In the annals of crypto’s tumultuous history, few stories have gripped the market as intensely as the FTX crypto scam, orchestrated by Sam Bankman-Fried. This massive ponzi, characterized by deceit, manipulation, and a staggering breach of trust, has sent shockwaves across the globe, profoundly affecting FTX investors and shaking the very foundations of the crypto market.

Understanding The FTX Scam

In a time where crypto was gaining momentum, the FTX scam emerged as a sobering reminder of the volatility and vulnerability inherent in the burgeoning crypto sector.

The Rise Of FTX: A Crypto Empire’s Beginnings

FTX, under the leadership of Sam Bankman-Fried, was not just another player in the crypto space; it was a behemoth that quickly ascended to become the second-largest crypto exchange in the world by trading volume. This meteoric rise was characterized not only by innovative financial products but also by a series of high-profile endorsements and partnerships that catapulted FTX into the public eye.

One of the most sensational partnerships was with NFL superstar Tom Brady, in a deal worth $55 million, which significantly boosted FTX’s visibility and credibility. Similarly, NBA star Stephen Curry signed a $35 million endorsement deal, further cementing FTX’s status as a major player in the crypto exchange market. These endorsements were not mere marketing stunts; they were strategic moves that showcased FTX’s ambition and reach.

In addition to sports stars, FTX made a remarkable entry into the world of sports sponsorships by securing a 19-year, $135 million naming rights deal for the Miami Heat’s arena, a move that underscored its financial muscle and ambition. The partnership with the Mercedes F1 Team further diversified its portfolio, indicating a strategy that transcended traditional crypto exchange boundaries.

These high-profile partnerships and endorsements were pivotal in building FTX’s reputation as a reliable and forward-thinking exchange. They played a crucial role in attracting a vast user base, as FTX’s visibility soared, luring investors and traders who were enamored by the platform’s association with global icons.

Sam Bankman-Fried: The Face Behind The FTX Scam

Sam Bankman-Fried, often abbreviated as SBF, emerged as a central figure in the crypto world, renowned for his unconventional approach and rapid success. A graduate of MIT with a degree in Physics, Bankman-Fried’s entry into the world of finance was marked by a stint at Jane Street Capital, a well-regarded quantitative trading firm.

His foray into cryptocurrency began with the founding of Alameda Research, a quantitative cryptocurrency trading firm, and eventually led to the establishment of FTX in 2019.

Bankman-Fried’s persona was a blend of a tech-savvy entrepreneur and a finance whiz, known for his casual attire and altruistic declarations. He quickly became a poster child for the crypto revolution, advocating for effective altruism and pledging to donate a significant portion of his wealth to charity.

His youth, combined with his commitment to philanthropy and a seemingly deep understanding of both cryptocurrency and traditional finance, made him a unique and respected figure in the financial world.

Good Product, Bad Faith

As the CEO of FTX, Bankman-Fried championed transparency and innovation in the crypto exchange market. Under his guidance, FTX introduced several groundbreaking products, including derivatives, options, and leveraged tokens, which attracted both retail and institutional investors. His approach was seen as a refreshing change in an industry often shrouded in complexity and jargon.

However, behind this facade of innovation and success, there were underlying issues. Questions began to arise about the relationship between FTX and Alameda Research, specifically regarding the use of customer funds and the solidity of FTX’s financial practices. The unraveling of these concerns would later be at the heart of the FTX scandal.

