To the surprise of many, Malaysia’s Deputy Minister of Communications and Multimedia has broken ranks and called for bitcoin and other cryptocurrencies to be adopted as legal tender in the South-East Asian nation.

Mixed Messages?

A few short weeks ago, Malaysia’s Deputy Finance Minister indicated that digital assets “do not exhibit characteristics of money” and were therefore not suitable as a method of payment.

Now, the country’s Communications and Multimedia Ministry, which oversees the digital and technology sectors, has called for the government to allow cryptocurrencies as legal tender:

We hope the government can allow this.

Zahidi Zainul Abidin, Deputy Minister, Communications and Multimedia

While financial regulation falls under the Finance Ministry, the Ministry of Housing and Local Government also has jurisdiction over “digital financial activities”, according to Zahidi.

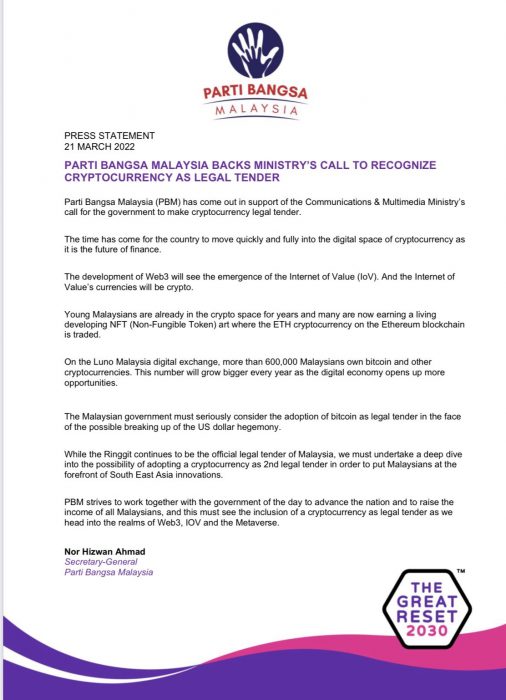

Interestingly, an opposition party known for its progressive politics has backed the Ministry’s call to declare cryptocurrencies as legal tender:

An ‘El Salvador Moment’ Unlikely

Despite positive signs, there are no clear indications that the government will shift its conservative stance towards digital assets.

Last September, the country joined forces with the Bank for International Settlements, Australia, Singapore and South Africa to test the use of central bank digital currencies (CBDCs) for international settlements via a shared platform in a project dubbed Project Dunbar. Then, in January, the central bank confirmed it was exploring CBDCs but has not yet adopted a formal position on the status of digital assets.

It’s been more than six months since El Salvador adopted bitcoin as legal tender and rumours abound that Honduras might be next, with a possible announcement expected within the week.

If there is going to be a nation declaring bitcoin as legal tender, it is likely to be an over-indebted developing nation with little to lose. As a conservative nation in a comparatively strong fiscal position, the incentives for Malaysia to adopt bitcoin at this juncture are probably limited. However, with that said, if we’ve learnt anything over the past two years, anything is possible.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link