Bitcoin bear markets are almost always viewed in a negative light. Net worth evaporates and more recent investors in the world’s largest cryptocurrency by market capitalization often find themselves deeply in the red on their initial investment.

But 2022’s bear market looks to have been a boom for one particular investor cohort. That is, the cohort of retail-sized crypto believers looking to get their hands on at least one BTC token.

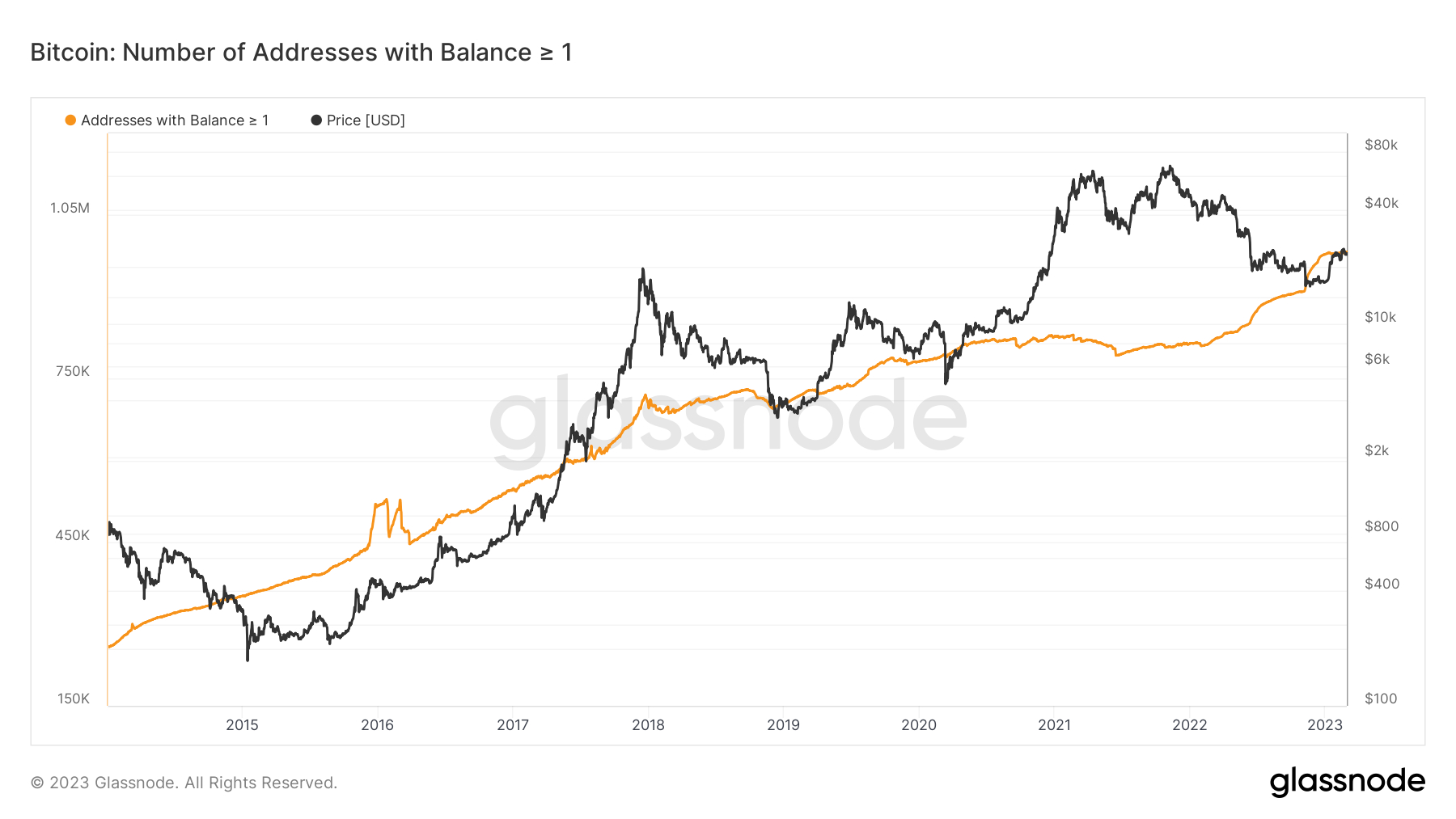

According to data presented by crypto analytics firm Glassnode, there were slightly more than 800,000 Bitcoin wallets with a balance of at least 1 BTC when Bitcoin hit its record highs at $69,000 in November 2021.

FTX Collapse Accelerates Trend Towards Self-Custody, High Conviction Retail Investor Dip Buying

Despite the aggressive price drop over the course of the last 15 or so months, that number has skyrocketed to over 980,000. A big part of that jump came after the untimely collapse of formerly one of the world’s largest cryptocurrency exchanges FTX, which resulted in customers losing access to billions worth of crypto deposits.

