US President Joe Biden has signed an executive order calling government agencies to examine the risks and benefits of cryptocurrencies. What are the key insights and reactions from industry players?

Today, @POTUS signed an Executive Order outlining a plan to address risks and harness potential benefits of digital assets, including cryptocurrency, helping America reinforce its leadership in the global financial system and the technological frontier.https://t.co/ERhN3hQek8

— The White House (@WhiteHouse) March 9, 2022

Addressing Risks and Benefits of Digital Assets

Contrary to the fears of some market participants, no direct action will be taken from the order, at least for now. Instead, it lays out a process and series of deadlines for the alphabet soup of government agencies to work together and deliver a report to the president.

Specifically, the executive order covers seven main areas and calls for measures to:

- protect consumers, investors and business;

- protect US financial stability and mitigate systematic risk;

- mitigate the financial and national security risks posed by the illicit use of digital assets;

- promote US leadership in technology and economic competitiveness within the global financial system;

- promote equitable access to safe and affordable financial services;

- support technological advances and ensure responsible development and use of digital assets; and

- explore a US central bank digital currency (CBDC).

Although lacking in detail, the White House noted the order would work “across agencies and with Congress to establish policies that guard against risks and guide responsible innovation”.

Put differently, the administration appears to be making an attempt at striking a regulatory balance between consumer protection and embracing innovation. Or at least appearing to do so.

Mixed Responses to EO

Despite the order lacking any real substance, most seemed to share the sentiments of Jerry Brito, director of Coin Center:

The message I take from this EO is that the federal government sees cryptocurrency as a legitimate, serious, and important part of the economy and society, and I think it’s a good signal to serious people who’ve been holding back from getting involved. The EO also presents another striking contrast with alarmist politicians and media in that it is ultimately a call for further study and deliberate planning, not a reactive rush to legislate or regulate.

Jerry Brito, director, Coin Center

Dave Grimaldi, head of government relations at the American Blockchain Association, agreed with these sentiments:

However, crypto libertarians such as Erik Voorhees regarded the announcement as a series of meaningless platitudes. Or, in his words, “a perfectly political communication”:

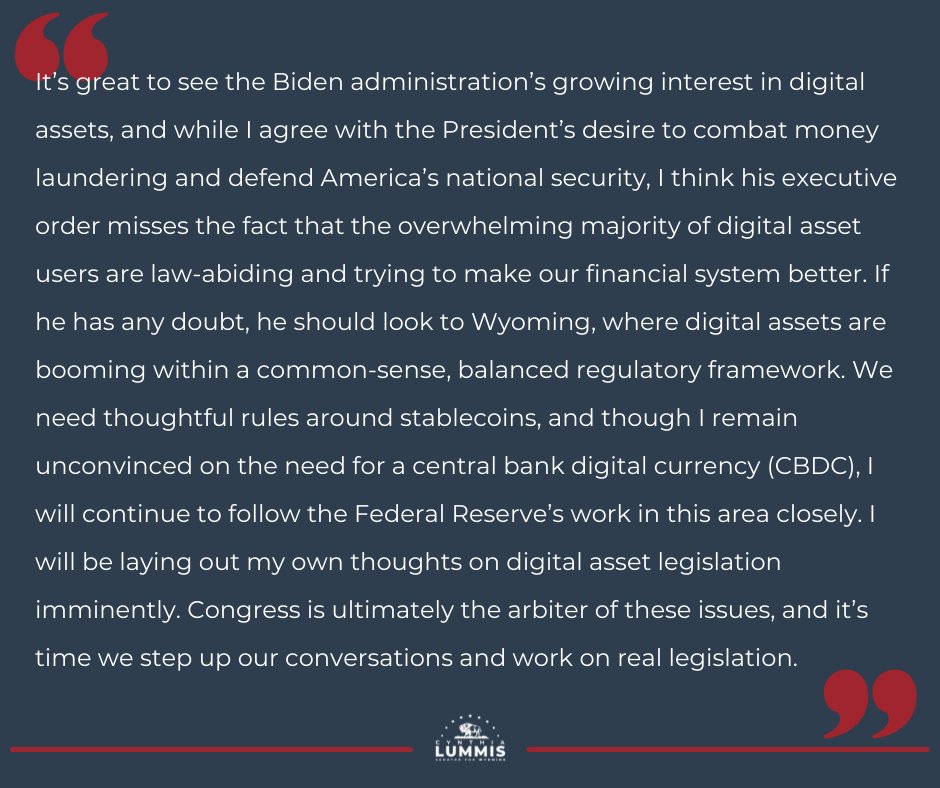

Bitcoin-friendly Senator Cynthia Lummis was equally uninspired, and issued a statement questioning the need for a CBDC:

Conclusions to be Drawn

On a close inspection of the executive order, it’s difficult not to be somewhat cynical, given that it is devoid of any real substance. While it may appease some market participants, it would seem prudent to reserve judgement pending the release of concrete information.

However unpopular, regulation appears to be an inevitable feature of any market on the path towards widespread global adoption. The hope, of course, is that regulators are not too heavy-handed, to the point where innovation flees to friendlier jurisdictions.

Australia appears to be on the right path with the Senate Committee recently publishing a 12-point reform plan designed to strike a balance between consumer protection and ensuring Australia remains competitive in the global digital asset arena. Recently, the former head of payments policy at the RBA suggested that regulation would threaten the crypto market, however money sitting on the sidelines awaiting regulatory clarity would argue otherwise.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link