Decoding The FTX Scam: How It Unfolded

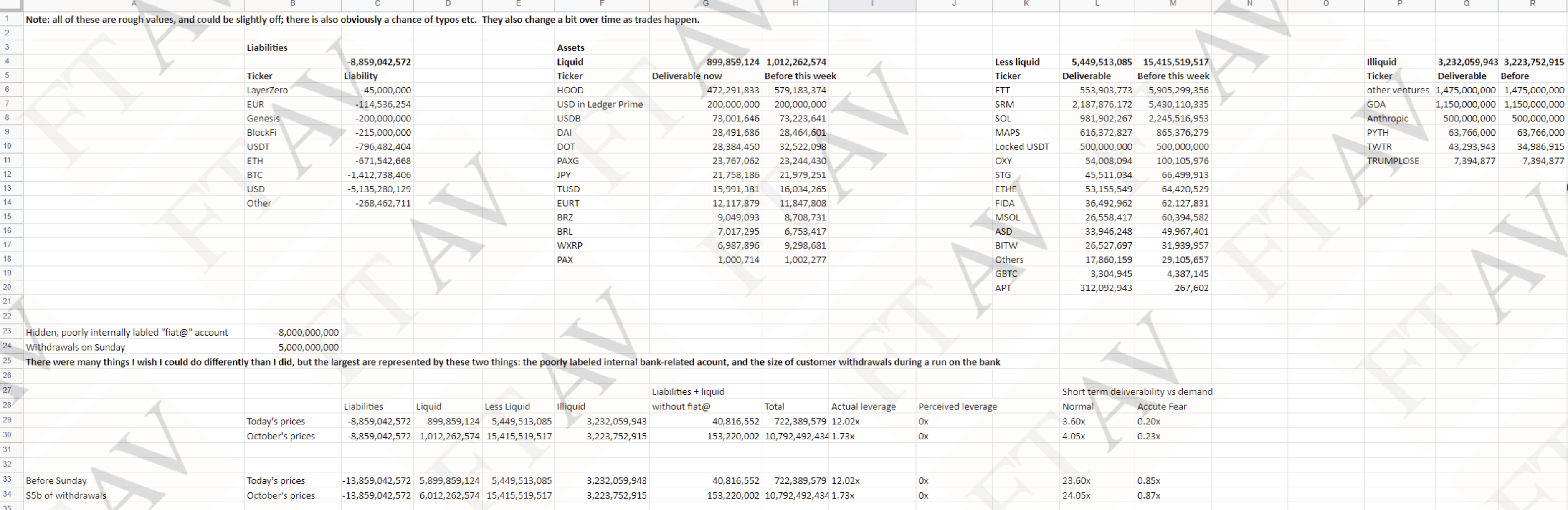

The unraveling of the FTX scam began with a seemingly innocuous revelation about the balance sheets of FTX and Alameda Research. In November 2022, a report exposed that a significant amount of Alameda’s balance sheet was underpinned by FTT, the native token of FTX. This discovery set off alarm bells for the solvency and interdependence of both entities.

FTX Balance Sheet Analysis: Red Flag

A critical examination of FTX’s balance sheet, particularly its proprietary trading arm Alameda Research, revealed significant red flags that contributed to its eventual downfall. In financial reports dated June 30, it was noted that Alameda Research had $14.6 billion in assets on its balance sheet, but alarmingly, its single biggest asset was $3.66 billion of “unlocked FTT”, FTX’s native token, and the third-largest “asset” was an additional $2.16 billion more of “FTT collateral”.

This meant that nearly 40% of Alameda’s assets consisted of FTT, a coin that was created by Sam Bankman-Fried himself, rather than an independently traded stablecoin or token with a market price or actual fiat in a reputable bank.

The intertwining of FTX and Alameda’s finances was further highlighted by the unusually close ties between the two entities. This interdependency was a critical factor that led to the liquidity crisis and eventual bankruptcy of FTX and its 160-plus business units. The situation reached a tipping point following a report by CoinDesk, which set off a chain of events including a public conflict with Changpeng Zhao, CEO of Binance, and Alameda Research’s Caroline Ellison.

FTX Vs. Binance: The Conflict Escalates

Tensions escalated when Changpeng Zhao (CZ), the CEO of the largest crypto exchange Binance and a former ally of SBF, signaled his intention to liquidate Binance’s position in FTT token. CZ tweeted:

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. […] Regarding any speculation as to whether this is a move against a competitor, it is not.

Caroline Ellison responded: “If you’re looking to minimize the market impact on your FTT sales, Alameda will happily buy it all from you today at $22!” Remarkably, the tweet did not calm the market, but rather further unsettled it. The Twitter dialogue stirred the market, as CZ’s decision to sell off FTT tokens prompted a precipitous drop in the token’s value, signaling a lack of confidence in FTX’s financial stability.

In the midst of this public back-and-forth, details about SBF’s relationship with Caroline Ellison began to surface, suggesting a closer personal and professional connection that further complicated the integrity of their businesses’ operations. This relationship would later come under intense scrutiny as part of the investigation into the mismanagement of funds.

A Liquidity Crisis

As the value of FTT plummeted, a run on FTX ensued, with customers frantically attempting to withdraw their assets. FTX’s liquidity crisis became apparent, revealing that the firm did not have the capital to honor these withdrawals.

