While strategists at major investment bank JPMorgan warn that it’s better for bitcoin (BTC) to break through the USD 60,000 level soon, lest it drops further, other researchers see more positive signals but note that we’re now at the crossroads, and may go either way.

JPMorgan strategists are “worried” over bitcoin potentially seeing deeper slumps and if the coin isn’t able to break back above USD 60,000 soon, momentum signals will collapse, as reported by Bloomberg.

They found it likely that traders, including Commodity Trading Advisers (CTAs) and crypto funds, were partly behind the buildup of long BTC futures in recent weeks, and the unwind in past days.

There was a steep liquidation in BTC futures markets in the past few days, similar to those in February and January this year, and November last year. “Momentum signals will naturally decay from here for several months, given their still elevated level,” the strategists noted. They added that in these previous events, the buyers prevented further drop, and the flow impulse was strong enough to enable BTC to break out above the key thresholds.

The likelihood of this scenario repeating now seems lower “because momentum decay seems more advanced and thus more difficult to reverse,” while flows into BTC funds seem weak as well.

However, according to digital asset management firm CoinShares, inflows into digital asset investment products nearly tripled to USD 233m last week, while BTC saw the largest inflows of USD 108m.

Also, in January, JPMorgan strategists argued that BTC could fall below its price at the time of USD 40,000, or push through it up again – but that the flow into the Grayscale Bitcoin Trust (GBTC) would likely need to sustain a USD 100m a day pace for a while for such a breakout to occur.

However, BTC broke USD 40,000 and rallied to USD 60,000 even without these large daily inflows into the GBTC.

Meanwhile, Mike McGlone, Bloomberg Intelligence Senior Commodity Strategist, argued that BTC will probably maintain its price discovery and adoption into the mainstream.

And some other researchers suggest that we’re currently at a crossroads.

Norway-based, crypto-focused research firm Arcane Research argued that we’re now facing the first resistance at around USD 58,000, while the USD 50,000 “should be a fairly strong support level.” This used to be a resistance in late February and early March, but then turned into support in late March and this weekend.

Going below USD 50,000 would be short-term bearish and could potentially lead to the USD 45,000 level.

But climbing above USD 58,000 and retaking the USD 60,000 level would be a bullish signal and potentially take us towards to a new all-time high again, Arcane said. Currently, it’s USD 64,805 (per Coingecko).

At 8:25 UTC, BTC is trading at USD 55,421. It’s up 1% in a day and is down 14% in a week. Also, it’s among the worst performers today and in the past week, as multiple altcoins are up by double digits today and in the past seven days.

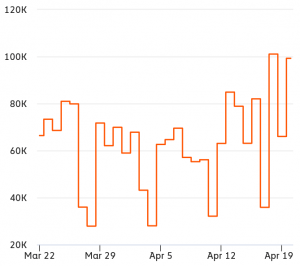

Meanwhile, per blockchain analysis company Chainlaysis, BTC inflows to exchanges have been on the rise since late-February, but are still not as high as they were in mid-February. That number in the last day is BTC 99,270 (currently USD 5.5bn), above the 180-day average. An increase in inflows suggests potentially increased selling pressure in the market, according to Chainalysis.

BTC inflows to exchanges

At the same time, major crypto exchange OKEx reported that the buying power still exists despite the BTC quarterly premium crashing over 10%, and that the altcoin season is “far from over.”

To Evercoin founder Miko Matsumura, bitcoin’s drop below 50% dominance signals altcoin seasonality, which he said would be led by ethereum (ETH). BTC dominance, or the percentage of the total market capitalization, now fluctuates around 49%-53%, depending on a data provider.

Popular BTC analyst Willy Woo argued that we’re close to the bottom, “if it hasn’t already been put in.” He added that the revisit of lower price has created “incredibly strong” price validation for BTC about USD 1trn capitalization.

Also, popular crypto trader and analyst Bitcoin Jack said that “low volume periods go hand in hand with consolidation of price,” while an uptick in volume on-chain and April 18 capitulation event are “likely indicators of renewed sustained volatility.”

____

Other reactions:

___

__

__

__

___

Learn more:

– Bitcoin Fees Hit ATH, Transactions Slow Down after China Explosion

– Bitcoin Sell-off Postmortem: Euphoria Exhaustion & FUD Behind Massive Liquidations

– 3/4 of Polled S Korean Bankers See Bitcoin At USD 90K Before End of 2021

– Bitcoin Faces Hedge Test Amid Rising Inflation Concerns

– Coinbase Listing Won’t Help Bitcoin Price – Analyst

– Bitcoin Market Changed ‘Radically’ & Volatility Decline Attracts Institutions

– Bitcoin to Be Worth Millions by 2023, ETH Above USD 2K by 2022 – Kraken CEO

– Institutions & Retail Compete For Bitcoin – Whose Hands Are Stronger?

– Next 2-3 Years ‘Should Be a Turning Point for Bitcoin’ – Deutsche Bank

– Inflation Is Here & Bitcoin Will Hit USD 115K ‘Ahead of Target’ – Pantera

Credit: Source link