Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Kadena (KDA)

Kadena KDA is a proof-of-work blockchain that combines the PoW consensus mechanism from Bitcoin with directed acyclic graph (DAG) principles to offer a scalable version of Bitcoin. Kadena claims it can provide the security of Bitcoin while being able to offer unparalleled throughput that makes the blockchain usable to enterprises and entrepreneurs alike. Kadena’s unique infrastructure is decentralized and built for mass adoption because of its multi-chain approach.

KDA Price Analysis

At the time of writing, KDA is ranked the 102nd cryptocurrency globally and the current price is US$1.96. Let’s take a look at the chart below for price analysis:

KDA climbed 65% from its mid-June low, creating a bullish market structure break on the daily chart.

Aggressive bulls might find the closest support near the August open, around $2.01. This level will likely show inefficient trading on the daily chart after Monday’s candle closes.

If this level breaks, the next support might be near $1.73. This level is near the 61.8% retracement. It’s also near the 9, 18, and 40 EMAs and the high of accumulation on the weekly chart.

A dip lower could reach $1.54, where bulls rejected bears on the weekly. However, a move this low could go significantly lower. Bulls’ stops near $1.34 and a large area of inefficient trading on the weekly offer little support to stop a more significant drop.

The closest resistance is from $2.20 to $2.30, near the June monthly open. This area showed inefficient trading on the weekly chart. The price has passed through this zone multiple times, but it could provide some resistance again.

If the market’s rally does continue, $2.47 might offer the next resistance. This level shows inefficient trading on the daily chart. It’s also at the low end of inefficient trading on the weekly and monthly charts. If the price does bounce from $1.73, the 68% and 100% extensions of the prior swing add more confluence to this area.

2. Swipe (SXP)

Swipe SXP is a platform that looks to form a bridge between the fiat and cryptocurrency worlds with its API that is designed to create global payment cards powered by its native SXP token. Swipe also has an on-chain product called Swipe Swap, an Automated Market Maker which is forked by Uniswap, SushiSwap and THORchain, and is powered by Swipechain. This ecosystem is powered by the Swipe Token SXP, which functions as the fuel for the Swipe Network, and is used for paying transaction fees and securing Swipechain through bonding and governance.

SXP Price Analysis

At the time of writing, SXP is ranked the 136th cryptocurrency globally and the current price is US$0.4405. Let’s take a look at the chart below for price analysis:

SXP has consolidated in a tight range since its 51% drop in early June.

Near $0.4080, an area of inefficient trading might offer support. This level is near the 9, 18, and 40 EMAS.

It’s reasonable for the price to drop slightly lower to the next area of inefficient trading, near $0.3876. Moving to this level would allow bulls to enter near the July open.

An area of inefficient trading, near $0.5293, might offer the closest resistance. This level is near the June open and could be the target as SXP shares its metaverse vision.

A move this high could reach slightly higher, near $0.5668. Bears rejected bulls on the weekly here in early June. It’s also near an old December 2020 weekly swing low.

If the market continues climbing, it could reach as high as $0.6550. This area shows inefficient trading on the monthly and weekly charts.

If the bullish move fails, bears might aim for an area near $0.2705. This level is near the midpoint of the March 2020’s swing low wick. On the weekly, it shows that bulls rejected bears. Reaching this level would allow bears to sweep bulls’ stops under relatively equal lows into inefficient trading on the daily chart.

3. Wax (WAXP)

WAXP is a purpose-built blockchain, released in 2017, that is designed to make e-commerce transactions faster, simpler and safer for every party involved. The WAX blockchain uses delegated proof-of-stake (DPoS) as its consensus mechanism. It is fully compatible with EOS. The custom features and the incentive mechanisms developed by WAX are intended to optimise the blockchain’s utility specifically for use in e-commerce, with the goal of encouraging voting on proposals.

WAX Price Analysis

At the time of writing, WAX is ranked the 130th cryptocurrency globally and the current price is US$0.1153. Let’s take a look at the chart below for price analysis:

WAX dropped 54% in early June before entering a consolidation range.

