Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Decentraland (MANA)

Decentraland MANA defines itself as a virtual reality platform powered by the Ethereum blockchain that allows users to create, experience, and monetize content and applications. Decentraland uses two tokens: MANA and LAND. MANA is an ERC-20 token that must be burned to acquire non-fungible ERC-721 LAND tokens. MANA tokens can also be used to pay for a range of avatars, wearables, names, and more on the Decentraland marketplace.

MANA Price Analysis

At the time of writing, MANA is ranked the 70th cryptocurrency globally and the current price is A$1.28. Let’s take a look at the chart below for price analysis:

After dropping nearly 70% in May, MANA found a low just above the monthly gap near A$0.9541. Since then, the price has been consolidating in a range between A$1.35 and A$1.15.

The weekly level near A$1.22 may continue to provide support during a run on the local swing lows. The monthly gap beginning near A$1.06 will likely give the next higher-timeframe support if this level fails.

The price is currently chewing into potentially strong resistance near A$1.32. A sweep of the relatively equal highs near A$1.38, and a daily close above this level, could signal a move to the next set of relatively equal highs near A$1.45.

Just above these highs, probable resistance rests near A$1.53, which may cap the price until the market moves out of consolidation. However, any significant bullish shift in market conditions during the next few weeks could help bulls reach the swing high near A$1.59, running stops into probable resistance near A$1.67.

2. VeChain (VET)

VeChain VET is a blockchain-powered supply chain platform. Begun in 2015 and launched in June 2016, VeChain aims to use distributed governance and Internet of Things (IoT) technology to create an ecosystem that solves some of the major problems with supply chain management. The platform uses two in-house tokens, VET and VTHO, to manage and create value based on its VeChainThor public blockchain. The idea is to boost the efficiency, traceability, and transparency of supply chains while reducing costs and placing more control in the hands of individual users.

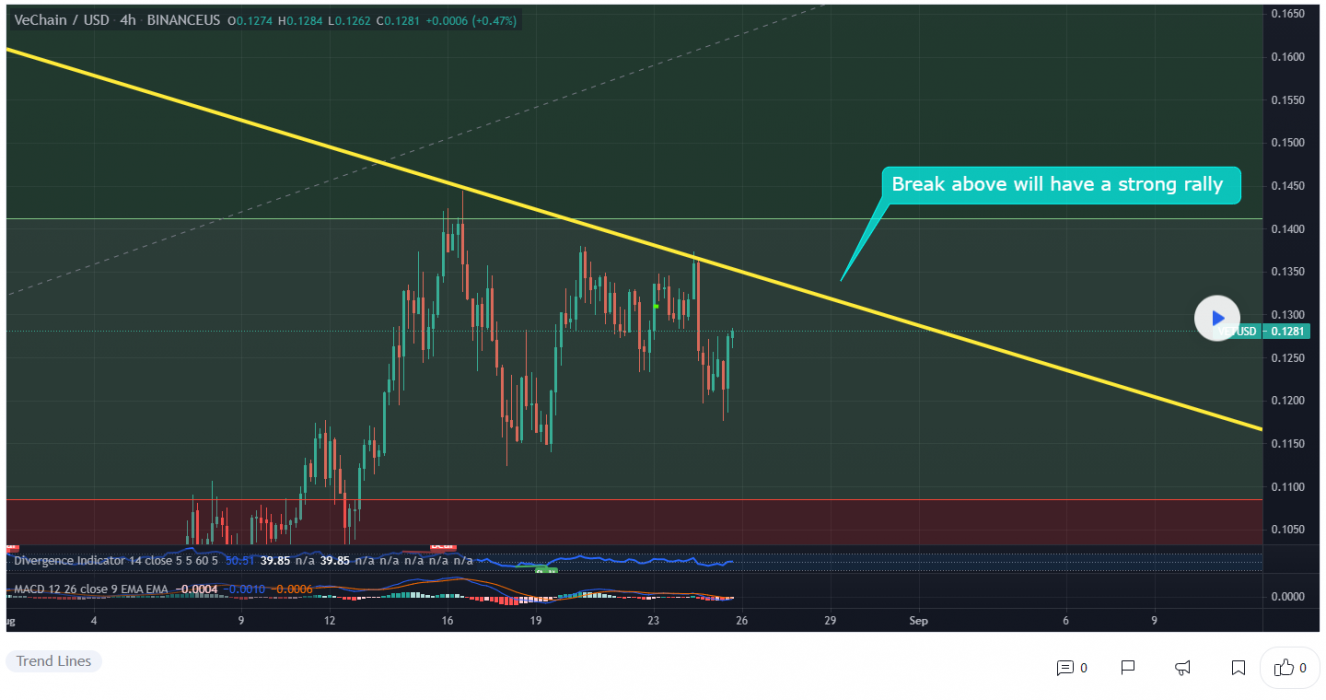

VET Price Analysis

At the time of writing, VET is ranked the 24th cryptocurrency globally and the current price is A$0.1772. Let’s take a look at the chart below for price analysis:

VET accompanied the rest of the market in the mid-Q2 drop, falling nearly 83% from its May high until it found a low late in June.

Price action in late June formed a weekly support level near A$0.1126, which has so far held up the price. The most recent swing low inside this range, near A$0.1573, might be the target for any future stop runs. After this low, the swing low near A$0.1612 and the gap beginning near A$0.1688 marks possible higher-timeframe support.

The price is currently battling with significant higher-timeframe resistance levels, with the closest probable resistance resting near A$0.1879, just over the June monthly open. A sweep of the relatively equal highs above this resistance might find sellers near A$0.2056 – but could reach as high as A$0.2385.

3. Zcash (ZEC)

Zcash ZEC is a decentralized cryptocurrency focused on privacy and anonymity. It uses the zk-SNARK zero-knowledge proof technology that allows nodes on the network to verify transactions without revealing any sensitive information about those transactions. Zcash transactions, on the other hand, still have to be relayed via a public blockchain, but unlike pseudonymous cryptocurrencies, ZEC transactions by default do not reveal the sending and receiving addresses or the amount being sent. There is an option, however, to reveal this data for the purposes of auditing or regulatory compliance.

ZEC Price Analysis

At the time of writing, ZEC is ranked the 64th cryptocurrency globally and the current price is A$224.36. Let’s take a look at the chart below for price analysis:

ZEC has been trading through a massive range since July, with the price showing mild bullishness during August.

The breaks of the swing highs at A$237 and A$240 led to support forming near A$225. Some bulls will likely wait for a more favorable entry on a potential stop run that could reach near A$221.

If the support near A$230 continues to hold, the recent swing high at A$240 is likely the next short-term target. This potential bullish swing might end with a run on short stops up to A$269 and A$282.

Higher-timeframe resistance between A$295 and A$312 may cap any move upwards until the overall market becomes more bullish. However, any significant bearish move in Bitcoin will likely push the price down toward the low and possible support near A$215.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link