The end may finally be in sight for creditors of the infamous Mt. Gox heist. Authorities were only able to recover an estimated 150,000 of the 850,000 stolen BTC. Creditors, forced to HODL through multiple cycles have seen their stash soar in value, and now need to decide whether to take their respective proceeds in Bitcoin, Bitcoin Cash or US dollars.

Mt. Gox Recap

Mt. Gox was originally founded in 2006 as an exchange to trade “Magic: The Gathering Online” cards, hence the acronym MTGOX. In 2010, it transformed into a Bitcoin exchange to provide an easy platform for users to buy and sell BTC.

At one stage, it handled over 70 percent of all bitcoin transactions globally, however through a combination of ignorance, naivety and security mismanagement, around 850,000 BTC were stolen between 2011 and 2013, the vast majority belonging to its customers.

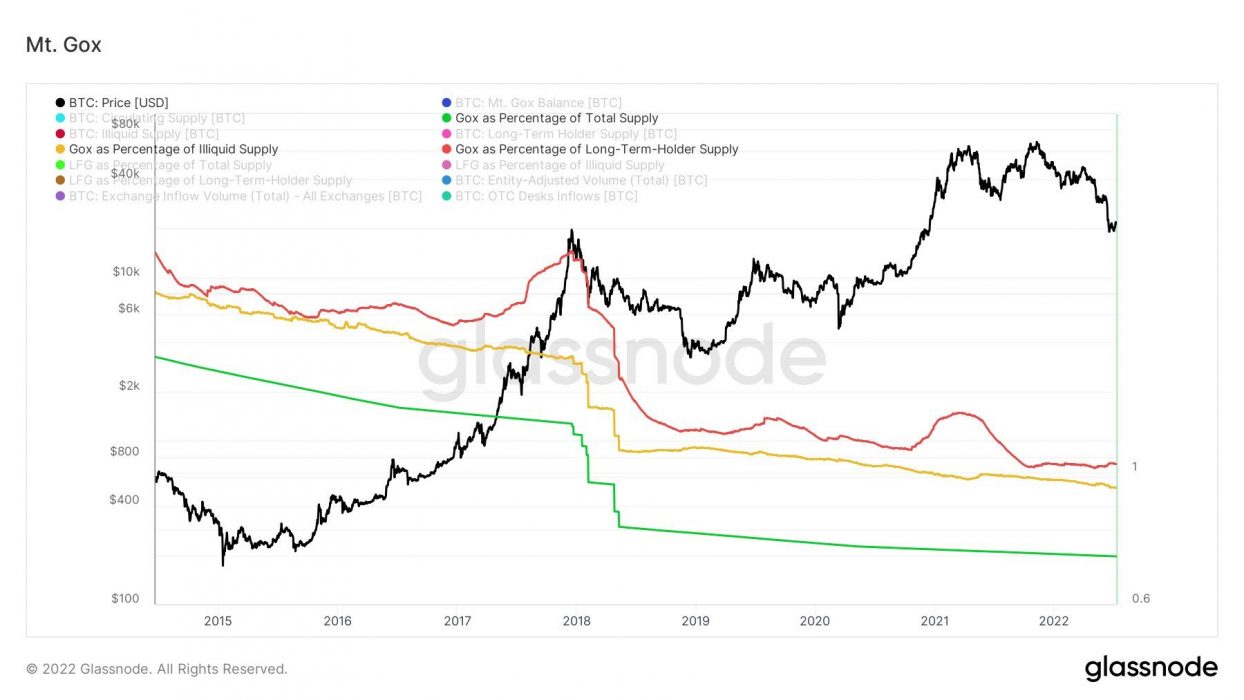

According to blockchain analytics firm Glassnode, the Mt. Gox stash represents 0.72 percent of total supply and 1.03 percent of long-term-holder supply:

For a compelling account of the entire saga, crypto analyst Miles Deutscher’s Twitter thread is well worth reading:

The End is Nigh

In October last year, the rehabilitation trustee for Mt. Gox released a formal rehabilitation plan to which 99 percent of creditors agreed. Although planned distribution of the proceeds has been somewhat delayed, an email sent by Mt. Gox trustee Nobuaki Kobayashi indicates that creditors now have an important decision.

According to Kobayashi, “rehabilitation creditors” have the following choices at their disposal:

Twitter users joked that Bitcoin Cash was even an option:

Impact on Price Action?

Given that bitcoin is 35 times higher than it was at the time of the hack, some have argued that it would be “realistic” to expect a flood of BTC sold, resulting in further price capitulation. Others have argued the opposite, suggesting that those who bought in early are likely to have had their conviction strengthened over the years, and probably wouldn’t sell into a bear market.

Time will tell how things play out, though as Ark Invest analyst David Puell notes, 2022 has thrown the proverbial kitchen sink at Bitcoin.

If Bitcoin navigates this period as proponents expect, it is likely to emerge stronger and more antifragile on the other end:

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link