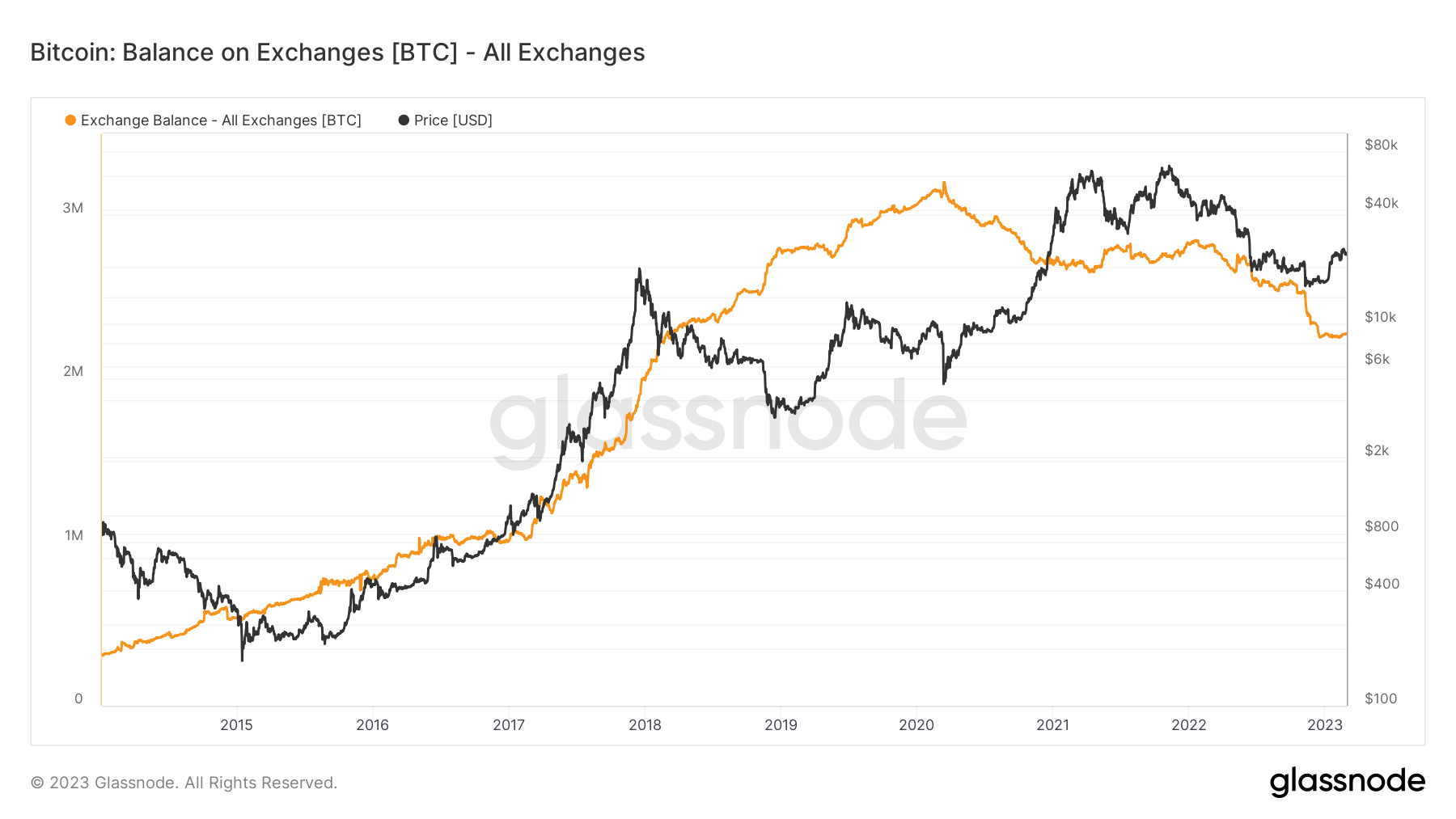

The FTX collapse dealt a severe blow crypto investor confidence in depositing their assets in centralized entities, hence the rapid shift towards crypto self-custody. The number of BTC held by exchanges is currently around 2.275 million, down from 2.53 million prior to FTX’s withdrawal halt.

But the FTX collapse only served to accelerate a trend that was already underway. High-conviction retail investors have clearly used the 2022 bear market as an opportunity to own at least 1 BTC for the first time. In other words, this cohort of investors has clearly also been buying the dip. And if the current pace of growth in the number of wallets owning at least 1 BTC continues, it is likely to hit the 1 million mark within a few months.

How Could This Impact the BTC Price?

2022 demonstrates that growth in the number of Bitcoin wallets with a balance of at least 1 BTC does not necessarily go hand in hand with upside in the BTC price. In fact, recent history suggests that the number of wallets with at least 1 BTC is more likely to hit one million if Bitcoin’s price falls from current levels in the $20Ks, rather than if it continues to steadily grind higher.

