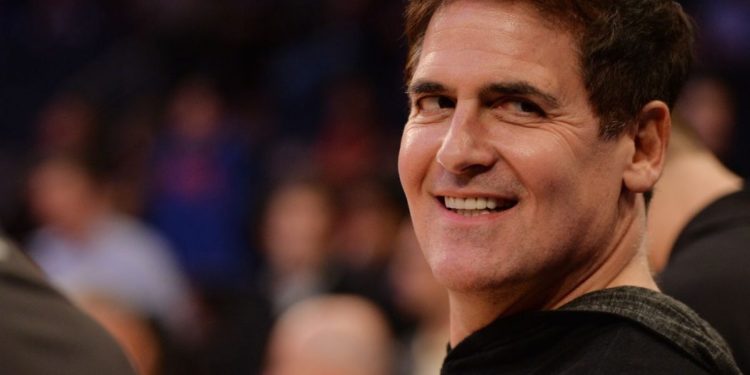

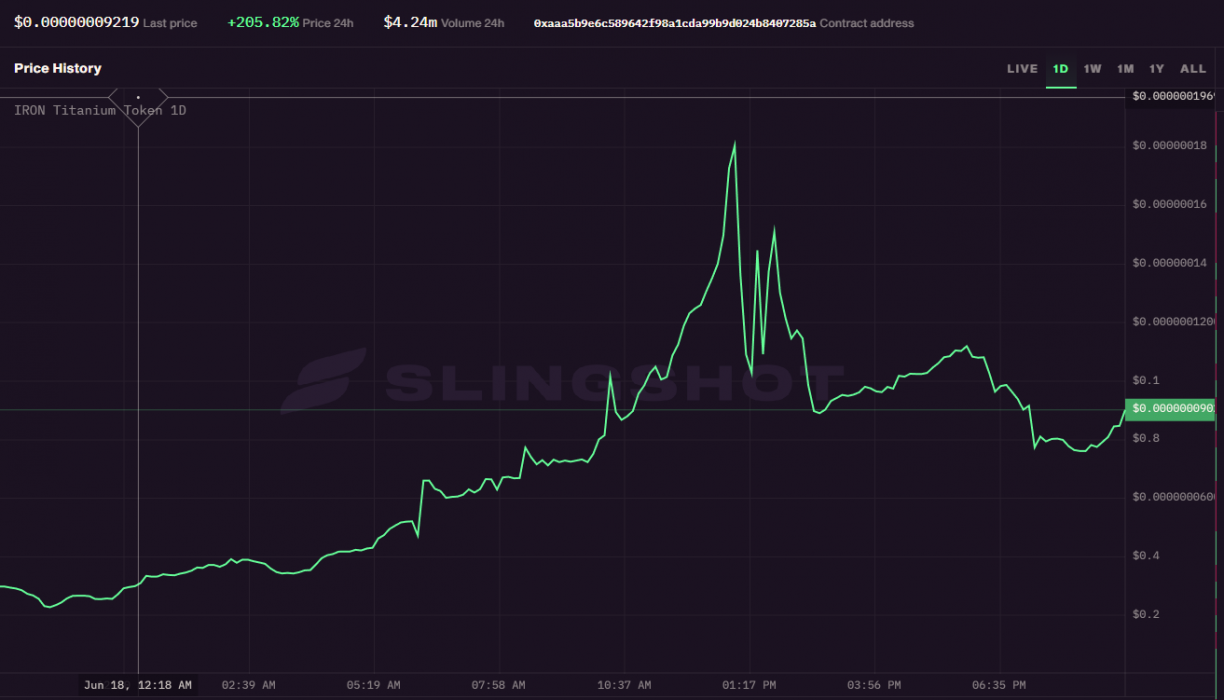

A DeFi token called TITAN has dropped to almost zero in price after suffering a bank run this week, plunging from US$65 to 0.00000003. Mark Cuban, who was staking liquidity for the token, is now asking for stablecoin regulation after losing a “small percentage” of his portfolio in the crash.

The TITAN token is part of a Stablecoin project called Iron Finance. According to the post-mortem released by the protocol, around 10am UTC on June 16, large holders began to sell, which triggered other holders to follow suit.

What we just experienced is the worst thing that could happen to the protocol, a historical bank run in the modern high-tech crypto space.

Iron Finance report

Cuban Calls for DeFi Regulation

Following the bank run, Cuban told Bloomberg there should be rules to determine what is a stablecoin and what level of collateralisation is acceptable. He added that part of his loss was his fault:

It is no different from the risk I take in angel investing […] The thing about DeFi is that it is all about revenue and math, and I was too lazy to do the math to determine what the key metrics were.

Mark Cuban

DeFi a Dangerous Space for Newcomers

It’s highly unlikely that regulations in the DeFi space occur as it would totally flip the idea of decentralised. However, it is a dangerous space for newcomers, especially those with a lot of capital to invest.

Many traders have lost substantial amounts of money due to mistakes such as sending funds to the incorrect address, like the DeFi trader who lost US$188,000, or being a victim of a rug pull or a hack, which have become increasingly common in the space.

One of the latest protocols to be hacked was DeFi100, which lost US$32 million in an alleged hack. However, rumours circulate that the project rug-pulled its investors.

With a Total Value Locked of over US$60 billion, more and more investors are exploring the DeFi world to take a chunk out of the high returns. However, new traders should educate themselves first and consider the risks of investing in DeFi.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link