Following this, Binance’s CEO, Changpeng “CZ” Zhao, expressed initial interest in acquiring FTX through a nonbinding agreement. However, after evaluating the situation for a day, Binance withdrew, with Zhao indicating that FTX’s financial challenges were too severe for an effective resolution. Concurrently, the SEC and CFTC began probing Alameda Research and FTX US for potential mismanagement of customer funds.

This development made FTX’s financial failure imminent. Sam Bankman-Fried endeavored to secure billions in emergency funding to salvage FTX, but without any willing investors to provide the necessary $9.4 billion, FTX declared bankruptcy on November 11, 2022, leading to Bankman-Fried’s resignation as CEO.

The next day, FTX reported the disappearance of $1 to $2 billion in customer funds, following the detection of substantial unauthorized fund transfers from FTX’s cryptocurrency wallets.

FTX Post Bankruptcy Filing

After filing for Chapter 11 bankruptcy, FTX witnessed a leadership change, with John Ray III taking over as CEO following Sam Bankman-Fried’s resignation. The transition marked a critical phase for FTX as it aimed to recover from the liquidity crisis and address missing customer funds. Remarkably, John Ray III gained prominence for leading Enron during its bankruptcy and recovering over $828 million for creditors.

Regulatory investigations by the SEC and CFTC remained ongoing, creating uncertainty. Restoring investor confidence and implementing robust financial controls were paramount challenges for the exchange. Additionally, FTX had to navigate the aftermath of its failed acquisition attempt by Binance, which had further complicated its financial situation.

The Role Of FTX Auditors In The Saga

In the wake of FTX’s collapse, the role of FTX auditors has been scrutinized in depth, with questions raised about their oversight and how they could have allowed the FTX scam to exist. The FTX auditor for the international branch, Prager Metis and the FTX auditor for FTX US, Armanino, are central to this scrutiny.

Prager Metis

Prager Metis is facing legal action from the SEC, accused of hundreds of violations related to its engagement with the now-bankrupt crypto exchange FTX. The SEC’s lawsuit alleges FTX auditor independence violations, specifically regarding a template used for client engagements. The accounting and consulting firm added indemnification provisions to engagement letters for more than 200 audits and other work between December 2017 and October 2020, which the SEC claims compromised the firm’s required independence.

The accounting firm has defended its practices, stating that the allegations are based on historical template language that was never enforced, and that it always acted independently from clients. The SEC’s complaint against the firm seeks an injunction and penalties, and the investigation is ongoing.

Armanino

Armanino, FTX’s US auditor, defended its accounting work amidst the fallout. Chris Carlberg, Armanino’s chief operating officer, stated in an interview with the Financial Times that the firm stands by its work for FTX US. Armanino gave FTX’s US branch a clean bill of health after reviewing its finances in 2020 and 2021. Carlberg highlighted that the firm was not engaged to audit internal controls, a process typically reserved for public companies, and not required for private company audits.

Both Armanino and Prager Metis are being sued by FTX customers. In light of the changing market conditions and the FTX scandal, Armanino has ceased its auditing and proof of reserve for crypto related firms.

FTX Scam: The Impact On The Crypto Market

The FTX collapse had a profound impact on both investors and the broader crypto market. Bitcoin’s price plummeted by over 30%, and the crypto market experienced a significant drop in market capitalization, resulting in billions of dollars in losses for investors. This sudden and severe downturn in the crypto market sent shockwaves through the entire industry, leaving investors reeling and questioning the stability of the ecosystem they had come to trust.

FTX Investors: A Trail of Loss And Deception

FTX investors faced a harrowing ordeal, with many reporting substantial financial losses, some exceeding 50% of their invested capital. What made this loss even more painful was the revelation of deception and a lack of transparency within the exchange’s operations. Investors had entrusted their assets to FTX, only to discover that the exchange had concealed critical information and misrepresented its financial health.

The FTX Meltdown: Consequences For The Crypto Market

The FTX meltdown had broader consequences for the entire crypto market. Market sentiment took a severe hit as news of the exchange’s collapse spread. It raised serious concerns about the stability and regulatory oversight of cryptocurrency exchanges, making investors wary of the potential risks associated with their investments.

This temporary loss of confidence had a cascading effect on the broader crypto ecosystem, affecting various tokens and projects, as the FTX contagion effects were not entirely clear for several weeks. Following the FTX meltdown, liquidity on the entire Bitcoin and crypto market eroded, further intensifying the bear market. Notably, the FTX crash marked the Bitcoin bottom at $15,440 for the bear market, which was followed by a long period of sideways movement for the BTC price.

