- MicroStrategy chairman Michael Saylor advocates for companies to abandon traditional bonds in favour of Bitcoin, which he frames as “digital capital” for forward-thinking enterprises.

- During an Orlando conference, Saylor criticised major tech companies like Microsoft and Nvidia for not adopting Bitcoin, comparing their approach to building with wood rather than steel.

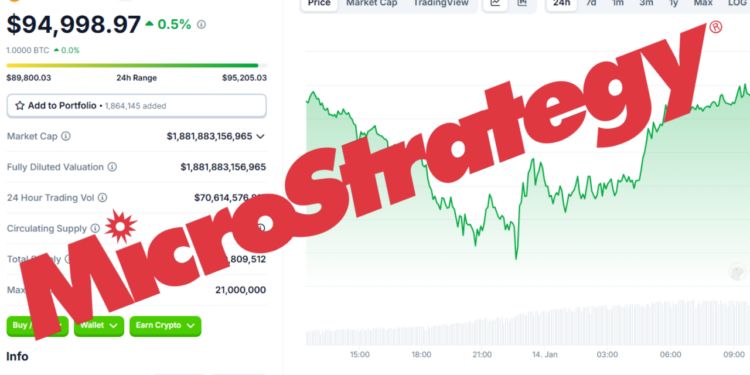

- MicroStrategy recently purchased an additional 2,530 Bitcoin for US$243 million, bringing their total holdings to 450,000 BTC at an average price of US$62,691 per coin.

- The firm’s Bitcoin holdings now rival major institutional investors, approaching 2.5% of total Bitcoin supply, while states like North Dakota and New Hampshire consider following their strategy.

According to Michael Saylor, the co-founder and chairman of MicroStrategy (MSTR), companies would be well advised to buy Bitcoin instead of what he calls toxic bonds.

Saylor made the comments during a conference in Orlando as Bloomberg reported on Monday. He compared the performance of bonds to that of BTC since MSTR has been adding the OG crypto to its portfolio in 2020.

Bitcoin as a Steel Framework

Saylor noted that bonds have declined in value while Bitcoin has gone up since.

It works for any company. Every company has a choice to make: Cling to the past, or embrace the future.

Michael Saylor

Michael SaylorThe chairman explained that any forward-thinking company should be adding Bitcoin as “digital capital”, rather than treasury bonds.

Related: Swissblock Analysts Say Bitcoin Positioned to Weather Upcoming Market Turbulence

Saylor took a swipe at Microsoft and Nvidia who have so far not followed his approach. He pitched Bitcoin as a treasury asset during a recent Microsoft shareholder meeting, but the majority voted against the move.

He also claimed that adding BTC to a corporate portfolio would set up the company with a much more solid foundation.

We’re the people building with steel and they’re building with wood.

Michael Saylor

Michael SaylorMSTR Adds More BTC

The comments come as MSTR has made another move which will surprise precisely no one. For what is the umpteenth time in a row, the company bought more Bitcoin on a Monday.

The Tysons Corner, Virginia-based firm bought another 2,530 Bitcoin for US$243 million (AU$392.8 million) or US$95,972 (AU$155,155) per coin.

MicroStrategy now holds 450,000 BTC, purchased for US$28.2 billion (AU$45.6 billion) at a price of US$62,691 (AU$101,341) per coin.

That’s a lot of Bitcoin the company is holding, for reference, the largest US Spot Bitcoin exchange-traded fund (ETF), BlackRock’s IBIT, holds around 555,948 Bitcoin.

That makes Saylor’s firm one of the largest corporate holders, nearing a 2.5% stake in the digital asset.

Related: Polymarket Banned in Singapore in Illegal Online Gambling Crackdown

Slowly, but surely, other companies and even nation states are taking a leaf out of Saylor’s playbook and start adding Bitcoin to their treasuries.

Recently, North Dakota and New Hampshire have started contemplating whether they should include digital assets into their state’s portfolio.

Credit: Source link