___

___

- North America and Russia will continue seeing their share of Bitcoin mining increase in 2022.

- “There will be both consolidation and new entrants, but there will be more consolidation than new entrants.”

- Compared to 2021, mining regulation will seem a little more moderate and evenhanded in 2022.

2021 has been a stellar year for crypto, which must also mean it’s been a stellar year for miners. And to a large extent, it was, with miners pocketing USD 3bn in revenues from Bitcoin (BTC) mining in the month of April alone.

But while transaction fees paid to BTC miners increased by over 750% year-on-year in the second quarter of the year, it doesn’t tell the whole story when it comes to crypto mining in 2021. It also doesn’t tell the whole story when it comes to mining in 2022.

Because while industry figures generally agree that miners will continue reaping significant revenues this year, they also report an expectation that competition will heat up in the sector. This will result in more companies — including energy companies — entering the market, as well as more investment in newer mining technologies.

Changing geographical focus

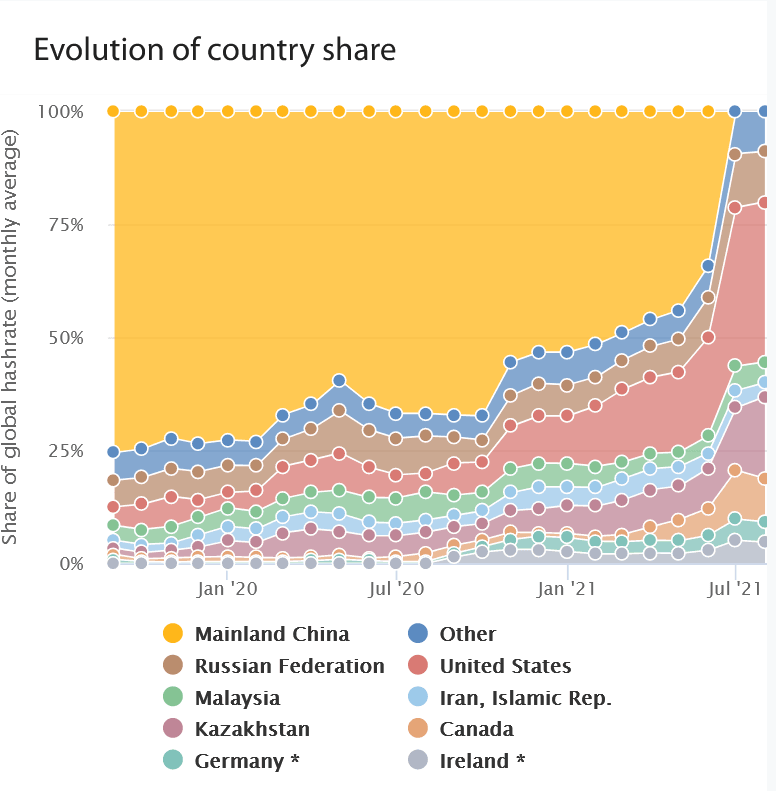

One of the biggest trends of 2021 was that the geographical locus of crypto mining shifted from China – which had long accounted for over two thirds of Bitcoin’s hashrate at one point – to elsewhere in the world. This is going to be a big theme once again in 2022, with two nations, in particular, competing for dominance.

“While both North America and Russia have clear regulations for mining compared with other countries, North America, with better access to capital markets, will continue to account for a majority of the global hashrate. But we believe Russia — with a high surplus hydropower capacity for mining — will emerge as the top international destination for sustainable mining,” said Igor Runets, CEO of BitRiver, a Russia-based colocation service provider for renewables-based crypto mining.

Other figures within the mining sector agree that North America (Canada and the US) and Russia will continue seeing their share of (Bitcoin) mining increase in 2022, even if they differ on which of these two will predominate.

“North America will continue to see a high concentration of miners. The fact that Foundry’s USA pool is now the largest pool in the world is more than enough evidence to suggest that this shift will endure,” said Zach Bradford, the CEO at Nasdaq-listed Bitcoin mining firm CleanSpark.

However, Bradford adds that other regions and countries — particularly those with large hydro and geothermal resources — could witness increases in mining share in 2022. This process will be accelerated by miners looking to identify locations with cheaper and greener energy.

“El Salvador is, of course, headed in that direction. Russia is another country that is probably underappreciated for its mining potential,” he told Cryptonews.com, adding that Russia’s increasing importance to mining will depend on how the Russian government responds via regulations and tariffs.

Share of global Bitcoin hashrate (monthly average)

Indeed, the Cambridge Centre for Alternative Finance’s latest data (running up to August 2021) shows that a number of smaller nations — such as Kazakhstan, Malaysia, and Iran — are increasing their share of Bitcoin mining, in addition to states such as the US, Russia, and Canada.