The price has just swept bulls’ stops above relative equal highs into an area of inefficient trading near $0.1145. This zone, up to $0.1223, could provide resistance.

If this level breaks, the price could climb to $0.1622. This move would let bulls run bear’s stops above June 2nd’s swing high. It would also fill in inefficient trading on the weekly and monthly charts.

However, macroeconomic conditions are still bearish. As of now, the economic climate makes it less probable that the price can reach this far.

Below, a relatively wide area from $0.1037 to $0.0955 could provide support. This area saw accumulation before the recent move up, shows inefficient trading on the daily, and overlaps with the 61.8% and 78.6% extensions.

Bulls rejected bears on the weekly chart, near $0.0842. This level might provide support if bears run bulls’ stops under July’s swing lows.

A more bearish turn in the market could propel the price significantly lower. The next downside target may be near $0.0560. Here, the weekly chart and monthly chart both show inefficient trading.

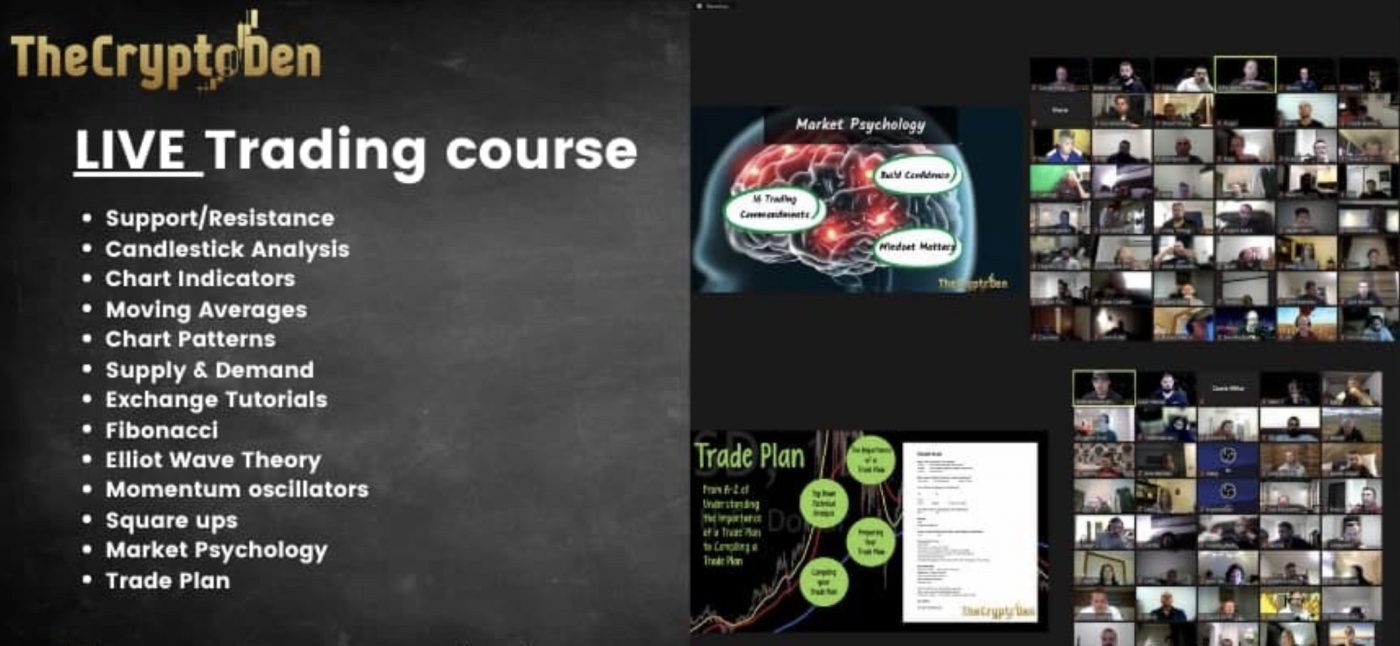

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link