoin is more likely forming a floor than a ceiling.”

More precisely, the price may be forming a bottom again around USD 30,000. This level “has held a floor under the market since the initial breach of what was resistance at the start of 2021,” the analyst wrote.

He added that the next key level to the upside for bitcoin is the much-discussed and long-predicted USD 100,000.

Also bullish on bitcoin earlier in the month was the financial research firm FSInsight, which said in a report that it expects “macro tailwinds” for the coin in the second half of the year. Combined with an expected rise in bitcoin’s market-value-to-realized-value (MVRV), this will bring BTC to USD 200,000 by the end of the year, the firm predicted.

Meanwhile, Ethereum co-founder Vitalik Buterin said in comments to Bloomberg over the weekend that he is not sure whether another “crypto winter” has arrived, or if crypto is just mirroring the current volatility in traditional financial markets.

However, if a prolonged “crypto winter” is upon the market, it wouldn’t necessarily be such a bad thing, according to Buterin.

“The people who are deep into crypto, and especially building things, a lot of them welcome a bear market,” Buterin said, adding that extended period of rising prices attracts a lot of “very short-term speculative attention.” During crypto winters, on the other hand, you can see which projects are actually long-term sustainable, the Ethereum co-founder was quoted as saying.

___

Learn more:

– Bitcoin Holders Search for ‘Hopium’ as BTC Breaches USD 40K, Gold Rises

– ‘Far More Bearish’ Survey Predicts Doubling of Ethereum Price This Year

– Brace for Green February, Kraken Tells Bitcoin Hodlers as BTC Tests USD 45K

– No New All-Time Highs This Year for Cardano, But Price Could Surge by 2030 – Survey

Credit: Source link