Turning specifically to the US, BIT Mining Vice President Danni Zheng notes that states which take the lead in introducing favorable crypto laws will be successful in attracting more of the hashrate of Bitcoin and other cryptoassets.

“As a result of their prior experience, we believe that miners will continue relocating to places, like Ohio and Texas, that have a friendlier regulatory environment and climate conditions that are beneficial for mining. Additionally, the fact that New York City and Miami’s mayors are both vocal proponents of cryptocurrency will likely drive miners to those regions in the future, especially if they enact forward-looking policies to attract the mining industry,” she told Cryptonews.com.

Consolidation, Competition, and Technologies

One thing that commenters seem to agree on is that, after the Chinese crackdown on mining and the emergence of new mining centers in 2021, 2022 will witness a fair amount of consolidation.

“There will be both consolidation and new entrants, but there will be more consolidation than new entrants. Bitcoin mining is very capital intensive and as such is less prone to typical disruption,” said Zach Bradford.

Bradford explains that Bitcoin mining now represents critical infrastructure, with this infrastructure requiring a significant amount of resources and investment for its maintenance. As such, the sector will inevitably witness some degree of consolidation as its regulatory environment settles.

“We believe that we’ll see some consolidation this year with larger, more established miners purchasing newer entrants that may have access to abundant energy but lack the capital to buy and host mining rigs,” he told Cryptonews.com.

Danni Zheng also expects more consolidation than new entrants this year, with the resource-intensiveness of mining being one of the reasons she highlights for this.

“With the global hash rate increasing 20% over the course of the year according to data on BTC.com, we anticipate that the number of new market entrants will decrease in 2022 after the rapid boom the industry experienced in 2021. We expect that many inexperienced mining companies will be forced to adjust their plans during the trial-and-error phase as they figure out proper resource allocation and how to optimize the efficiency of their data centers,” she said.

However, while there will be some degree of consolidation, competition between bigger mining enterprises will heat up this year, something which will drive technological innovation within the sector. This is something that will be further accelerated by the entrance of energy companies, whose control over energy resources will lead them towards a transition into mining.

“I believe that we will continue to see more companies, especially those from the energy sector, enter the mining industry in 2022. This also means that the competition among miners will continue to get more intense, and that the companies with the most flexible, innovative, and sustainable mining operations will lead the competition,” said Igor Runets.

The CEO adds that he expects mining operations to exhibit an increased focus on newer technologies — such as immersion-cooling — that can make operations more efficient and profitable. Likewise, Zach Bradford says that the emergence of US-based manufacturers of mining equipment will “drive greater technological change in the sector.”

Regulation becomes more constructive

Compared to 2021, mining regulation will seem a little more moderate and evenhanded in 2022, particularly with China now out of the equation.

“With China’s exit, I do not think that regulations will have a bigger impact on the mining industry in 2022 than they had in 2021. Governments in the USA and Russia — the countries that account for most of the world’s Bitcoin mining now — encourage sustainable Bitcoin mining as a way to strengthen energy generation infrastructure and drive economic growth in otherwise underdeveloped areas,” said Igor Runets.

Still, even if 2022 is likely to be kinder to miners on the regulation front, some industry participants expect the New Year to bring a mix of favorable and unfavorable laws.

“Some of it will be good, providing the kind of guardrails the industry needs to continue to be successful. Some of it will be like China’s and be detrimental to miners in those countries, but perhaps a boon to miners located in other parts of the world,” said Zach Bradford.

While Bradford’s comment might suggest that there will be just as much restrictive as permissive mining regulation in 2022, he is generally hopeful that the overall picture will be positive. This is in part because Bitcoin, crypto, and mining will have grown so large by that point that it would be futile for most regulators to try to stamp them out.

“The year 2022 will be a watershed moment in the mass adoption of Bitcoin and there will be resistance. But that resistance is a last gasp,” he concluded.

___

Learn more:

– BTC Mining Migration, Challenges & Forecasts for the Post-crackdown Industry

– Dominated by Institutions, Bitcoin Mining is also Possible from Home

– How Bitcoin Mining Might Help Nations With Domestic Energy Production

– NFTs in 2022: From Word of the Year to Mainstream Adoption & New Use Cases

– Bitcoin and Ethereum Price Predictions for 2022

– Crypto Adoption in 2022: What to Expect?

– 2022 Crypto Regulation Trends: Focus on DeFi, Stablecoins, NFTs, and More

– DeFi Trends in 2022: Growing Interest, Regulation & New Roles for DAOs, DEXes, NFTs, and Gaming

– Crypto Security in 2022: Prepare for More DeFi Hacks, Exchange Outages, and Noob Mistakes

– How Global Economy Might Affect Bitcoin, Ethereum, and Crypto in 2022

– Crypto Exchanges in 2022: More Services, More Compliance, and Competition

– Crypto Investment Trends in 2022: Brace for More Institutions and Meme Manias

Find more predictions for 2022 here.

Credit: Source link