That’s because, since Bitcoin’s sharp price surge since the beginning of the year, the number of 1 BTC holding wallets has pretty much stagnated. Clearly, investors in this cohort have been tempted by the market recovery to release (some of) their coins to newcomers. Indeed, the number of non-zero balance wallet addresses hit a new record high in mid-February above 44.2 million.

Continued temptation by this cohort to release coins to smaller wallets as the BTC price rises could be interpreted as bearish, or at least a headwind to the price. But assuming that the cohort of investors who own at least 1 BTC are dominated by investors with a “HODLer” mentality, that might not be a bad thing for the Bitcoin price.

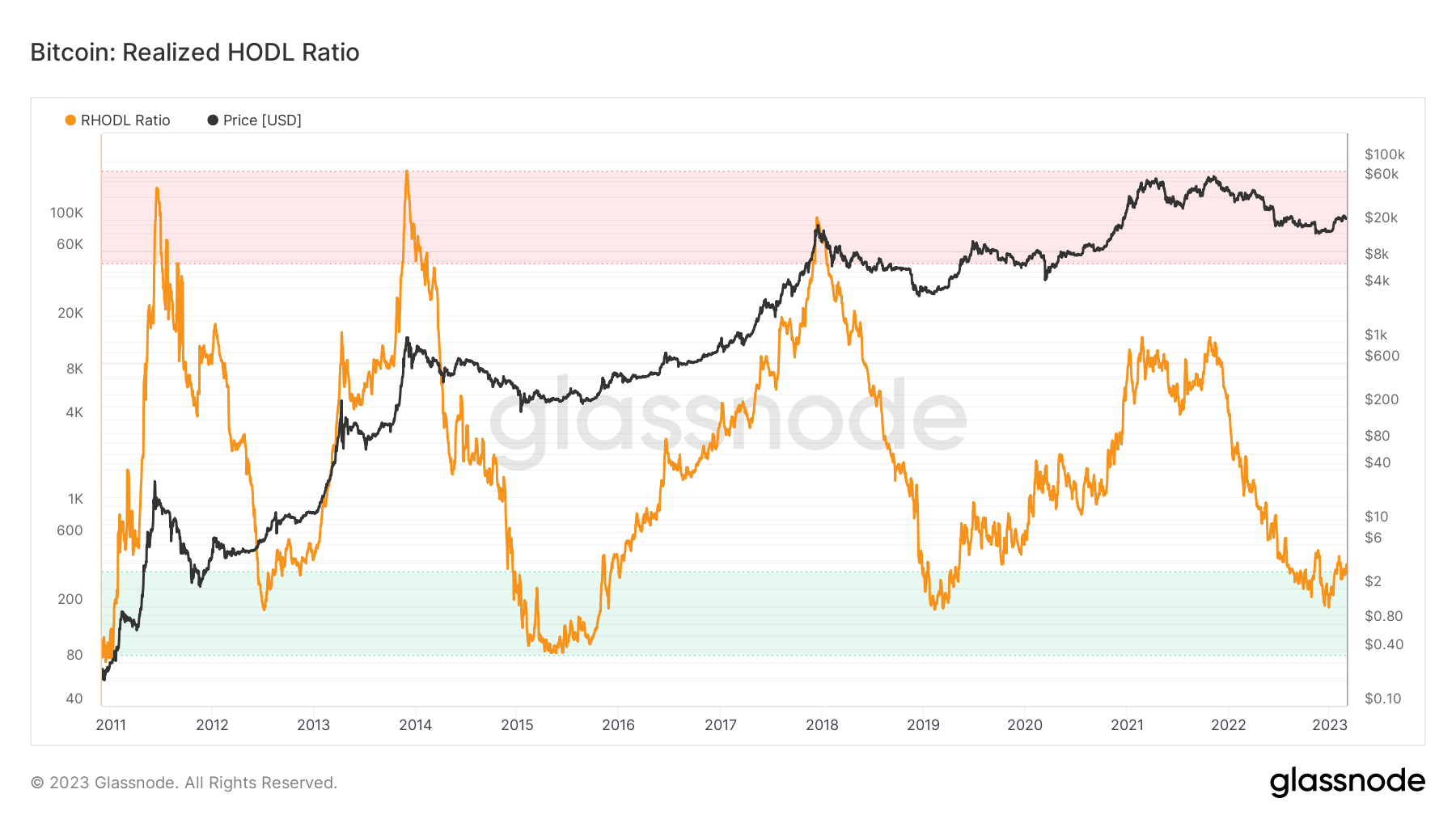

That’s because, according to Glassnode’s popular Realized HODL (RHODL) Ratio indicator, when HODLers start releasing coins after a prolonged period of accumulation amid following a bear market, this can often be taken as a bullish sign. Glassnode’s RHODL multiple takes the ratio between the realized market capitalization of coins that last moved under a week ago versus 1-2 years ago.

The RHODL Ratio is in the process of bottoming after reaching historically low levels that have, in the past, been consistent with bear market bottoms.

Credit: Source link