Michael Kitson, University Senior Lecturer in International Macroeconomics, Cambridge Judge Business School.

_______

The economic orthodoxy has long been that governments should try to balance their books and leave all the heavy lifting in managing their economies to central banks. We saw this writ large in the years after the financial crisis of 2007-2009, as most major powers pursued austerity while their central banks slashed interest rates and announced successive rounds of quantitative easing (AKA printing money).

Yet this orthodoxy has been disrupted by the COVID-19 pandemic, and now President Joe Biden’s USD 1.9trn stimulus package has buried it. The reality is that “we are all Keynesians now” as there is widespread acceptance that governments around the world must spend more than they earn to stimulate their economies, which have been devastated by the pandemic and the restrictions to cope with it.

The Biden stimulus, known as the American Rescue Plan, includes: a one-off payment of USD 1,400 for most Americans; extended unemployment support; increased food stamp benefits; increased tax credits; grants to businesses; and increased education funding. This is a major injection into the US economy that is not matched by a comparable withdrawal from increased taxation (although Biden is raising some taxes and considering more, especially on the wealthy).

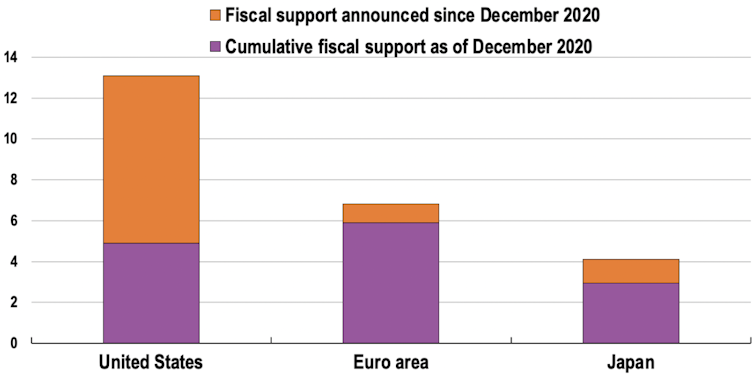

Many other countries are borrowing and spending to support their economies, but the US boost is much larger. The Organisation for Economic Co-operation and Development (OECD) estimates that the US fiscal stimulus will be more than 15% of GDP compared to 7% in the Euro area and 4% in Japan, as in the chart below.

Fiscal support packages as a % of GDP

OECD

The effects

The impact of this fiscal stimulus on the US economy will depend on how consumers and producers respond. Simply, will consumers spend more and not save their extra income, and will producers invest more and not scrap capacity?

The behavior of consumers and producers will be influenced by the extent of the vaccination roll-out and the opening of the economy. In 2020, the US was in the grim zone, where the combination of incompetence and/or bad luck led to a high rate of COVID deaths and loss of GDP.

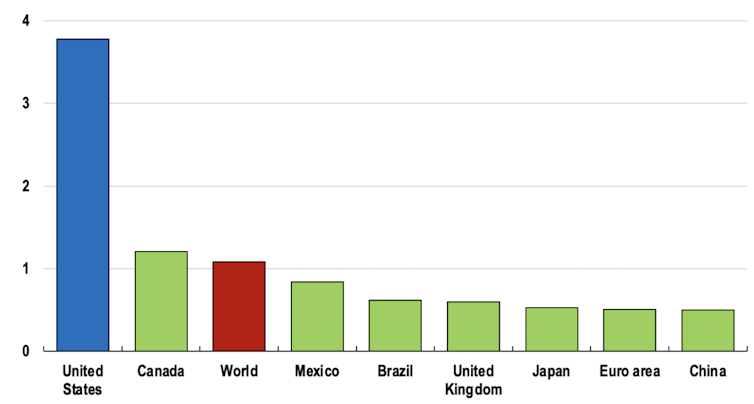

The US is in a much better place now, with a relatively fast vaccine rollout and large parts of the economy opening up. This suggests that consumers and producers will spend, and the economy will recover quickly. The OECD estimates that the Biden stimulus will increase US GDP by 3.8%, which will boost employment, wages, and profits.

Other countries will also benefit from the Biden stimulus because of the size of the US economy and its global links. This will be influenced by how Americans spend their stimulus money, and the strength of US trade links with other countries.

If Americans respond to the opening up of the US economy by spending their income and pent-up savings on consumer services – dining out, trips to the gym, theatre, cinema and so on – then the impact on other countries will be much less, since most of these services are produced locally.

But if American consumers buy more imported goods as a result of the stimulus, it will boost other countries’ economies. As you can see in the chart below, the OECD expects that the Biden boost will increase world GDP by 1.1%, with the Canadian economy increasing by 1.2% – showing that geography still matters.

GDP impact of US fiscal stimulus: selected countries

OECD

Yet despite the apparent precision of the OECD forecasts, the overall outcome for individual countries will depend on how well they are dealing with the pandemic. If the extra national income from increased exports to the US converts into more spending in the country in question, it will further boost that economy.

But if much of the income is saved, perhaps because of pandemic restrictions or because consumers are gloomy about their economic prospects, the overall impact on the economy will be muted. Given that the vaccination rollout in many countries has been slow and erratic, this is highly likely for the near future.

So although the Biden boost is a much-needed fillip to the world economy, for many countries it will not be enough to return them to pre-pandemic levels of economic activity. They need to accelerate their vaccination programs and implement a fiscal stimulus on a similar scale to the US.

The big gamble?

Despite the general acceptance that deficit spending is the best way to reignite global growth, there are still concerns from some orthodox economists with a pathological antipathy to big government and widening deficits. The Economist has proclaimed that Biden’s package is a “big gamble”, arguing that the US budget deficit could get out of control and that inflation might take off.

In reality, the deficit is easily fundable as there is plenty of demand for US government debt. And as Treasury Secretary Janet Yellen has argued, US inflation risks are small and “manageable”.

The biggest threat is that a booming US economy could lead to a rising dollar and higher global interest rates. This may stall recovery elsewhere and will be a major burden for emerging economies that have debts denominated in US dollars.

Overall, however, the world economy will benefit from the stimulus, and all the more so if other high-income countries spend on the same scale – there is no reason why they cannot do this. But the first priority is to accelerate the vaccination rollout around the globe: the World Health Organization has warned of a “catastrophic moral failure” as poor countries are falling behind in the race to vaccinate their citizens.![]()

This article is republished from The Conversation under a Creative Commons license. Read the original article.

___

Learn more:

– A Debt-Fuelled Economic Crisis & Bitcoin: What to Expect?

– Turks Turn to Exploring Bitcoin, Ethereum, And Tether as Lira Plummets

– Why The Return Of High Inflation Can No Longer Be Excluded

– Inflation Is Here & Bitcoin Will Hit USD 115K ‘Ahead of Target’ – Pantera

– Dalio Disses Dollar Debt, But Warns Gov’ts May Target Bitcoin & Gold

– Will Joe Biden’s Stimulus Plan Cause the US Economy to Overheat?

– Norwegian Giant Aker Goes Bitcoin, Defends BTC Mining, Eyes Micropayments

– This Is Why ‘Hedge Against Inflation’, Bitcoin, Dropped On Inflation Fears

– The Evidence Is in on Negative Interest Rate Policies

– Undetected Inflation: Your Fiat Money Devalues Faster Than You Think

Credit: Source link