Glassnode analysts are pointing out one historically bullish signal for Bitcoin (BTC) that previously prompted explosive rallies for the top crypto asset by market cap.

Glassnode co-founders Jan Happel and Yann Allemann say that Bitcoin has “crushed” multiple critical resistance levels and is now at a point of strengthening momentum.

The analysts zero in on BTC’s relative strength index (RSI), which is traditionally used to gauge an asset’s momentum.

With Bitcoin’s RSI now above the 70 level, the analysts say that based on history, BTC could be on track for another large move to the upside.

“We analyzed our proprietary regime shift and concluded that we were transitioning from a bearish to a bullish environment. The weekly chart reinforces our view. A long-term bullish trend was confirmed, momentum is building up, and from the looks, it’s only the beginning. Notice how the last time RSI crossed 70, bitcoin exploded.

The RSI is now beginning to be overbought and could stretch higher toward the 100 mark, as it is the norm with bullish markets. In other words, as long as it sustains the uptrend, the BTC price would be inclined to keep the rally intact.”

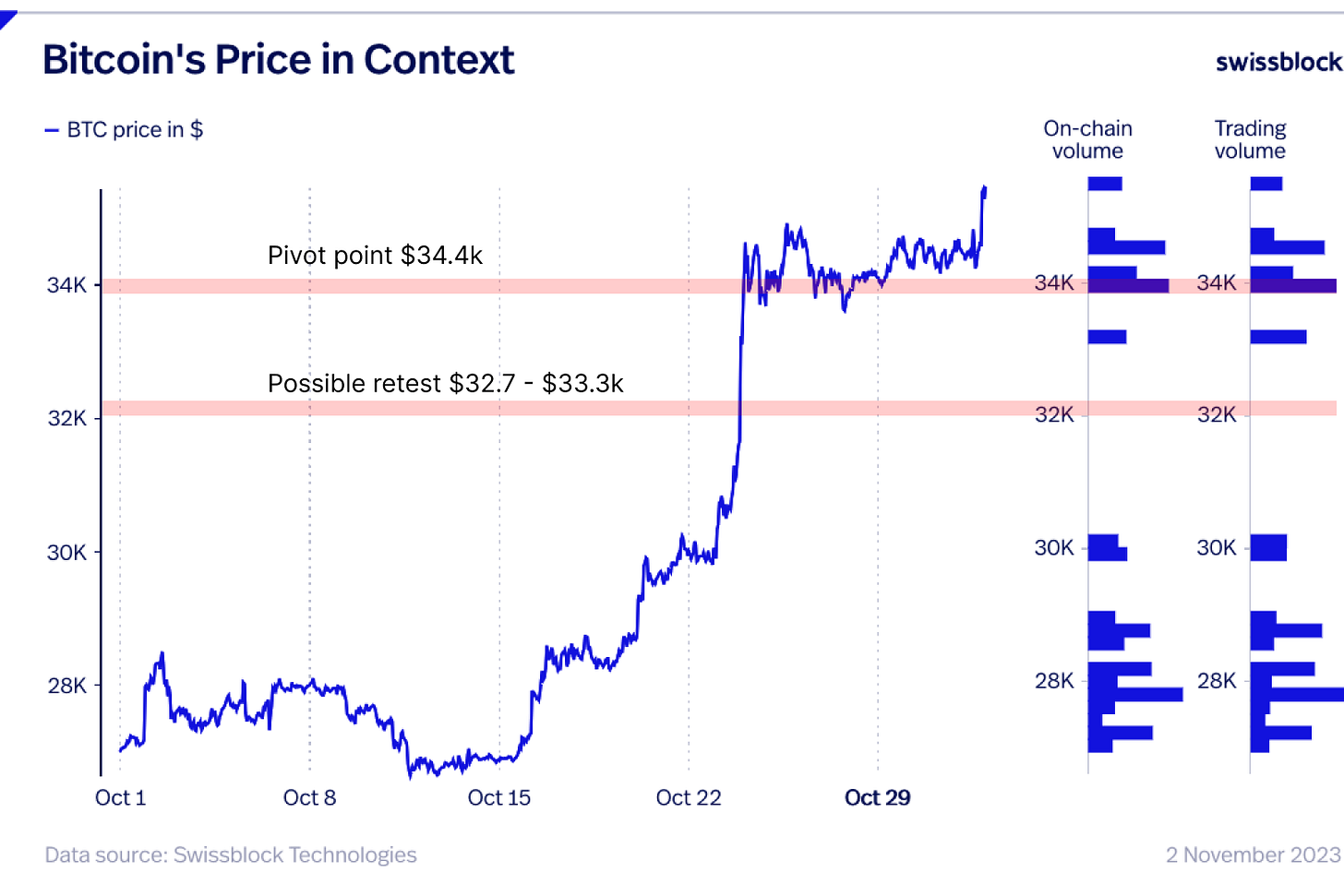

The analysts also warn that BTC is more or less traversing into “uncharted territory” as it begins to flirt with ranges not seen since last year. According to the Glassnode co-founders, BTC may hit the $32,700 level before continuing higher.

“We must remember that nothing moves in an up-only manner, and we’re, in a way, in uncharted territory. Therefore, it’s essential to define the critical ranges to identify attractive entry and exit levels.

Short-term support is forging around $33,700, with a pivot point at $34,400. In the mid-term, however, we could see a retest of the $32,700 – $33,300 level. Remember that volatility is high, so that we could see wicks below our current support levels. The BTC bulls still have a solid near-term technical advantage as a price uptrend is on the daily bar chart.”

At time of writing, Bitcoin is trading for $35,142.

Generated Image: Midjourney

Credit: Source link