FTX Contagion: Ripples Across US Politics

The FTX contagion extended its reach into US politics, prompting regulatory alarms. US agencies like the SEC and CFTC, due to the FTX scam, intensified their scrutiny of crypto companies, including Binance, Coinbase, DCG, and Gemini. Lawmakers and regulators became increasingly concerned about the potential systemic risks posed by crypto market instability. Calls for stricter regulations and oversight in the cryptocurrency industry gained momentum as policymakers grappled with the fallout from the FTX collapse.

The Sam Bankman-Fried Trial

The trial of Sam Bankman-Fried, a defining event in the crypto and financial fraud landscape, commenced in Manhattan federal court and concluded with a verdict on November 2, 2023. This month-long trial, which followed FTX’s bankruptcy filing almost a year prior, centered around allegations of one of the largest financial frauds in history.

Bankman-Fried faced seven counts, including fraud and conspiracy, resulting from his management of FTX and Alameda Research. The trial’s outcome not only underscored the severe implications of financial mismanagement in the crypto industry but also brought to light the vulnerabilities and regulatory gaps within this rapidly evolving sector.

FTX Ponzi Scheme Allegations: Legal Insights

The trial of Sam Bankman-Fried, the founder of the now-defunct cryptocurrency exchange FTX, has been a significant event in the financial world, especially within the cryptocurrency community. Found guilty on all seven counts he faced, including fraud and conspiracy, Bankman-Fried’s trial revealed the intricate details of one of the most extensive financial frauds on record.

The prosecutors in the case painted a picture of Bankman-Fried as someone who looted $8 billion from FTX users out of sheer greed, leading to a swift corporate meltdown and the bankruptcy of FTX. This verdict has not only marked the downfall of a once-celebrated crypto figure but also highlighted the potential vulnerabilities within the crypto industry.

During the trial, it was argued that Bankman-Fried diverted funds from FTX to his crypto-focused hedge fund, Alameda Research. This action was in direct contradiction to his public claims of prioritizing customer fund safety. Reportedly, the use of the funds varied, including payments to Alameda’s lenders, loans to executives, speculative venture investments, and significant political donations aimed at influencing cryptocurrency legislation.

Notably, Bankman-Fried took the stand in his own defense, testifying over three days. He maintained that he did not steal customer funds and that he believed the financial arrangements between FTX and Alameda were permissible. He also admitted to mistakes in running FTX, such as not establishing a risk management team.

Key Revelations From The Sam Bankman-Fried Trial

The trial of Sam Bankman-Fried, former founder of FTX, brought forth several startling revelations, particularly through the testimonies of Caroline Ellison, ex-CEO of Alameda Research and Bankman-Fried’s former romantic partner. As Bitcoinist reported, key moments revelations include:

- “Secret Exemption” From FTX Liquidation: Alameda Research had a “secret exemption” from FTX liquidation protocols, according to FTX’s new CEO John J. Ray III. Alameda’s privileged status extended to a “secret software change” on FTX, exempting it from automatic asset sell-offs. Court documents also revealed that FTX allowed Alameda to borrow $65 billion for trading.

- Bitcoin Price Manipulation: Ellison admitted to coordinating with Bankman-Fried to keep Bitcoin’s price below $20,000, a strategy aimed at attracting investors.

- Bribery In China: Bankman-Fried allegedly bribed Chinese officials with $100 million to unfreeze $1 billion in Alameda Research funds. This included contentious discussions and the use of unconventional methods to navigate Chinese financial systems.

- Targeting Saudi Royalty: Ellison mentioned Bankman-Fried’s plans to solicit funds from the Saudi Crown Prince to repay FTX customers, though details remain unclear.

- Strategies Against Binance: Ellison revealed efforts by Bankman-Fried to influence US politicians and agencies with the goal to start regulatory actions against Binance, aiming to boost FTX’s market position.

- Substantial Financial Losses Due To Security Lapses: Alameda Research reportedly lost $190 million due to security oversights, including a $100 million loss from a trader activating a malicious link and a $40 million loss from an unverified blockchain platform.

The Future Of FTX Post Sam Bankman-Fried

The future of FTX, following the tumultuous downfall of Sam Bankman-Fried, is taking a new direction with plans to relaunch the platform. The initiatives are being spearheaded by the bankruptcy administrators and the new management under CEO John Ray.

