Recent on-chain activity suggests that blue-chip investors are the force behind Bitcoin’s (BTC) latest price action, according to a popular crypto analyst.

Ali Martinez tells his 45,800 followers on the social media platform X that there’s been a “noticeable decline” in the daily creation of new BTC addresses amid Bitcoin’s recent price surge.

According the Martinez, the reduction in the creation of new BTC wallets indicates that institutions heavily account for the recent price movement of BTC as retail traders are still waiting on the sidelines.

“This trend points towards a lack of retail participation in the current BTC bull rally, suggesting that the recent price action is primarily fueled by institutional demand.”

BTC is trading at $52,048 at time of writing. The top-ranked crypto asset by market cap is up 10% in the past week and nearly 22% in the past month.

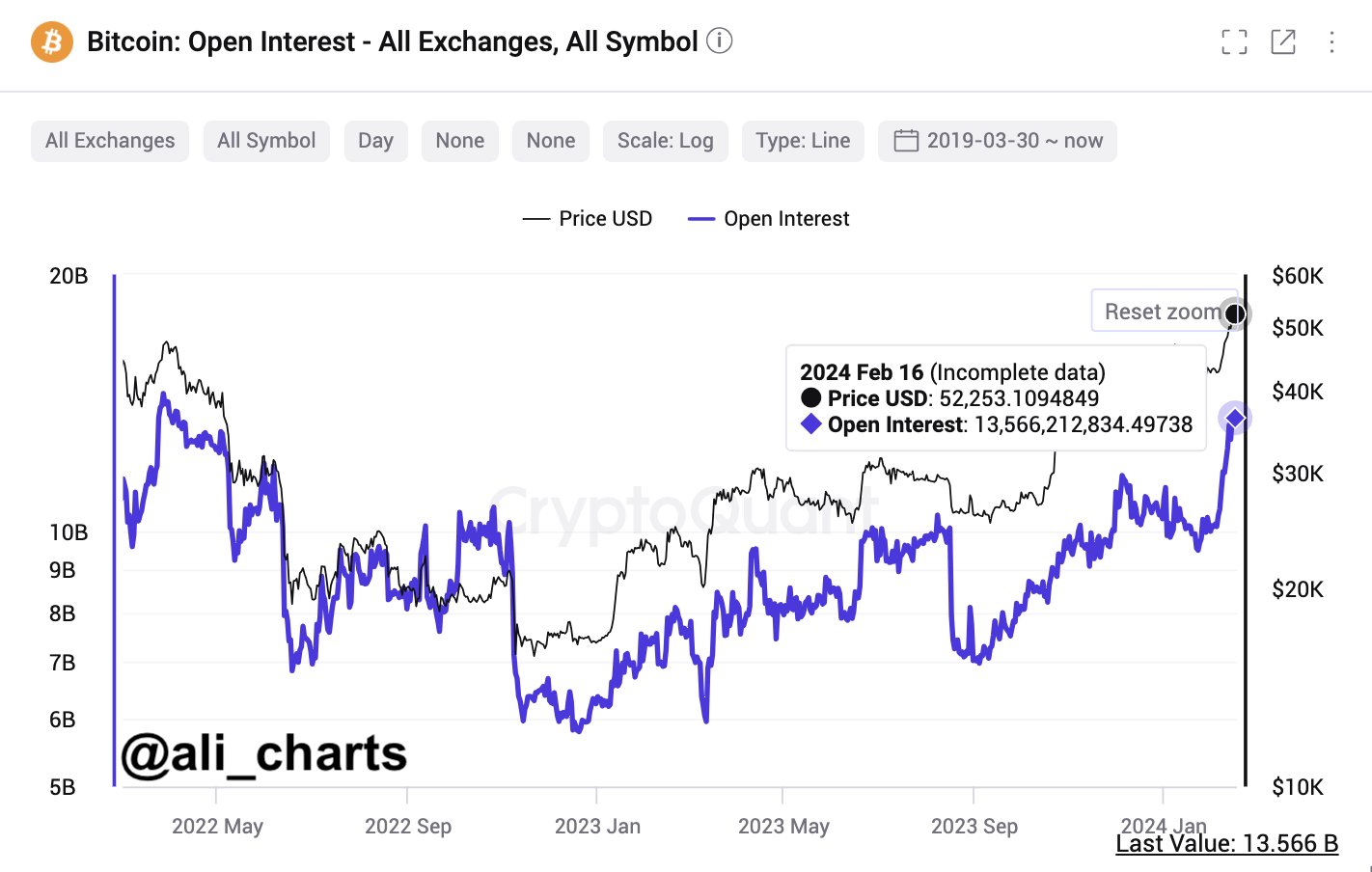

Martinez notes that Bitcoin’s open interest (OI) across all exchanges has jumped to $13.57 billion, its highest level since April 2022. Open interest is a metric that tracks the total amount of open BTC long and short positions.

