The important long-term holders (LTHs) of both bitcoin (BTC) and ethereum (ETH) are still optimistic about the near-term price moves of the two cryptocurrencies, according to on-chain indicators analyzed by Kraken Intelligence.

Despite hitting all-time highs earlier in November, both BTC and ETH are still far from reaching what has historically been considered “overbought” territory, Kraken’s on-chain digest for November said about the two largest cryptocurrencies.

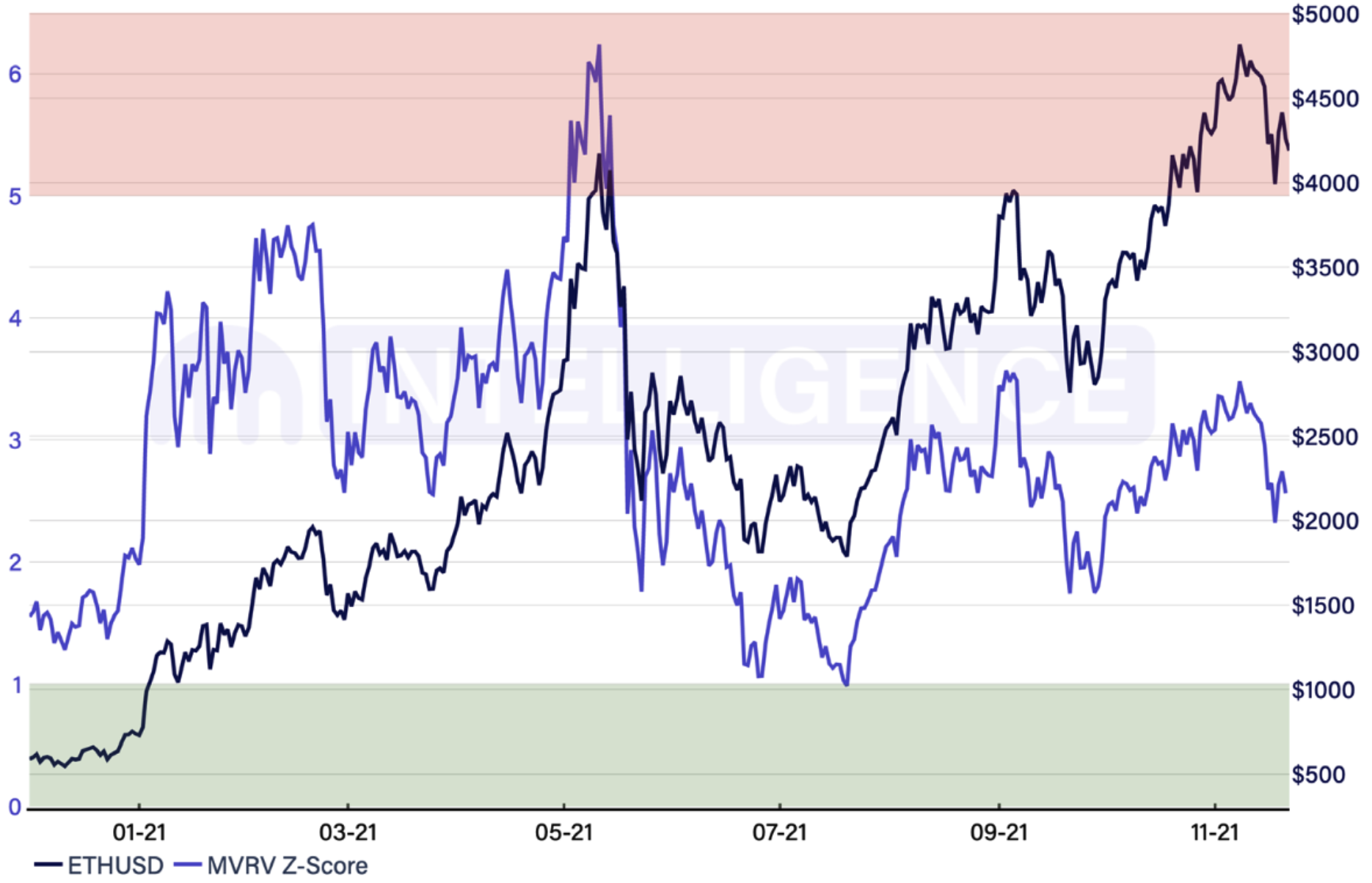

For ETH specifically, the finding that the asset is not yet overbought was reached by looking at the so-called market value to realized value (MVRV) Z-score.

In this formula, the Z-score is a measurement of the difference between a value and a group’s average, measured in standard deviations. Further, the market value (MV) is what we usually call the market capitalization of the asset, while the realized value (RV) is the price of each unit of BTC or ETH when it was last moved multiplied by the number of tokens in circulation.

Analysts typically consider a reading above 5 as “overbought” and a reading below 1 as “oversold.” And according to Kraken’s calculations, ETH’s MVRV Z-score is currently at 2.56 – or about halfway between overbought and oversold levels.

According to the exchange’s team of in-house researchers, this shows that ETH “still has momentum” to rise further from its current price. And not only that, but history also shows that ETH has “significantly more momentum” this time around than it did when it last hit all-time highs in May this year.

Back then, the MVRV Z-score was abut the double of what it is now, Kraken’s report said.

