US inflation is running hot at 5.4 percent for the year ending June 30, a level last seen in 2008. Bitcoin is often touted as the solution, but is that necessarily the case?

Inflation is controversial since not everyone agrees about its constituents. Many consider CPI little more than a tool used to steer policy since it often excludes food, energy, housing and investment assets – all things the average person would typically want.

There is also a raging debate in the US about whether the current inflation levels are “transitory” as reflected in this recent tweet:

Bitcoiners and Inflation

Transitory or not, Bitcoin advocates argue that Bitcoin is a hedge against inflation. In making their argument, they lean on principles of Austrian economics and sound money. In short the argument is:

- There are two forms of money – hard/sound money and soft/unsound money.

- Hard/sound money is money that tends to retain its purchasing power over time and whose supply is difficult to increase.

- By contrast, easy/soft money is money that tends to depreciate over time and whose supply is generally easy to increase.

- Historically, human beings tend to flourish during times of sound money, whereas the opposite is true of unsound money which tends to result in inequality, civil unrest and socioeconomic turmoil – hyperinflation in Venezuela would be an extreme example.

- Hard money tends to be deflationary whereas soft money tends to be inflationary (ie, you can buy less goods/services with it over time).

- Fiat currency is unsound money and leads to long-term currency devaluation.

- Bitcoin by contrast is the opposite – it is the soundest money we’ve seen since it has a fixed supply with a predictable and immutable deflationary monetary policy.

This line of thinking is broadly shared throughout the Bitcoin community, including US Senators.

Detractors are often quick to point out that Bitcoin isn’t a good hedge against inflation, particularly in light of its recent price movements.

While that may be true, the same argument could also be made against gold, which is traditionally considered an inflation hedge. In the past 12 months, it is down 0.26 percent.

With that being said, if you are going to be comparing the relative strength of inflation hedges, a longer timeframe is critical. Short-term volatility in the market is to be expected and can’t viably be used as an argument against Bitcoin, gold, real estate or any other traditional inflation hedge.

When faced with strongly held beliefs on both sides of the debate, it is often best to consult balanced analysts such as Lyn Alden. For a comprehensive overview of how Bitcoin could play a role as an inflation hedge within a portfolio, this fascinating video is well worth a watch.

Bitcoin Could Be an Inflation Hedge … in the Long Run

Since Bitcoin’s inception, it has proven to be a long-term store of value whose purchasing power has increased dramatically, notwithstanding its volatility in the short term.

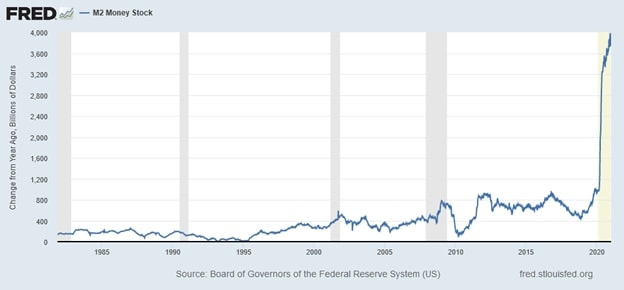

By contrast, the US dollar has lost purchasing power, accelerated even more over the past 18 months. Note the sudden increase in money supply since March 2020 described by some as the greatest monetary expansion in history.

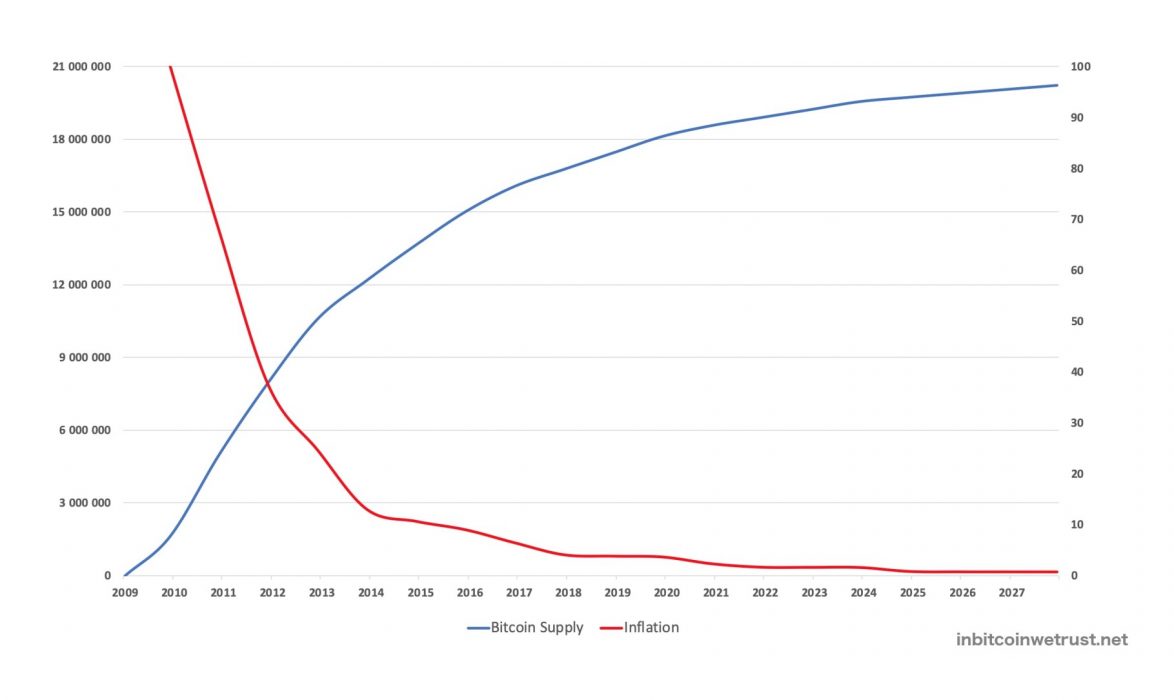

Compared to the US dollar, Bitcoin is deflationary and its supply is entirely predictable and slowing down over time due to the inbuilt four-year halvings as seen below:

Based on historical patterns and Bitcoin’s intrinsic scarcity, it looks like it has a good chance of being an effective inflation hedge in the long run. If, however, your goal is to protect against short-term currency devaluation, less volatile assets may be more suitable. One thing is for sure – we’ve never seen this much liquidity injected into the market within such a short space of time. How this plays out over the long term remains to be seen.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link