Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Litecoin (LTC)

Litecoin LTC is a cryptocurrency designed to provide fast, secure, and low-cost payments by leveraging the unique properties of blockchain technology. The cryptocurrency was created based on the Bitcoin protocol, but it differs in terms of the hashing algorithm used, hard cap, block transaction times, and a few other factors. Litecoin has a block time of just 2.5 minutes and extremely low transaction fees, making it suitable for micro-transactions and point-of-sale payments.

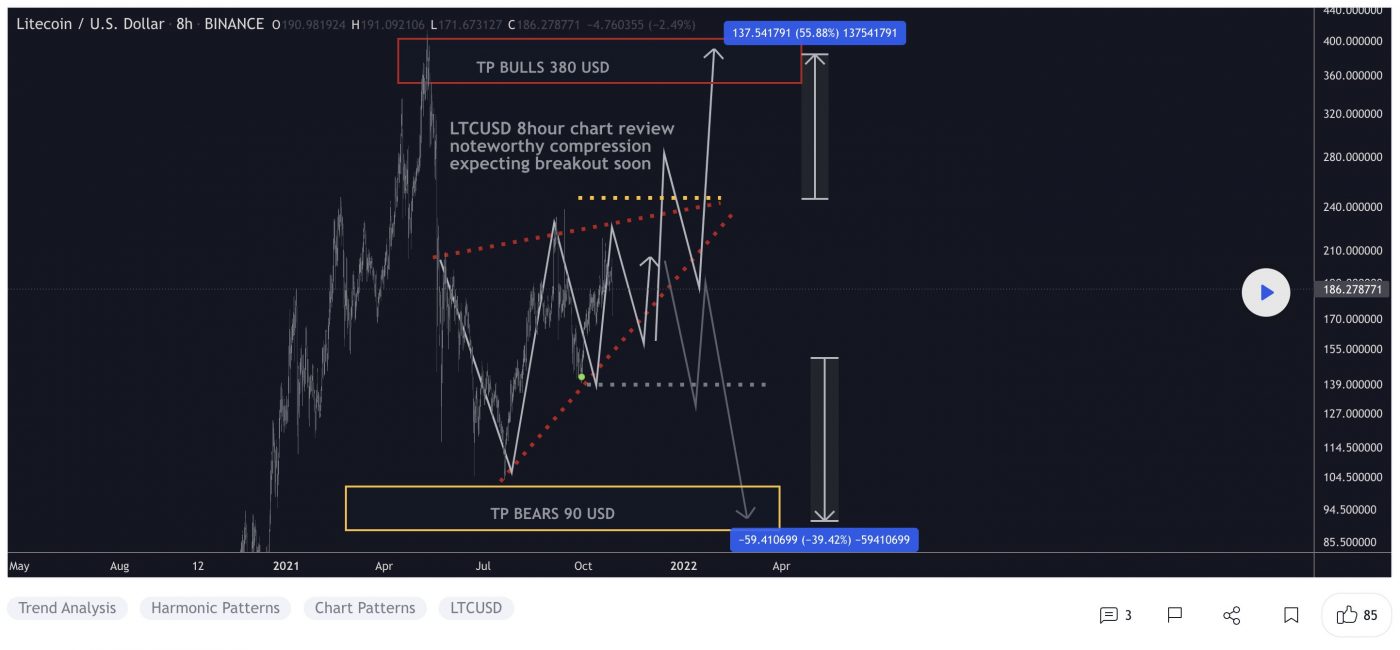

LTC Price Analysis

At the time of writing, LTC is ranked the 19th cryptocurrency globally and the current price is A$250.46. Let’s take a look at the chart below for price analysis:

After setting a low in late July, LTC kicked off a bullish trend that rallied nearly 115% by September to break March’s cycle high.

The following 50% plummet found support near A$225.36, sweeping under the 40 EMA into the 61.8% retracement level before bouncing to resistance beginning at A$220.43.

This area could continue to provide resistance, possibly causing a retracement to the 9 EMA and 18 EMA near A$259.12, where aggressive bulls might begin bidding. The level near A$266.98, which has confluence with the 40 EMA, may see more interest from bulls loading up for an attempt on probable resistance beginning near A$274.05.

However, if Bitcoin continues its downtrend, much lower prices could be seen. The old support near A$215.18 could provide at least a short-term bounce. If this level fails, the old highs near A$208.44 might also give support and see the start of a new bullish cycle.

2. 1inch (1INCH)

1INCH is a decentralised exchange (DEX) aggregator, connecting several DEXes into one platform to allow its users to find the most efficient swapping routes across all platforms. In order for users to find the best price for a swap, they need to look at every exchange – DEX aggregators eliminate the need for manually checking, bringing efficiency to swapping on DEXes. 1inch has launched its 1INCH governance token, and the 1inch Network began to be governed by a decentralised autonomous organisation (DAO).

1INCH Price Analysis

At the time of writing, 1INCH is ranked the 117th cryptocurrency globally and the current price is A$7.01. Let’s take a look at the chart below for price analysis:

After breaking its May highs, 1INCH began a range that has been whiplashing both bulls and bears.

Resistance beginning near A$7.54 has held the price down for the second half of September, although bulls have shown some strength near the 9 and 18 EMAs.

A quick drop to A$7.43, or into the zone beginning near A$7.40, could give bulls the fuel to push through the nearby resistance. If this resistance breaks, the high near A$7.62 provides a reasonable target.

A break of this level could move further into uncharted territory with the nearest probable resistances projected around A$7.68 and A$7.79.

More patient bulls might be waiting far below the 40 EMA with bids near the higher-timeframe range’s 61.8% retracement, near A$6.78.

3. The Sandbox (SAND)

The Sandbox SAND is a blockchain-based virtual world allowing users to create, build, buy and sell digital assets in the form of a game. By combining the powers of decentralised autonomous organisations (DAOs) and non-fungible tokens (NFTs), the Sandbox creates a decentralised platform for a thriving gaming community. The Sandbox employs the powers of blockchain technology by introducing the SAND utility token, which facilitates transactions on the platform.

SAND Price Analysis

At the time of writing, SAND is ranked the 130th cryptocurrency globally and the current price is A$1.19. Let’s take a look at the chart below for price analysis:

Since August’s high, SAND‘s 57% drop marks the current range as a reasonable area to expect accumulation.

The recent bearish flip of the 9, 18 and 40 EMAs might cause bulls to be less aggressive in bidding. However, possible support near A$1.10 and A$1.05 – between the 61.8% and 78.6% retracements – could see at least a short-term bounce.

Long-term consolidation suggests that the areas near A$1.25 and A$1.37 may be more likely to cause a longer-term trend reversal.

Bears are likely to add to their shorts at probable resistance beginning near A$1.14, which has confluence with the 18 EMA. A fast break of this resistance could trigger more selling near A$1.21, the start of the bearish move.

If an aggressive bullish move does appear, trapped buyers in the probable resistance beginning near A$1.29 might provide a ceiling for this impulse.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link