The institutional investors are here, bringing with them billions of dollars and record-high bitcoin (BTC) prices. This is something the market had been expecting for years, but now that it has finally arrived, it potentially brings risks as well as benefits.

Might institutions be less ‘loyal’ to bitcoin than retail investors who are subscribed to the ‘HODL’ culture and mentality? Might the fact that they hold millions or billions of bitcoin put the market at risk of a big drop if one or more of them were to offload their holdings?

Well, analysts say that the answer to these two questions are: no, and not really. In fact, institutions are likely to be more of a stabilizing influence on the bitcoin market than retail traders, many of whom used leveraged trades and aren’t able to absorb dips to the same extent as big funds and corporations.

Institutions are in BTC for the long haul

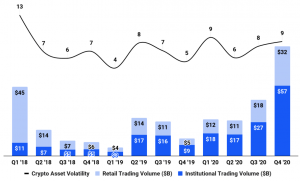

Recent research from JPMorgan, indicated that retail investors purchased more bitcoin than institutions in Q1 2021, at a ratio of 187,000 to 173,000. On the other hand, Q4 2020 witnessed institutions buy around BTC 307,000, while retail traders bought ‘only’ BTC 205,000.

Looking at the bigger picture, Coinbase’s regulatory filing with the US Securities and Exchange Commission revealed that retail’s share of bitcoin purchases has fallen steadily over time, from 80% in Q1 2018 to 36% in Q4 2020. This indicates that institutions are buying up a bigger share of the bitcoin pie, a trend which may only continue and perhaps even accelerate in the future.

Trading volume and crypto asset volatility

It’s clear that institutions are here, but are they in it for the long-term, or could they be out to maximize short-term gains? Most commentators seem to gravitate towards the first option.

“Most institutions will be in it for the long haul or to HODL as it’s not a simple process for them to attain approvals to purchase Bitcoin,” said Samson Mow, Chief Strategy Officer at Blockstream.

As Ben Lilly, a crypto economist and partner at Jarvis Labs, said, the process by which an institution formally decides to invest in bitcoin is fairly arduous. So few will be willing or even able to simply divest themselves of bitcoin on a whim.

“After the stakeholders are educated and are onboard with getting involved in bitcoin and/or crypto in some capacity, then there’s the implementation process. This involves legal counsel, corporate governance discussions, regulatory concerns and policy considerations,” he told Cryptonews.com.

Lilly added that an institution will then need to address the questions of how to buy bitcoin, how to store it, what allocation to give to it, and how to reallocate your holdings over time.

“It’s not as simple as creating a login on Coinbase and pressing the buy button with USD 100m of dry powder. It requires contracts, outsourced algorithms and trade desks, and even custodians,” he said.

Given the drawn-out nature of this process, institutions end up creating an investment timeline that’s on the horizon of years, not weeks to months. As such, there’s little short-termist about their bitcoin investments.

This assessment is likely bolstered by the current macroeconomic climate, which is likely to endure beyond 2021.

“When interest rates are extremely low and inflation is expected to rise, these institutional investors are looking for a store of value, and bitcoin is growing into that role,” said Bendik Norheim Schei, the head of research at Arcane Crypto.

Volatility and fear

With institutions boosting bitcoin’s price, Q1 2021 has seen a new wave of retail investment, and this could continue into the coming months.

For some analysts, a higher proportion of retail investors brings greater risks of volatility.

“Retail traders can leverage up to 125x on some exchanges and we have seen massive liquidations during this bull market. These over-leveraged traders are without a doubt contributing to a more volatile market,” said Norheim Schei.

That said, it’s not certain what percentage of retail traders use leverage, with other analysts thinking that a relative balance between retail and institutions would be a good thing.

“It’s a good thing that retail and institutional buys are balanced, or more skewed towards retail. Having large entities hold too much bitcoin increases the risk of rehypothecation, which is bad for bitcoin and bad for the new financial system being built on Bitcoin,” said Samson Mow.

The fear of rehypothecation — in which collateral on a debt is reused as collateral on another debt — is one shared by Ben Lilly.

“What worries me is the rehypothecation beginning to take place off the blockchain. It’s the non-transparent entities selling or lending the same piece of collateral twice. This type of behavior is what leads to vulnerabilities,” he said.

Increasing stability

Most analysts agree that retail is only just beginning to enter the current bull market. However, when looking at the longer term, institutions are likely to be the dominant presence in the bitcoin market.

“We’re still in the very beginning of large scale institutional adoption of bitcoin, and institutions will continue to take a larger share of the total bitcoin market,” said Bendik Norheim Schei.

While he says that institutions are largely driving the current halving cycle, Ben Lilly also expects retail investors to join later in the game.

“Once these institutions finish their hoarding I’d expect the final push to be retail in the form of retirement accounts, pension funds, and mutual funds that allocate a percentage to bitcoin and crypto as a whole,” he said.

What this means is that, with institutions occupying the greater share of bitcoin holdings, the bitcoin market is likely to become more stable and less volatile in the future.

____

Learn more:

– Bitcoin Snowball Is Expected To Hit More Institutions in 2021

– Crypto in 2021: Institutions Prefer Bitcoin, Retail Open to Altcoins

– ‘Time To Get Educated’: Morgan Stanley Brings BTC Funds To Rich Clients

– Next 2-3 Years ‘Should Be a Turning Point for Bitcoin’ – Deutsche Bank

– 1,400+ Firms Flock To Learn About Bitcoin, But ‘There Is No Playbook’

– Inflation Is Here & Bitcoin Will Hit USD 115K ‘Ahead of Target’ – Pantera

– Ruffer Reveals Why They Poured GBP 550M in ‘Non-Sensical’ ‘Beast’ Bitcoin

– Norwegian Giant Aker Goes Bitcoin, Defends BTC Mining, Eyes Micropayments

Credit: Source link