ETH’s MVRV Z-score and price:

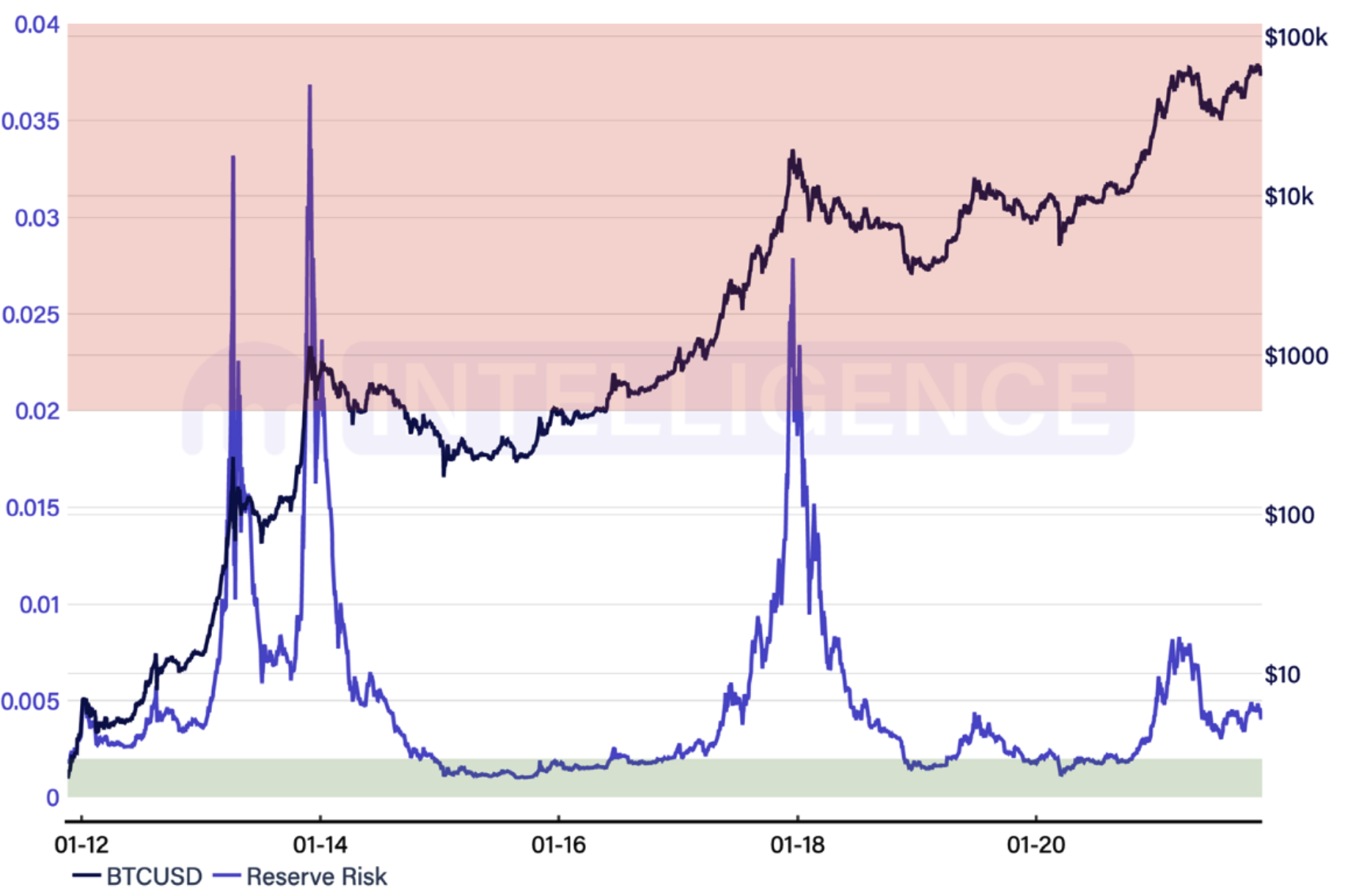

Moving over to bitcoin, Kraken looked at another on-chain metric known as the Reserve Risk and determined that bitcoin also remains well below historically overbought levels.

The Reserve Risk indicator is derived by dividing bitcoin’s price by the so-called “HODL Bank,” a measure of the opportunity cost of holding BTC rather than selling over the lifetime of the bitcoin network. And according to the indicator, bitcoin’s reserve risk is now “significantly below” the level from the last all-time high in May.

Like the MVRV Z-score for ETH, bitcoin’s reserve risk also signals that the price has “room to run higher” before reaching overbought territory, Kraken wrote.

BTC’s reserve risk and price:

In conclusion, the report noted that supply of both BTC and ETH on exchanges are at multi-year lows, which it said suggests that holders have conviction about their positions. However, it also warned that sentiment can change quickly, and that corrections are an inevitable part of the market.

Meanwhile, and on a slightly more bearish note, the on-chain analytics firm Coin Metrics wrote in its latest report that the crypto market may see selling pressure rise.

“Short-term market pressure might be rising due to changing macroeconomic conditions,” the firm wrote, while citing sharply rising US bond yields as one example of this. When the “risk-free” rate that can be obtained from bonds rise, this could negatively impact assets with a higher perceived risk such as crypto, the firm reminded.

At 14:44 UTC on Tuesday, BTC is trading at USD 56,777, down 2.4% over the past 24 hours and nearly 11% over the past seven days. At the same time, ETH is changing hands at USD 4,204, down almost 1% for the day and 8.2% for the week.

____

Learn more:

– Bitcoin Rally Healthy, Less Leverage Than in the Past, Say On-Chain Analysts

– Still Upside Potential in Bitcoin, While ETH Faces Competition – Kraken

– Ethereum Fee Debate Heats Up as Avalanche Enters and Exits Top 10

– BTC, ETH Find Support After Sell-Off, Long-Term Technicals Remain Strong

Credit: Source link