- Australia gears up to join the global trend with potential ASX listings of crypto ETFs from Van Eck and BetaShares by late 2024.

- Despite lower success rates and AUM in the APAC region, Australia’s large superannuation balance could significantly impact these ETFs.

- Hong Kong is launching its own Bitcoin and Ethereum spot ETFs, with hopes to surpass US performance amid regional challenges.

Amid the flurry of excitement surrounding US Spot Bitcoin exchange-traded funds (ETFs) and the imminent launch of Hong Kong Spot BTC and Ethereum ETFs, Australia appears next in line for crypto ETFs.

Related: MicroStrategy Reports Operating Loss Amid Bitcoin Holding Impairment, Adds New BTC to Stack

As per a report by Bloomberg, issuers including Van Eck Associates and BetaShares Holdings are among some of the funds poised to soon start trading on the Australian Stock Exchange (ASX).

According to unnamed sources, the ASX is on track to approve these ETFs before the end of 2024.

The news comes at a time when Hong Kong is ready to launch its first versions of Ethereum and Bitcoin spot ETFs. Some hope these funds are going to outpace their US counterparts – although historical data for future ETFs show these products are less successful in Asia than the US.

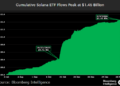

Additionally, the Asia-Pacific region lags behind in assets under management (AUM) compared to other regions as the below Bloomberg graphic shows.

Aussie Super To Boost ETFs?

However, Australians have large amounts of money in their superannuation funds. According to Deloitte, which cites figures from June 2023, there are AU$3.2 trillion in super assets. Therefore, even a small amount invested in these ETFs could have a big impact. Then again, likely only self-managed super funds will be able to invest in these funds.

However, Australian investors have already had access to Spot Bitcoin ETFs through Cboe Australia, previously Chi-X, rather than the ASX, which offers broader market share and options.

Despite the hype over US Bitcoin ETFs, products like Global X’s 21Shares Bitcoin and Ethereum ETFs were already available on Cboe. Meanwhile, Cosmos Asset Management delisted its fund due to poor reception.

Get the most important crypto news delivered to your inbox by subscribing to the CNA newsletter

Credit: Source link