Relaunch Plans And Timeline For FTX International

FTX’s administrators have outlined a plan to potentially restart the FTX.com platform, focusing on non-US customers. Various classes of creditors propose organizing this rebooted exchange, which could enable one class of claimants, specifically offshore customers, to relaunch FTX with the support of third-party investors.

The company is actively assessing the feasibility of this relaunch, aiming to file a restructuring plan by the third quarter of 2023, with the hope of getting judicial confirmation for this plan by the second quarter of 2024. The exact timeline for the relaunch remains uncertain, as FTX must first convince the bankruptcy judge that the relaunch serves the best interest of its creditors.

Specific Regional Focus: Japan

FTX Japan anticipates a more immediate restart, where robust consumer protection laws have enabled it to maintain a separate account system for its users.This unique position allows FTX Japan to potentially reopen sooner than other regional entities of FTX. CEO John J. Ray III has been in talks with Japanese officials regarding the reopening, which would mark a significant step forward in the relaunch process.

US Market Challenges

The relaunch in the US presents unique challenges due to stringent securities regulations. Currently, US customers have access to FTX US, a separate entity from the main FTX exchange. The decision to merge these platforms or maintain them as separate entities will have to consider compliance with US laws, potentially complicating the relaunch process in the US.

Incentives For Former Customers

To encourage former customers to return to the platform, FTX’s new management is considering offering stakes in the company. This could involve issuing equity in the new company or providing options to purchase shares at a specific price in the future. Such incentives would allow former customers to participate in any future growth or profits of the relaunched exchange.

Meanwhile, the future of the FTX token (FTT) in the relaunch remains unclear. While FTX holds a significant amount of FTT tokens, suggesting a vested interest in the token’s recovery, management has not announced concrete plans for FTT’s role in the potential relaunch. Any engagement with FTT will likely attract regulatory scrutiny, especially in the US, where crypto assets are subject to securities laws.

FAQ: The FTX Scam And Sam Bankman-Fried

What Was the FTX Scam?

The FTX scam involved the misappropriation of billions of dollars from FTX users. Sam Bankman-Fried, the founder of FTX, and his associates at Alameda Research used customer funds for various purposes, including personal investments and political donations, contrary to their commitments to prioritizing user fund safety.

Who Is Sam Bankman-Fried?

Sam Bankman-Fried, often known as SBF, is the founder of FTX, a cryptocurrency exchange. He rose to prominence in the crypto industry before his fall from grace due to the FTX scandal.

Were FTX Investors Aware Of The Scam?

Most FTX investors were not aware of the fraudulent activities within the company. The operations proceeded with a lack of transparency, resulting in widespread surprise and shock when the company’s financial troubles became public.

What Was the Role Of FTX Auditors In The Scam?

The role of FTX auditors in the scam is unclear. Effective auditing should have identified discrepancies in FTX’s financials, raising concerns about the thoroughness and integrity of the auditing processes involved.

How Was The FTX Balance Sheet Manipulated?

The manipulation of the FTX balance sheet aimed to hide the misuse of customer funds. This included overstating the value of certain assets and failing to disclose the significant financial relationship between FTX and Alameda Research.

Was the FTX Operation A Pre-Planned Ponzi Scheme?

Whether FTX was a pre-planned Ponzi scheme is subject to legal interpretation. However, it exhibited characteristics typical of a Ponzi scheme, using new investors’ funds to pay out others.

What Caused The FTX Meltdown?

A combination of financial mismanagement, misuse of customer funds, and a loss of market trust caused the FTX meltdown, resulting in a liquidity crisis.

How Did The FTX Contagion Affect Crypto Markets?

The FTX contagion deeply affected crypto markets, leading to a loss of investor confidence and market instability. As a key player in the crypto exchange sector, FTX’s meltdown resulted in decreased market liquidity and increased volatility, affecting a wide range of crypto assets and companies connected to FTX.

Are There Legal Proceedings Against FTX And Sam Bankman-Fried?

Yes, there are legal proceedings against FTX and Sam Bankman-Fried. A court found Bankman-Fried guilty of fraud and conspiracy charges related to the FTX scandal.

Will FTX Investors Be Made Whole?

The possibility of making FTX investors whole remains uncertain. The restructuring and potential relaunch of FTX aim to reimburse investors, but it is unclear if and to what extent this will happen.

Featured images from Shutterstock

Credit: Source link