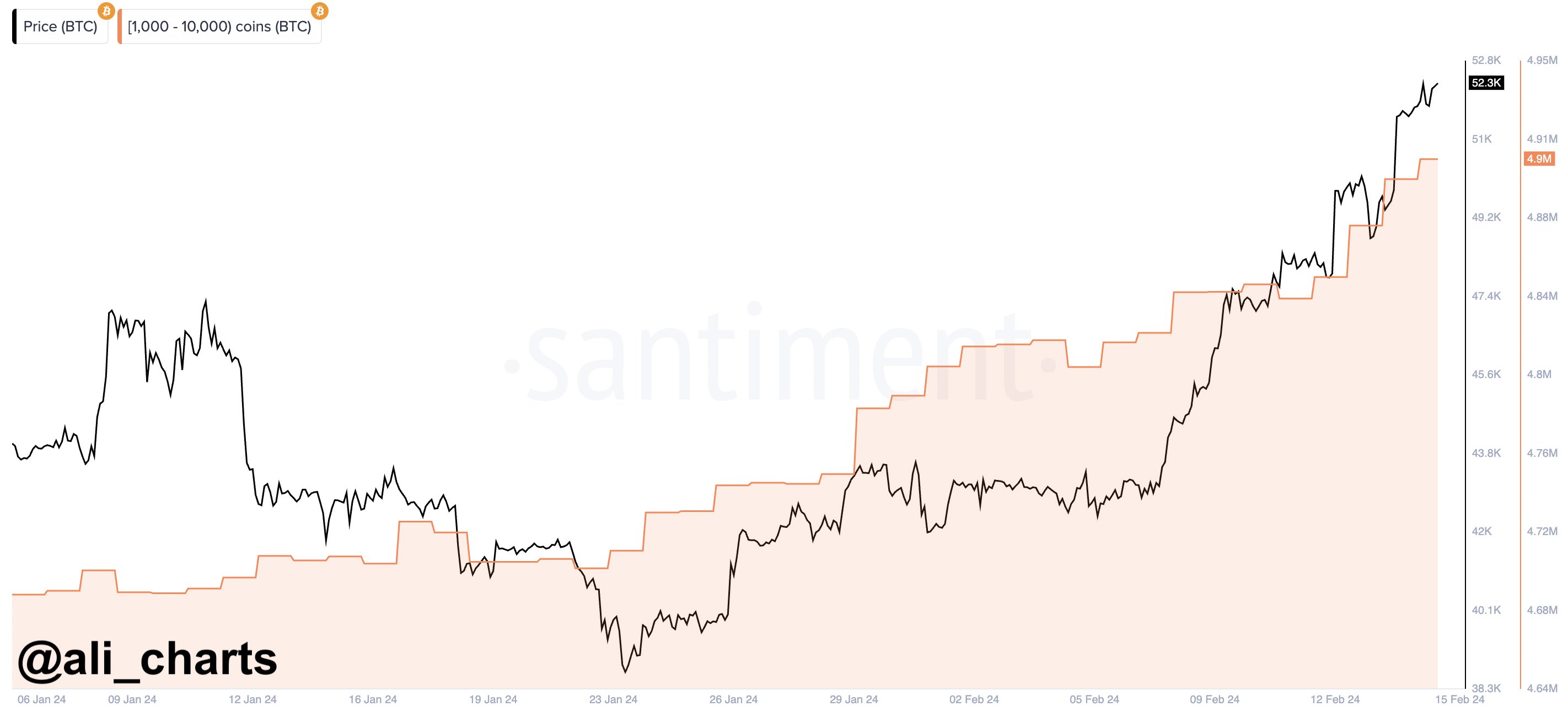

The trader also points out that Bitcoin whales have purchased more than 100,000 BTC in the past ten days worth about $5 billion.

In terms of other crypto assets, Martinez says Ethereum (ETH) rival Cardano (ADA) could break out earlier than expected.

“Still, if history repeats itself, we are anticipating ADA to rise to $0.80, retrace to $0.60, and then enter a bull run toward $8 by January 2025!”

ADA is trading around $0.596 at time of writing. The ninth-ranked crypto asset by market cap is up more than 10% in the past week.

Generated Image: Midjourney

Credit: Source link